Products You May Like

Form 1099-A typically lands in your lap after a foreclosure or when your property securing a debt was repossessed or abandoned. In this guide, we’ll break down everything you need to know about a 1099-A tax form and how to use it during tax filing so you can approach tax season with a little less stress and a lot more confidence.

At a glance:

- You’ll get Form 1099-A after the foreclosure, repossession, or abandonment of property used as a security for a loan.

- This can mean you had a taxable event, such as a gain, loss, or canceled debt.

- Have Form 1099-A on hand when filing your taxes.

What is a 1099-A form?

If you had property foreclosed, repossessed, or abandoned, you may receive Form 1099-A. Filing requirements set by the Internal Revenue Service (IRS) require lenders to issue IRS Form 1099-A, Acquisition or Abandonment of Secured Property, when they acquire property used as a security for a debt (or when that property has been abandoned).

Lenders send this form, also called an information return, to the taxpayer (you) and the IRS to notify both parties of the property’s status and provide key details that you may need for tax purposes.

Form 1099-A is only necessary for the following types of property:

- Real property, such as your house and any land you own

- Intangible property like stocks or patents that don’t physically exist

- Tangible personal property used in a trade or business for investment (this excludes personal property used for personal purposes)

Losing secured property through foreclosure, repossession, or abandonment can result in the following taxable situations:

- A gain or loss

- Forgiven debt (often reported on Form 1099-C)

Because of this, you’ll need the details on Form 1099-A to complete your income tax return.

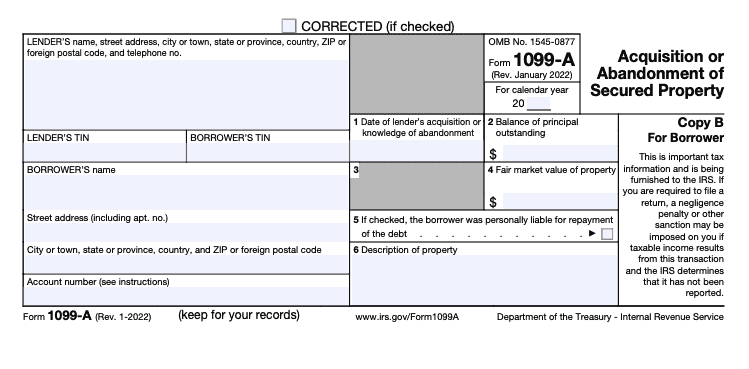

Example of Form 1099-A

Here’s a peek at what a 1099-A form looks like. As the borrower, you’ll receive copy B:

Form 1099-A is broken down into a few essential parts:

- Box 1: Date of lender’s acquisition or knowledge of abandonment: This box tells you when the lender took the property back or realized you had abandoned it.

- Box 2: Balance of principal outstanding: This is the remaining loan amount you still owed at the time of acquisition or abandonment.

- Box 4: Fair market value of property: This is the property’s fair market value (FMV) when it was acquired by the lender (the date in Box 1). This figure is important because it could affect whether you need to report any income or loss on your tax return.

- Box 5: Personally liable for repayment of the debt: This box will be checked if you were personally liable for repaying the loan when it was first taken out (or when it was last modified).

- Box 6: Description of property: For real estate, this is typically an address or other identifying information such as lot and block numbers. For tangible personal property, it may simply indicate the type of property, such as a car make and model.

On Form 1099-A, you’ll also find contact information for the financial institution, plus your taxpayer identification number (TIN) and account number.

Instructions for Form 1099-A

If you received a 1099-A, you’ll need it handy when filing your tax return. This form does not automatically mean there will be tax consequences, but you may have a gain or loss to report or additional taxable income due to canceled debt. Either way, TaxAct® can help you properly report the information found on Form 1099-A.

What to do with Form 1099-A

- Check your numbers: As with any tax form, always verify that the information on the form is correct. Mistakes happen, and you want to be sure everything is accurate before you include it in your tax return.

- Determine your taxable income: Use the worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to calculate if you have a gain or loss to claim. If you have any forgiven debt to report, you should also have Form 1099-C.

- Report your gain, if applicable: Our tax preparation software will then guide you through reporting your 1099-A information, depending on whether you received the form for your main home, business, or investment property. We’ll ask detailed questions about your Form 1099-A to ensure accurate tax reporting.

Calculating gains or losses with Form 1099-A

When you lose your property through foreclosure, repossession, or abandonment, the IRS still considers it a “sale,” meaning you may have a reportable gain or loss.

- You have a gain if you sell for more than your adjusted cost basis.

- You have a loss if you sell for less than your adjusted basis.

The “selling price” can be tricky for a foreclosed or repossessed property. Depending on your situation, it can be either what’s left on your loan or the property’s FMV. However, thanks to the home sale exclusion, you may not owe taxes on any “gains” you had on the sale of your main home.

The home sale exclusion allows you to exclude up to $250,000 in gains ($500,000 for married couples filing jointly). If the bank took back your house, you generally wouldn’t owe taxes on any capital gains within the home sale exclusion amounts as long as you meet both the following criteria:

- Owned your home and lived there as your primary residence for at least two out of the last five years AND

- Haven’t used the home sale exclusion in the last two tax years.

If you do end up with a taxable gain, it is treated as a capital gain or an ordinary gain (taxed at ordinary income tax rates). Capital gains come from selling capital assets, but there are some exceptions.

Specific cases

Here’s how to determine your sales price in different scenarios:

- Foreclosure and repossession: If you’re still liable for the remaining debt (Box 5 is checked on your 1099-A), your sales price is the lower of the outstanding balance (Box 2) OR the property’s FMV (Box 4) plus any foreclosure sale proceeds.

- Abandonment: If you abandon the property and Box 5 is checked, there is no “sale” until the bank officially takes over and forecloses on it. If Box 5 isn’t checked, you’ll use the amount in Box 2 as your sales price.

- Ordinary loss from abandonment: If you abandon the property and aren’t personally liable (Box 5 not checked), the IRS treats it as an ordinary loss rather than a capital loss. You can deduct this ordinary loss from your ordinary income only if the secured property was not held for personal use (i.e., your personal home would not be deductible in this instance).

Don’t worry; we can help you report all this correctly if you e-file with TaxAct.

Calculating cancellation of debt income with Form 1099-A

Cancellation of debt income is often taxable unless you qualify for an exclusion. If the lender canceled your loan after foreclosure, repossession, or abandonment, you may need to report this as income when filing your taxes. Again, Box 5 on Form 1099-A is important here:

- If Box 5 is NOT checked: You are not personally liable for the loan and won’t have to report canceled debt as income.

- If Box 5 IS checked: For foreclosures and repossessions, you only owe taxes on the amount of canceled debt greater than the property’s FMV (Box 4). For abandoned property, the full canceled debt amount is taxable.

However, the IRS offers several exceptions to the rules on canceled debt. TaxAct’s software can help you figure out what’s taxable and what isn’t by asking you a series of questions about the canceled debt.

Note: Instead of Form 1099-A, your lender may only send you Form 1099-C. In other cases, you may receive both forms. TaxAct can help you report with either form on your tax return if necessary.

FAQs About Form 1099-A

Do I have to pay taxes on the amount listed on my 1099-A?

In some cases, yes. As previously mentioned, you might have a reportable gain or loss from the transaction, or you may have some taxable income to report due to canceled debt. However, simply receiving Form 1099-A does not automatically mean you have tax liability.

When will I receive Form 1099-A?

The IRS due date for lenders to send Form 1099-A is Jan. 31, so you should see it in your mailbox (or email inbox) by mid-February. This will be the calendar year after the property was foreclosed, repossessed, or abandoned.

What if I disagree with the information on my 1099-A?

If you notice a mistake on your Form 1099-A, contact your lender immediately to resolve any discrepancies and receive a corrected 1099-A form.

Can I deduct losses related to foreclosure or abandonment?

If the property was a business or investment property, you might be able to deduct a loss. However, losses on personal-use property, like your primary home, aren’t deductible.

How to file Form 1099-A with TaxAct

TaxAct can help you file your 1099-A form. Where you enter your 1099-A information depends on whether the form you received is for your main home, business property, or investment property.

Main home

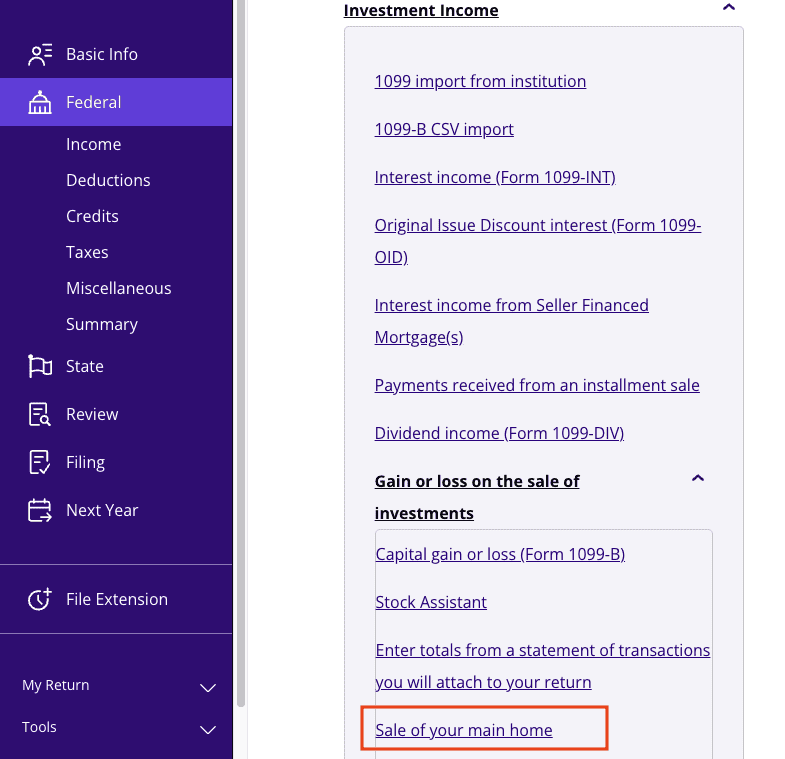

If this is a foreclosure of your main home, any gain (that is not excluded due to this being your main home) will be taxable. A loss will not be deductible on your return since it is personal-use property. To report this in TaxAct:

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Investment Income dropdown, click the Gain or loss on the sale of investments dropdown, then click Sale of your main home.

3. Continue with the interview process until you reach the screen titled Investment Income – Sale of Main Home, then click Yes.

4. On the second screen, titled Investment Income – Sale of Main Home, click Yes.

5. On the screen titled Sale of Main Home – Date Acquired/Sold, enter the Date sold (shown in Box 1 of Form 1099-A).

6. On the screen titled Sale of Main Home – Selling Price, enter the Sales price (from Line 6 of the Worksheet for Foreclosures and Repossessions), and continue with the interview process to enter your information

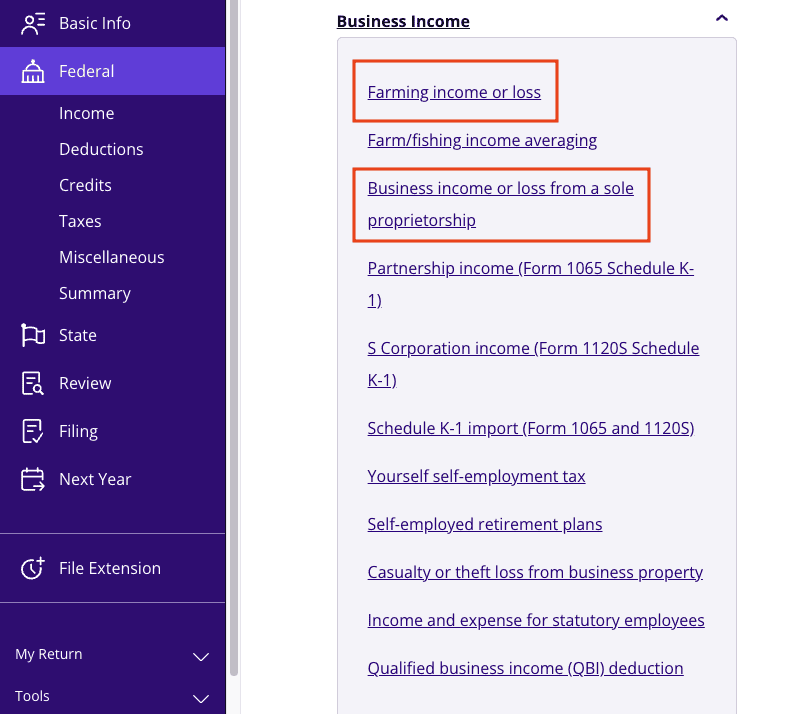

Business use

To enter the gain or loss for business property, use the Sale of Business Property Worksheet in the appropriate business section (Schedule C, E, or F).

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

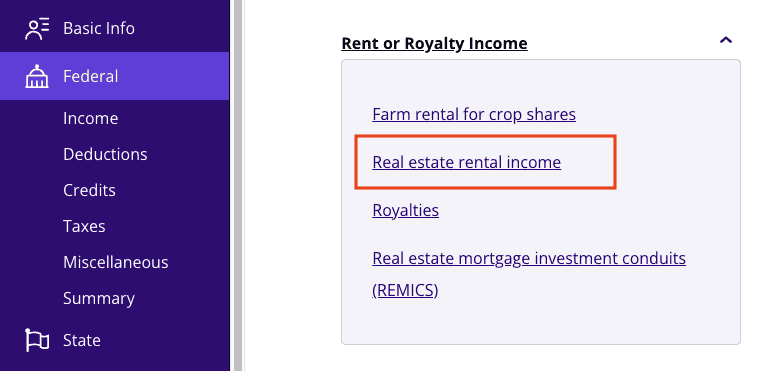

- Depending on your situation, you should click the Business Income dropdown, then click Business income or loss from a sole proprietorship OR Farming income or loss. Alternatively, click the Rent or Royalty Income dropdown, then click Real estate rental income.

3. Click + Add Schedule C, + Add Schedule F, or + Add Schedule E, Pg 1 to create a new copy of the form or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process to enter your information.

Investment use

To enter the gain or loss for investment-related property (on Schedule D):

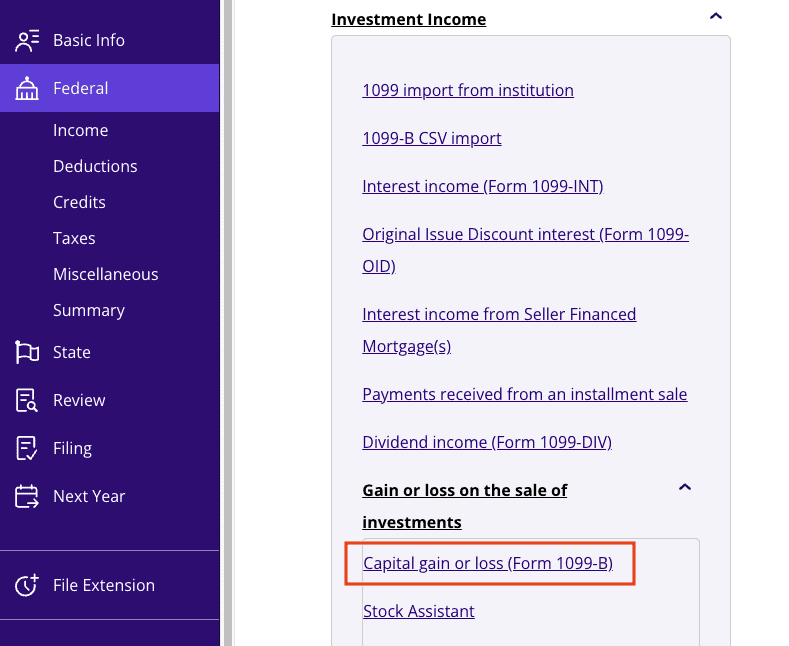

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Investment Income dropdown, click the Gain or loss on the sale of investments dropdown, then click Capital gain or loss (Form 1099-B).

3. Click + Add Form 1099-B to create a new copy of the form or click Edit to edit a form already created (desktop program: click Review instead of Edit).

4. Continue with the interview process until you reach the screen titled Investment Sales – Transaction Details and enter your Form 1099-A and Worksheet for Foreclosures and Repossessions information.

Enter the transaction information:

- Please enter an appropriate description.

- The Date acquired will be the date you bought the property.

- The Date sold will be shown in Box 1 (Form 1099-A).

- The Cost or other basis will be the amount from Line 7 of the Worksheet for Foreclosures and Repossessions.

- The Sales proceeds will be the amount from Line 6 of the Worksheet for Foreclosures and Repossessions.

Note: If this is personal property (possibilities are a vacation home, timeshare, vehicle and some inherited property), continue to the screen titled Investment Sales – Adjustment Code(s), then select “L – Other Non-Deductible Loss (including Personal Loss)” from the Other adjustment code drop-down to indicate the property is personal-use property. Any gain computed will be taxable; a loss will not be deductible on your return since it is personal-use property.

The bottom line

Dealing with IRS Form 1099-A can appear confusing, but TaxAct can give you the support you need to navigate reporting any applicable gains or canceled debt with confidence. So, take a deep breath, head over to taxact.com, and let’s tackle that 1099-A!