Products You May Like

A centerpiece of the Build Back Better Act (BBBA) as passed by the House last year was drug pricing legislation, which could be included in the next version of the BBBA, now rebranded as an inflation-control, climate, and deficit-reduction bill. While headline inflation is at an alarming rate, with the most recent 12-month reading at 8.5 percent, prescription drugs are experiencing some of the lowest levels of inflation across various goods and services.

Price control legislation is highly misguided in its own right. Government-set pricing of prescription drugs is not a fix for today’s rampant inflation and further, it would give rise to new problems of its own.

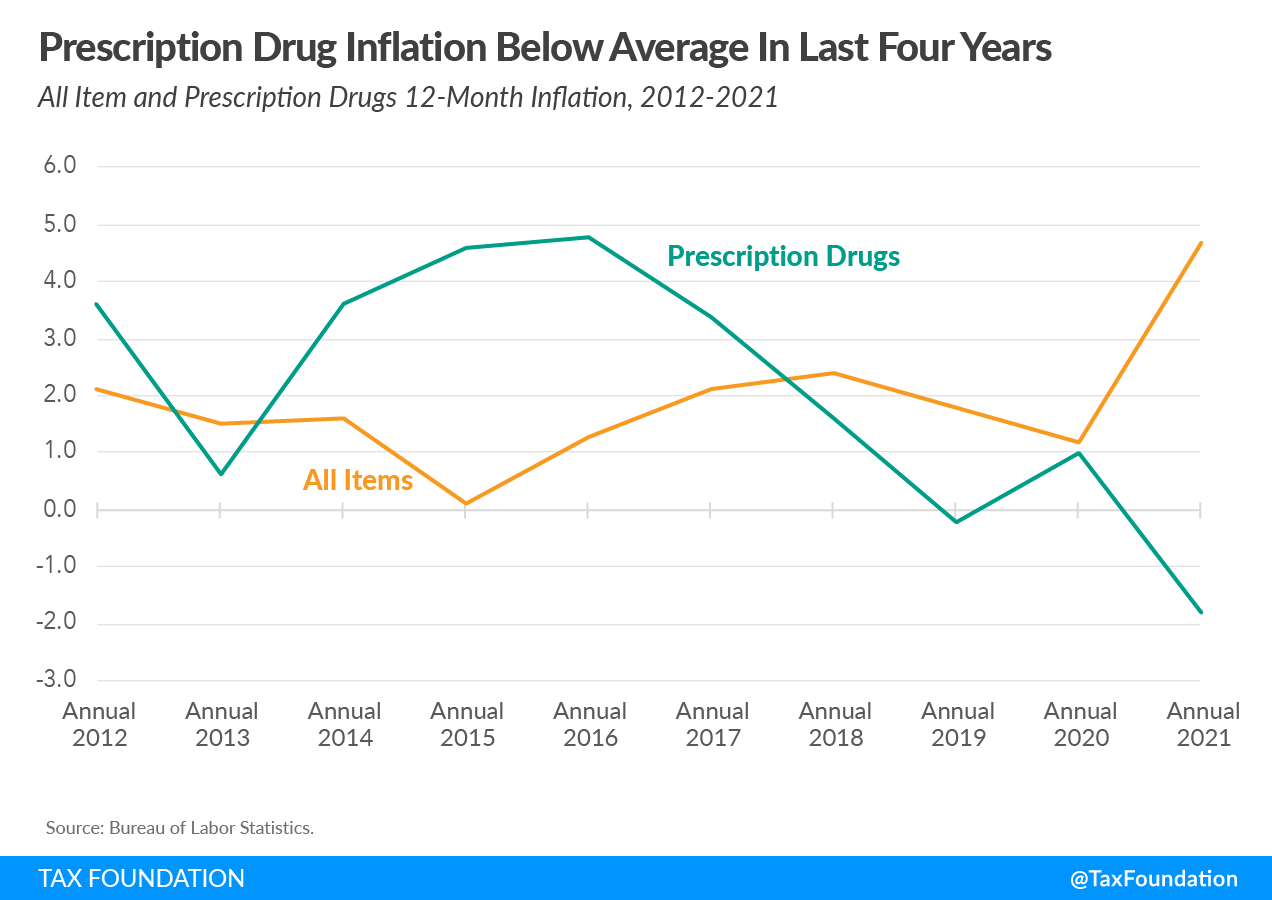

The drug pricing provisions in the House-passed BBBA would allow the government to set prices for a certain number of drugs under Medicare Part D, among other changes, and President Biden has touted the provisions as a way to address current inflation. According to the Bureau of Labor Statistics (BLS), however, prescription drugs are experiencing relatively low levels of inflation, rising 2.2 percent over the last 12 months. Prescription drugs even declined month-over-month from February to March of this year, and drug price inflation has been below average inflation for the last four years (see accompanying charts). In other words, changes in the price of prescription drugs are not a driver of the record-levels of inflation we’re currently seeing.

