Products You May Like

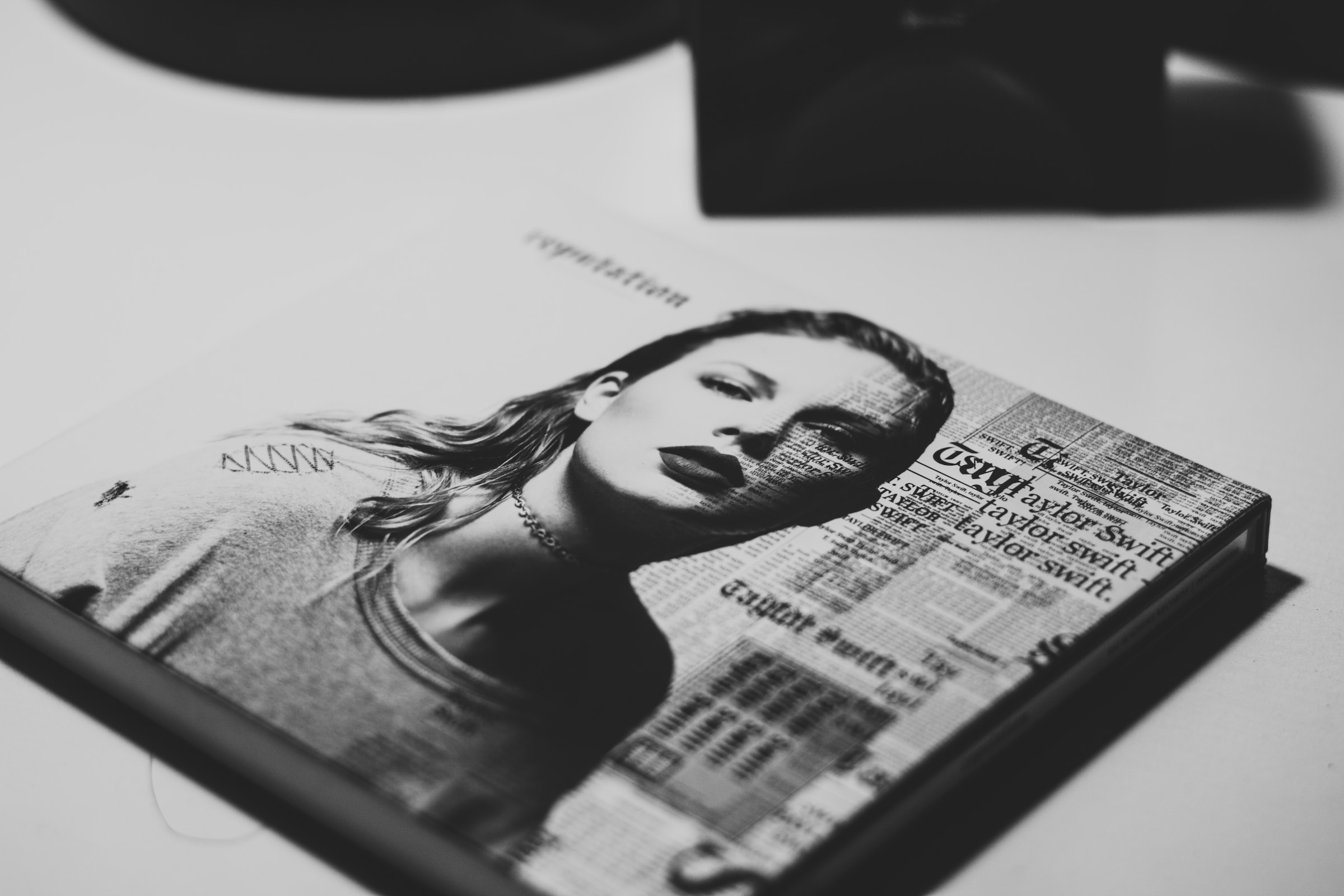

It’s no “Cruel Summer” this year if you’re a Swiftie. Taylor Swift’s Eras Tour could be the highest-grossing tour ever by the time its 131 shows are finished in 2024—potentially bringing in $1.4 billion. While ticket sales and hotel industry revivals have made headlines, what are the tax implications of the Eras Tour?

Increasing State and Local Tax Revenue

Swift’s arrival in town is good news for state and local governments—the tour brings in significant local tax revenue. Take Cincinnati for example, where Swift played two shows. Visit Cincy and the Cincinnati Regional Chamber’s Center for Research and Data estimated that the singer would draw in $48 million of new spending, resulting in an extra $3.8 million in tax revenue for the city. The tour has even earned the praise of the Philadelphia Federal Reserve for its contribution to growing the city’s tourism and hotel revenue.

Tax Karma for Ticket Scalpers

The astronomical demand for Eras Tour tickets has also led to increased tax revenue. Fans who weren’t lucky enough to purchase tickets through the Ticketmaster pre-sale earlier this year are turning to sites like StubHub and Seat Geek for last-minute deals to her remaining shows. Due to overwhelming demand, these second-hand ticket sellers have been marking up prices by almost 10 times their face value. But with higher markups come the potential for larger tax bills. The American Rescue Plan of 2021 lowered the reporting threshold for online marketplaces so that sellers are required to file a Form 1099-K (which helps determine a taxpayer’s total taxable income) if their profit is over $600. With tickets going for well over a thousand dollars, that can mean more tax revenue.

Tax Deductions (Taylor’s Version)

When it comes to Swift herself, she’s not only helping the government take in more revenue, but she also gets to deduct many of her expenses on the road when it comes to her own taxable income. Swift’s accounting team can use the music industry’s unique tax rules to maximize her deductions and reduce her overall tax burden. For example, musicians can deduct the cost of transportation, hotel stays, musical instruments, equipment, and gear (including their maintenance costs). Tax deductions for these business expenses are important because they make sure that artists like Swift are taxed only on their profits, not their expenses. This lower tax burden allows artists to ultimately reinvest in their work, such as purchasing newer instruments and recording equipment and planning future tours. As written in one of her songs, “if you fail to plan, you plan to fail,” and planning for taxes is crucial for artists to continue touring and releasing new music.

Taylor Swift’s Eras Tour highlights that taxes impact everyone, artists and fans alike. It also showcases how deductions for business expenses make it easier for artists like Swift to reinvest, tour more, and, in turn, boost local economies and increase tax revenue.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe