Products You May Like

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

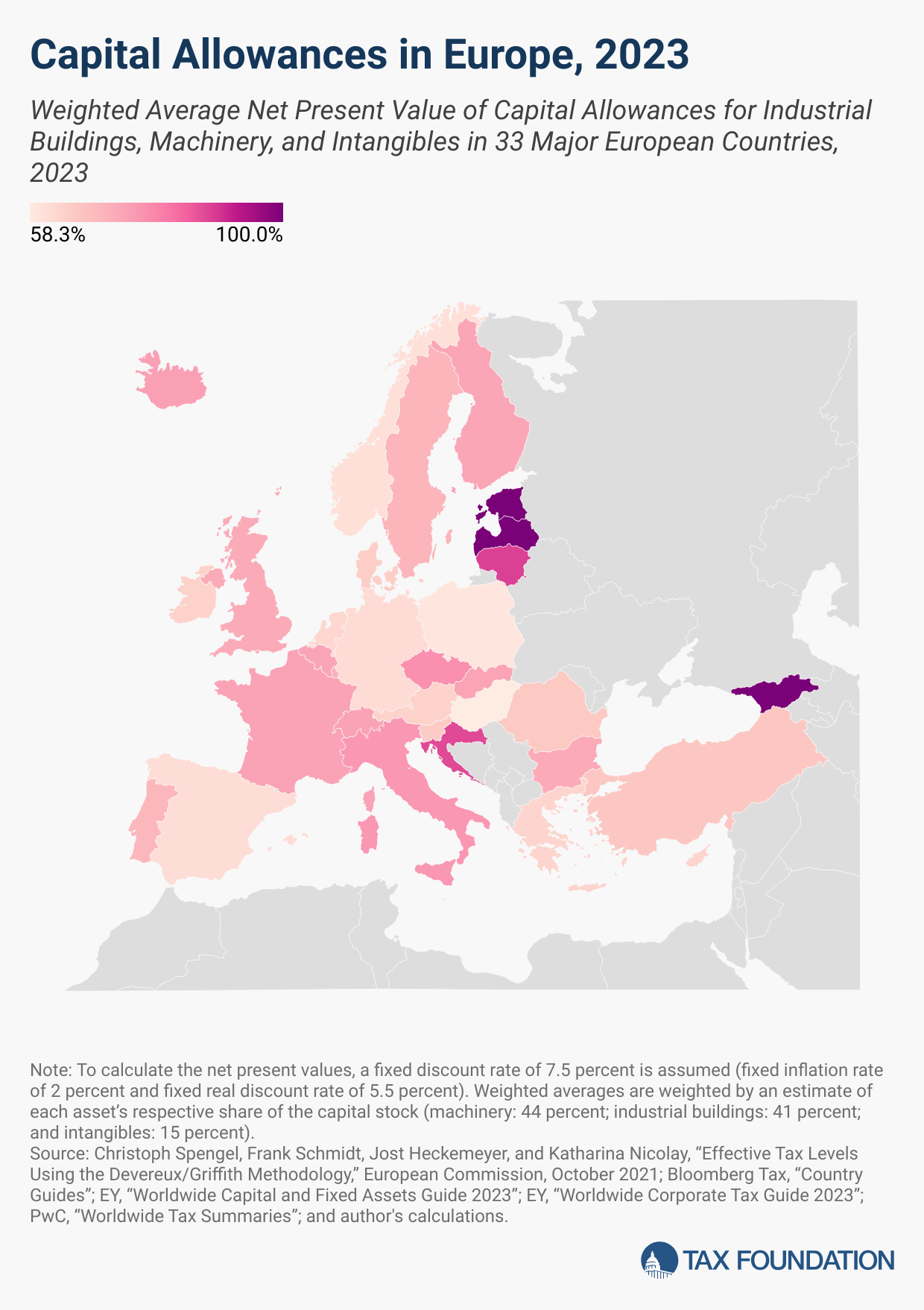

and can impact investment decisions—with far-reaching economic consequences. And as today’s map shows, the extent to which businesses can deduct their capital investments varies greatly across European countries.

Businesses determine their profits by subtracting costs (such as wages, raw materials, and equipment) from revenue. However, in most jurisdictions, capital investments are not seen as regular costs that can be subtracted from revenue in the year of acquisition. Instead, depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment.

schedules specify the life span of an asset, which determines the number of years over which an asset must be written off. By the end of the depreciation period, the business would have deducted the total initial euro cost of the asset.

However, in most cases, these depreciation schedules do not consider the time value of money (a normal return plus inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

). For instance, assume a machine costs €10,000 and is subject to a life span of 10 years. Under straight-line depreciation, a business could deduct €1,000 every year for 10 years. However, due to the time value of money, a deduction of €1,000 in later years is not as valuable in real terms as today’s deduction. As a result, businesses cannot fully deduct the net present value of capital investment. This inflates taxable profits, which, in turn, increases the cost of capital investment. A higher cost of capital can lead to a decline in business investment and reductions in the productivity of capital and lower wages.

The map reflects the weighted average capital allowances of three asset types: machinery, industrial buildings, and intangibles (patents and “know-how”). Capital allowances are expressed as a percentage of the present value cost that businesses can write off over the life of an asset. The average is weighted by the capital stock’s respective share in an economy (machinery: 44 percent; industrial buildings: 41 percent; and intangibles: 15 percent). For instance, a capital allowanceA capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances.

rate of 100 percent represents a business’s ability to fully deduct the cost of an asset—either through full immediate expensing or neutral cost recovery.

Estonia, Georgia, and Latvia only taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

distributed profits while reinvested earnings are untaxed. This allows for 100 percent of the present value of all capital investment to be written off, making their treatment of capital investment the most attractive in Europe.

Among countries without distribution-based systems, Lithuania (88.2 percent), Croatia (87.2 percent), and the Czech Republic (77.6 percent) provided the best tax treatment of capital investment in 2023, while businesses in Norway (60.7 percent), Poland (59.3 percent), and Hungary (58.3 percent) could write off the lowest shares of their investment costs.

On average, in 2023, businesses in Europe could write off 71.9 percent of the present value cost of their investments in machinery, industrial buildings, and intangibles. By asset category, the highest capital allowances were for machinery (86.9 percent), followed by intangibles (82.6 percent), and industrial buildings (52.1 percent).

For comparison, in 2023, the US allowed its businesses to recover 66.7 percent of capital investment costs on average. Nevertheless, bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

, which was adopted in 2017, is phasing out in 2023. By 2027, the treatment of business investment will return to a much less generous policy.

In 2023, Estonia, Georgia, and Latvia had distribution-based systems, allowing businesses to deduct the full cost of investment. Other countries like the United Kingdom provided full deductions for certain investments in equipment. Unfortunately, some of these policies are temporary, and as they expire, the after-tax cost of investment will rise.

The Czech Republic applied extraordinary depreciation of machinery from 2020 to 2023, allowing businesses to deduct 60 percent of investment costs in the first year and the remaining 40 percent in the second year. The provision expired in 2024.

Countries like Finland, Germany, and the United Kingdom recognized the importance of capital allowances in supporting business investment and decided to prolong, renew, or modify the policies set to expire.

In Finland, the declining-balance depreciation rate for machinery was temporarily doubled for the years 2020-2023. A proposal to extend the increased depreciation rules to 2025 was recently approved.

In Germany, accelerated depreciation schedules for machinery that were in place for the years 2020-2022 expired at the end of 2022. However, they were partly renewed in 2024 and the federal government is planning to increase and extend them into 2028.

The United Kingdom implemented full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

for machinery and equipment in April 2023, along with a 50 percent first-year deduction for long-life asset investments, and increased the corporate tax rate from 19 percent to 25 percent. Originally set to expire on March 31, 2026, the 2023 Autumn Statement made full expensing and the 50 percent first-year deduction permanent features of the tax code.

As European countries try to support investment, policymakers should aim to permanently provide immediate deductions for investments in machinery and equipment, and for all other capital investments, they should provide adjustments for inflation and the time value of money.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share