Demand-side factors likely explain some of the recent slower growth in drug prices. New drug prescriptions as tracked by the IQVIA Institute were at 76 percent of their pre-COVID-19 levels in 2020, due to reduced demand for doctor visits and elective procedures during the pandemic.

Official estimates may overstate inflation by not adjusting for quality improvements. Research from Seidu Dauda, Abe Dunn, and Anne Hall explains the BLS does not adjust health-care sector prices for quality, which could mean official inflation estimates may not capture decreases in quality-adjusted prices within the sector. Their estimates indicate, “In contrast to official statistics that suggest medical care prices increased by 0.53 percent per year relative to economy-wide inflation from 2000 to 2017, we find that quality-adjusted medical care prices declined by 1.33 percent per year over the same period.”

Moreover, while the official inflation estimate uses transaction prices rather than list prices to account for negotiated discounts, the measure does not adjust for rebates. As such, a more comprehensive measure would show even lower inflation for drug prices. The IQVIA Institute tracks the net manufacturer price for drugs, accounting for all discounts and rebates, and finds prices actually fell 2.9 percent in 2020.

From 2009 to 2018, according to the Congressional Budget Office (CBO), within Medicaid and Medicare Part D, average net prices of prescriptions have fallen due to the increasing availability of generics. Prices for brand-name drugs, and new drugs in particular (which tend to be specialty in nature), have risen, but the increases have been offset by higher availability of lower-priced generics on average. While the report examines average prices within Medicare Part D and Medicaid, CBO indicates “Nationwide data on the average prices of prescription drugs are not readily available, but it is unlikely that the average net price of a prescription has increased considerably in recent years.”

High prices for new, specialty drugs have led some policymakers to express concerns about the profitability of pharmaceutical companies. CBO explains a longer-range view indicates “the profitability of the pharmaceutical industry is similar to that of other industries.” The report discusses the factors at play:

Understanding the profitability of the pharmaceutical industry requires distinguishing the revenues and short-run costs of producing a drug once it is approved from the much larger long-run costs of drug development and gaining approval for sale. … A pair of recent studies found that when capital costs and financial risks are taken into account, the pharmaceutical industry’s profits are close to—or just below—the middle of the distribution of all industries and might be trending downward.

If the government were to intervene in the market by setting prices, it would come with trade-offs for U.S. consumers.

Currently, the pharmaceutical industry is one of the most R&D-intensive, devoting about a quarter of its revenues to R&D in 2019, higher than even semiconductor or software firms. Further, the drug development process is highly risky and uncertain, with only about 12 percent of drugs that enter clinical trials receiving final approval by the Food & Drug Administration. Many of the new drugs receiving approval are specialty drugs. As CBO explains, “Specialty drugs generally treat chronic, complex, or rare conditions, and they may also require special handling or monitoring of patients. Many specialty drugs are biologics…which are costly to develop, hard to imitate, and frequently have high prices.” The availability and use of new specialty drugs has led to many health benefits, improved outcomes, and extended life spans for consumers.

Drug pricing legislation would lower prices for some existing drugs, which would likely cause a reduction in R&D investment because the expected returns to new drug development would fall. While lower prices would lead to increased use of existing drugs, less R&D would lead to fewer new drugs. In a CBO analysis of a previous version of drug pricing legislation, the report explained, “The overall effect on the health of families in the United States that would stem from increased use of prescription drugs but decreased availability of new drugs is unclear.”

The experience of European countries with drug pricing illustrates how past imposition of government pricing policy has caused R&D to flee. Until the 1990s, biopharmaceutical R&D in Europe was consistently higher than in the United States. Research by Nam D. Pham and Mary Donovan of ndp analytics explains how the diverging policy approaches of Europe and the U.S. in the 1990s reversed the trend—U.S. biopharmaceutical R&D surpassed Europe and the U.S. saw significant job expansion in the sector. Over the past two decades, the U.S. has been the leader in funding biomedical R&D, accounting for an estimated 70 to 80 percent of global funding.

Golec and Vernon estimated that by 2004, the real costs of the European Union drug pricing policies were “about $5 billion in forgone R&D spending, 1680 fewer research jobs and 46 forgone new medicines. Prospective long-horizon costs for the EU are estimated at between ten and 20 times these costs. … These policies essentially trade off the health and employment opportunities of future generations for cost savings for current pharmaceutical consumers.”

From the consumer perspective, drug pricing policies can also lead to delays in accessing new drugs that do come to market, which can have negative health outcomes by slowing the adoption of new technology.

Another concern with U.S. consideration of government-set prices for drugs is the question of where R&D activity might go in response. A 2020 report notes, “The United States was once a global also-ran in biomedical innovation, but it’s become the world leader thanks to the adoption of a broad set of public policies.” The report further explains how a number of competitors have implemented strategies to attract life-sciences innovation, including China, Singapore, Japan, and Sweden.

Government price setting is a misguided idea. Adopting government-set drug pricing is not a fix for today’s high inflation and it would discourage R&D and innovation that benefit U.S. consumers.