Products You May Like

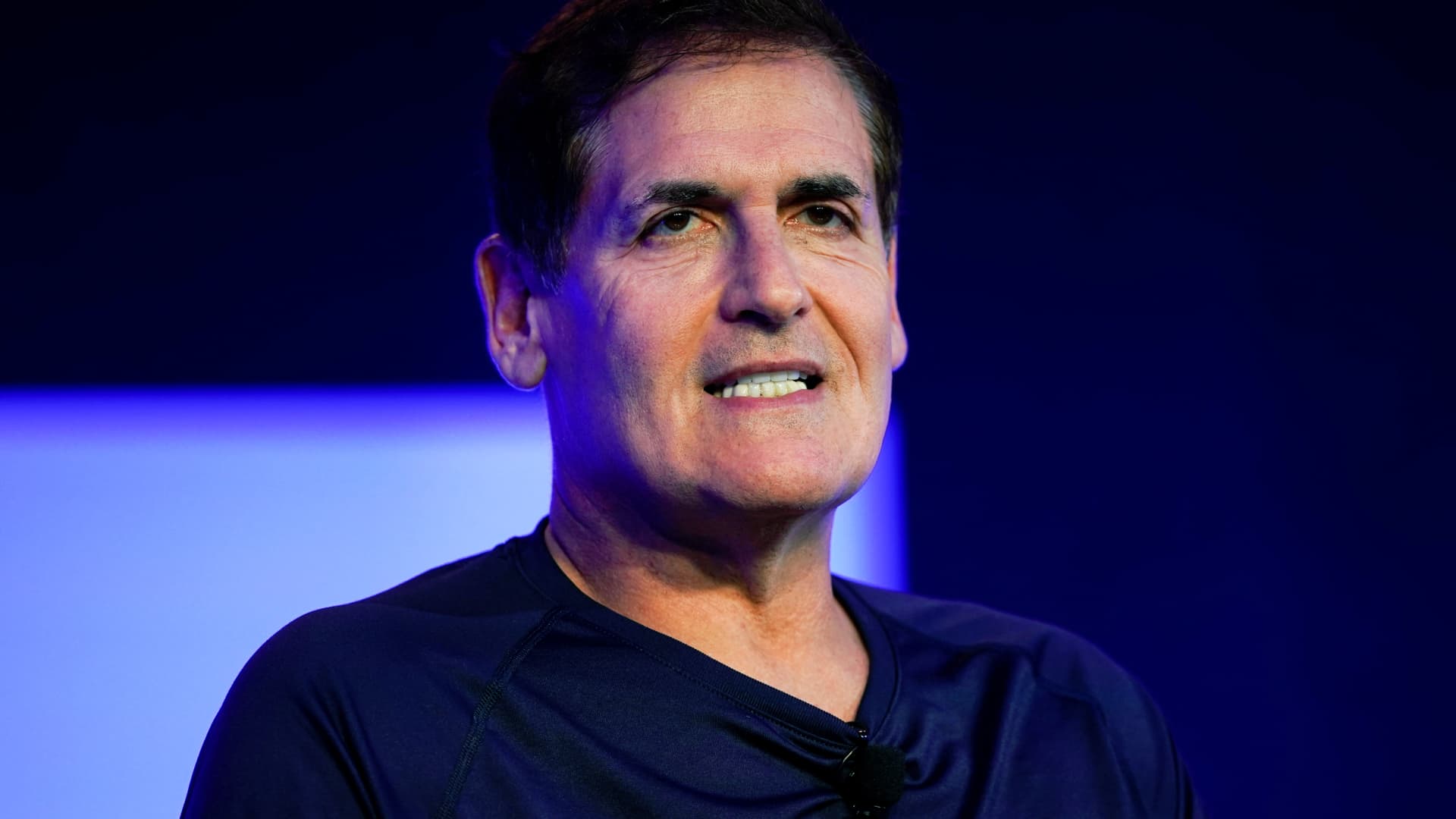

Over more than a decade on ABC’s “Shark Tank,” billionaire Mark Cuban has seen his share of good investments — and bad ones.

