Products You May Like

Patent box regimes (also referred to as intellectual property [IP] regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Depending on the patent box regime, income derived from IP can include royalties, licensing fees, gains on the sale of IP, sales of goods and services incorporating IP, and patent infringement damage awards.

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

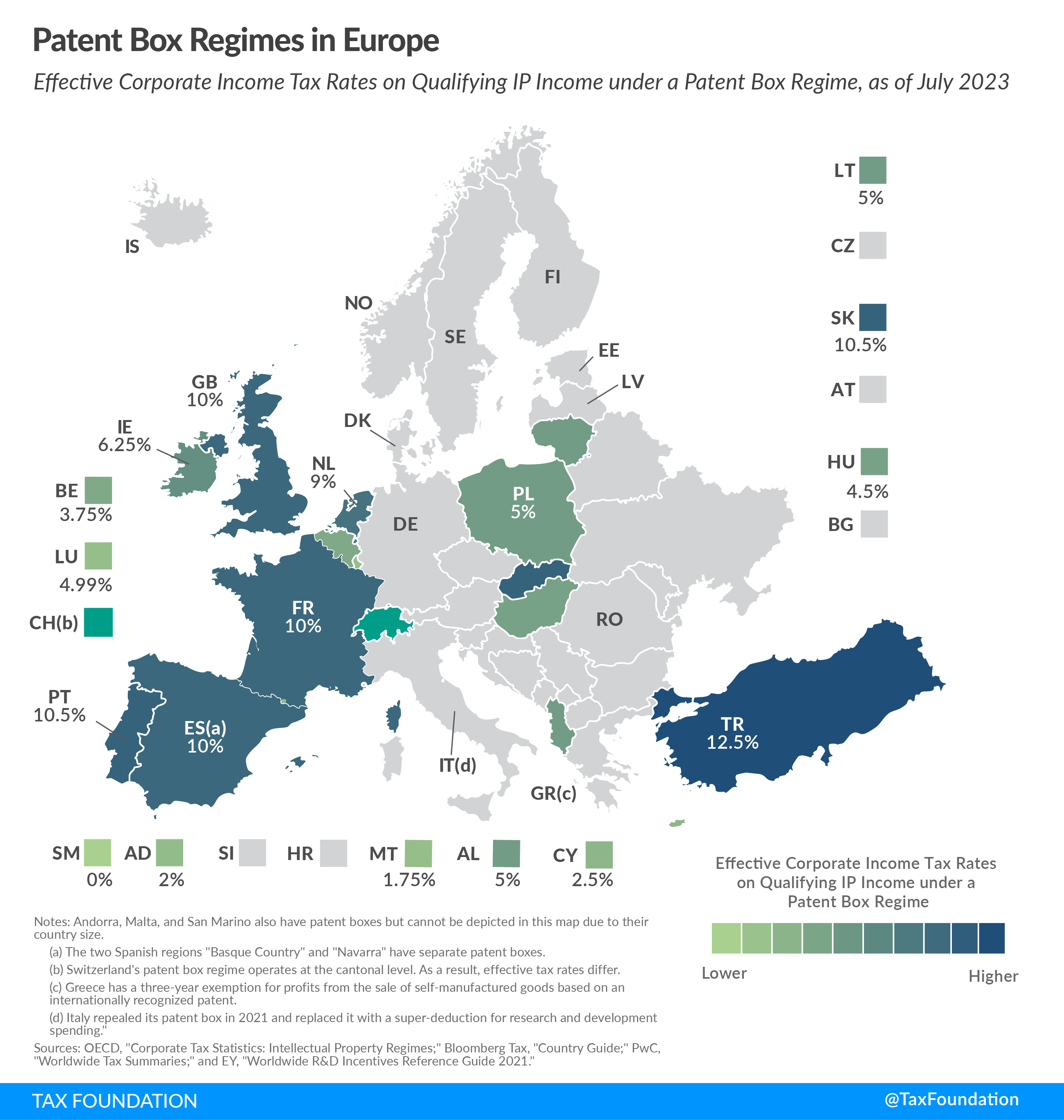

As today’s map shows, patent box regimes are relatively widespread in Europe. Most have been implemented within the last two decades.

Currently, 13 of the 27 EU Member States have a patent box regime in place. These are Belgium, Cyprus, France, Hungary, Ireland, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Slovakia, and Spain (federal, Basque Country, and Navarra). Non-EU countries Albania, Serbia Switzerland, Turkey, and the United Kingdom have also implemented patent boxes.

The reduced tax rates provided under patent box regimes range from 1.75 percent in Malta to 10.5 percent in Slovakia.

Italy repealed its patent box in 2021 and instead introduced a deduction for 230 percent of costs related to R&D. This represents a transition away from a benefit based on income (the patent box) to a benefit focused on investment or expenditure (the super-deduction). San Marino is the most recent country in Europe to repeal both of its IP regimes in 2022.

In 2022, Portugal increased its corporate income tax exemption for patent income from 50 to 85 percent and extended the exemption to income from software copyrights.

In 2015, OECD countries agreed on a so-called Modified Nexus Approach for IP regimes as part of Action 5 of the OECD’s Base Erosion and Profit Shifting (BEPS) Action Plan. This Modified Nexus Approach limits the scope of qualifying IP assets and requires a geographic link among R&D expenditures, IP assets, and IP income. To be in line with this approach, previously noncompliant countries have either abolished or amended their patent box regimes in the last few years.

Many European countries offer additional R&D incentives, such as direct government support, R&D tax credits, or accelerated depreciation on R&D assets. The effective tax rates on IP income can therefore be lower than the ones stated in the respective patent box regimes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe