Products You May Like

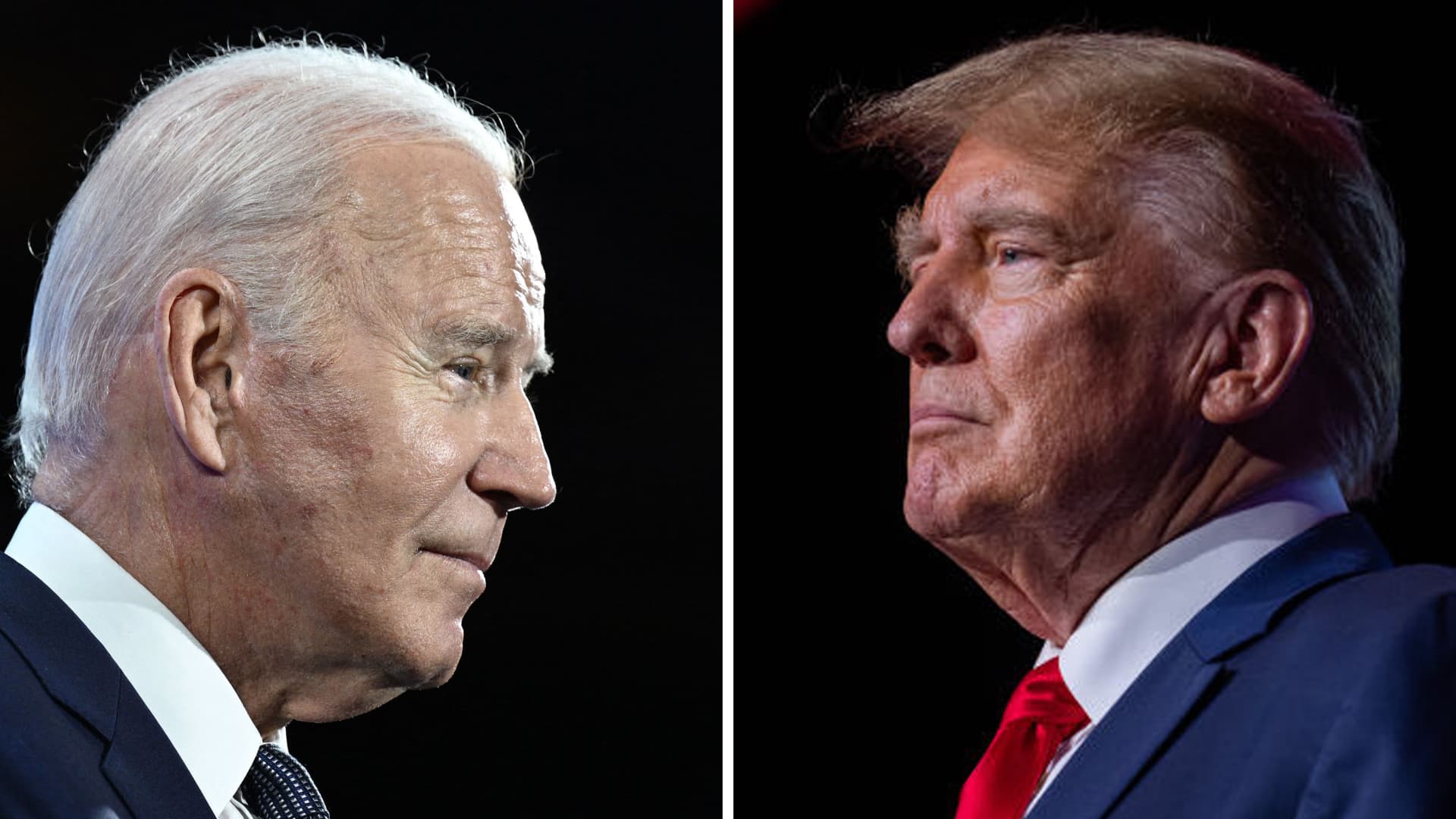

The stock market has yet to price in a potential outcome in the presidential election, a rematch between President Joe Biden and former President Donald Trump.

In general, election years are not great for the stock market leading up to voting day, David Woo, CEO of research firm Unbound, said Wednesday in a session during CNBC’s Financial Advisor Summit.

But this year is an exception, Woo explained.

“This year we’re up 12% so far. This is the best-performing year for the S&P 500 [in] an election year since [the] 1980 election,” Woo said.

Looking back to 1928, the S&P 500 returned an average 7.5% in presidential election years, versus an average 8% in non-election years, according to a March analysis from J.P. Morgan Private Bank.

“Given this is going down in history as probably the most consequential and contentious election in the U.S. in 100 years, it’s kind of difficult to believe that the market is trading with the election in mind,” Woo said.

What Biden, Trump could mean for the stock market

While domestic issues are usually determinative in presidential elections, the coming race will likely be focused on international issues, said Woo.

Both candidates will enter office with a budget deficit of $1 trillion, meaning “whoever is going to be the next president is going to be facing a real serious constraint,” said Woo. “When it comes to fiscal policy, frankly speaking, I don’t think there will be a huge difference.”

Instead, the differentiator will depend on the candidate’s stance on foreign policy, he said.

Defense spending might increase under a Biden administration, signaling a potential boost for defense stocks, Woo said.

Meanwhile, emerging markets “may be more bullish” under a Trump administration, he said.

“I think Trump is going to come back with a more transactional approach in dealing with American adversaries,” said Woo, who believes the Republican candidate us going to revisit the Phase 1 Trade agreement between China and Russia as the “starting point” of any negotiation deal between the U.S. and China.

Elsewhere, energy stocks might benefit under Biden more so than Trump.

“Everybody thinks Donald Trump is going to be bullish for energy … that’s completely untrue,” Woo said.

“It was actually not until Biden became president and energy stocks soared because geopolitical risks went through the roof,” he said.

Meanwhile, all polls are pointing toward a Trump reelection, Steve Kornacki, National Political Correspondent at NBC News and MSNBC, said during the summit.

“Donald Trump in the average is leading Biden by 1.1 points nationally,” he said, as Trump has made gains among Hispanic and African American voters, as well as younger, nonwhite voters.

“That accounts for why Donald Trump is polling better now than he did four years ago,” he said.

When the market gets volatile during elections

Historically, potential election outcomes have a minimal impact on financial market performance in the medium and long term, according to an analysis by investment strategists at U.S. Bank Wealth Management. They studied market data from the past 75 years and identified patterns that repeated themselves during election cycles.

Yet delays in verifying an election winner have negatively affected riskier asset classes in prior races, according to the analysis.

“The stock market does not like uncertainty whatsoever,” said Douglas A. Boneparth, a certified financial planner, president and founder of Bone Fide Wealth, a wealth management firm based in New York City.

If things are delayed and there’s not a “clear-cut winner,” that uncertainty can lead to market volatility, he said. “But it’s very hard to predict what the market is going to do based on simply who’s going to get elected.”

Overall, the stock market has done well under both presidents, said Boneparth: “No one’s crying over how well the market has done in either administration.”

‘You’re probably going to make a mistake’

“As financial advisors, we don’t really make decisions around politics, let alone who’s going to be elected president,” said Boneparth, a member of the CNBC Financial Advisor Council.

Therefore, it’s in your best interest to stick to your long-term strategy, said Boneparth.

“If you’re making any changes specifically because of one candidate or the other, you’re probably going to make a mistake,” he said. “If you’re going to let this disrupt your long-term strategy, what else are you going to let disrupt your long-term strategy?”