Last week, Cuban told the “Full Send” podcast that after investing nearly $20 million in 85 startups on “Shark Tank,” he’s taken a net loss across all of those deals combined. “I’ve gotten beat,” Cuban admitted with a laugh, before going on to share the worst investment deal he’s ever made on the TV show: the Breathometer.

In 2013, an entrepreneur named Charles Michael Yim went on “Shark Tank” to pitch his product, the Breathometer, as “the world’s first smartphone breathalyzer.” Yim wowed Cuban and the other Sharks by showing off a smartphone attachment that he claimed could accurately measure blood alcohol content (BAC).

Yim’s gave the Sharks glasses of champagne, and then had them blow into a small, plastic device that could attach to a smartphone. Yim claimed the device could send BAC level readings to your phone, and gave you the option of calling a cab with the touch of a button if your BAC level was too high.

Charles Michael Yim pitches the Breathometer on ABC’s “Shark Tank” in 2013.

Kelsey Mcneal | Disney General Entertainment Content | Getty Images

The pitch was compelling, and Yim became the first “Shark Tank” entrepreneur to pull in all five Sharks into a joint investment. Cuban, Kevin O’Leary, Daymond John, Lori Greiner and Robert Herjavec pooled together a $1 million investment for a 30% stake, which valued Yim’s company at $3.3 million.

“It was a great product,” Cuban said last week. “But, the guy – Charles – I’d look at his Instagram and he’d be in Bora Bora … Two weeks later, he’d been in [Las] Vegas partying, and then he’d be on Necker Island with Richard Branson.”

“I’d text him, like ‘What the f— are you doing? You’re supposed to be working,'” Cuban said. According to Cuban’s recollection, Yim would reply that he was “networking” on behalf of the business.

Cuban said the excuse didn’t quite hold up: “Next thing you know, all of the money’s gone.”

By 2016, Yim was transitioning away from the Breathometer, partnering with health care giant Philips on a product called Mint that measured levels of sulfur compounds in your mouth to determine whether or not you had bad breath.

In January 2017, the Federal Trade Commission filed a complaint against Yim and Breathometer, alleging that the company misled its customers about the product’s ability to accurately measure BAC. According to the FTC, Breathometer “lacked scientific evidence to back up their advertising claims.”

That same month, Breathometer reached a settlement with the FTC over that complaint, forcing the company to notify and fully refund every customer who’d bought a device. According to the FTC, the company never performed adequate testing despite claiming that its products were backed by “government-lab grade testing.”

“That was my biggest beating,” Cuban said.

In response to Cuban’s allegations, Yim tells CNBC Make It that the “comments were completely off [base],” and that he didn’t blow his company’s money on personal travel. He also says it’s “not fair” that Cuban would base his assessment of Yim’s CEO abilities on a series of social media posts, and notes that his trip to Necker Island was to pitch the Breathometer to Richard Branson. The pitch was successful, and Yim became a 2015 finalist in Branson’s Extreme Tech Challenge pitch competition.

“You can’t look at someone’s social media and take it for face value,” Yim says. “That’s not how social media works.”

Yim acknowledges not committing to proper testing for some of his products, and says that lack of rigor contributed more to derailing his company’s progress than his travel schedule. Today, neither the Breathometer or Mint products are available for purchase on the company’s website.

The founder notes that Cuban took the lion’s share of the investment, accounting for $500,000 of the total $1 million. He says the Sharks might finally recoup some value from their investment, because the company recently agreed to be acquired. Details for such a deal do not yet appear to be public.

Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank.”

Sign up now: Get smarter about your money and career with our weekly newsletter

Don’t miss:

Why Mark Cuban called this ‘Shark Tank’ CEO who brought in millions ‘a great case for what not to do’

Barbara Corcoran to ‘Shark Tank’ start-up: This common mental mistake is ’the biggest danger’ to your success