Products You May Like

Federal prosecutors endorsed plans to allow two former Sam Bankman-Fried lieutenants, Gary Wang and Caroline Ellison, to post bail after both pleaded guilty to supporting a multibillion-dollar fraud allegedly perpetrated by former FTX CEO Bankman-Fried, court documents show.

Gary Wang was the chief technology officer of FTX. Caroline Ellison was the co-CEO of Alameda Research, Bankman-Fried’s cryptocurrency trading firm.

Wang and Ellison would be required to post $250,000 in bail each, surrender their passports and restrict their travel to the continental United States.

In return, the pair conceded their role in supporting an $8 billion fraud that left millions of customers without their investments and destabilized the crypto industry.

Prosecutors won’t object to the bail conditions, but it’s unclear whether a judge will approve them.

Attorneys for Ellison and Wang did not immediately respond to requests for comment.

In an earlier statement, Wang’s attorney Ilan Graff, a partner at Fried, Frank, Harris, Shriver & Jacobson, said “Gary has accepted responsibility for his actions and takes seriously his obligations as a cooperating witness.”

In addition to admitting their complicity in the collapse of FTX, Wang and Ellison signed consent orders with the Commodity Futures Trading Commission, a civil concession that Bankman-Fried has yet to make. Wang and Ellison also both settled separately with the Securities and Exchange Commission.

Wang, 29, and Ellison, 28, both pleaded guilty to fraud charges stemming from their leadership positions at FTX and Alameda, respectively. They signed their deals in the Manhattan U.S. Attorney’s Office on Monday.

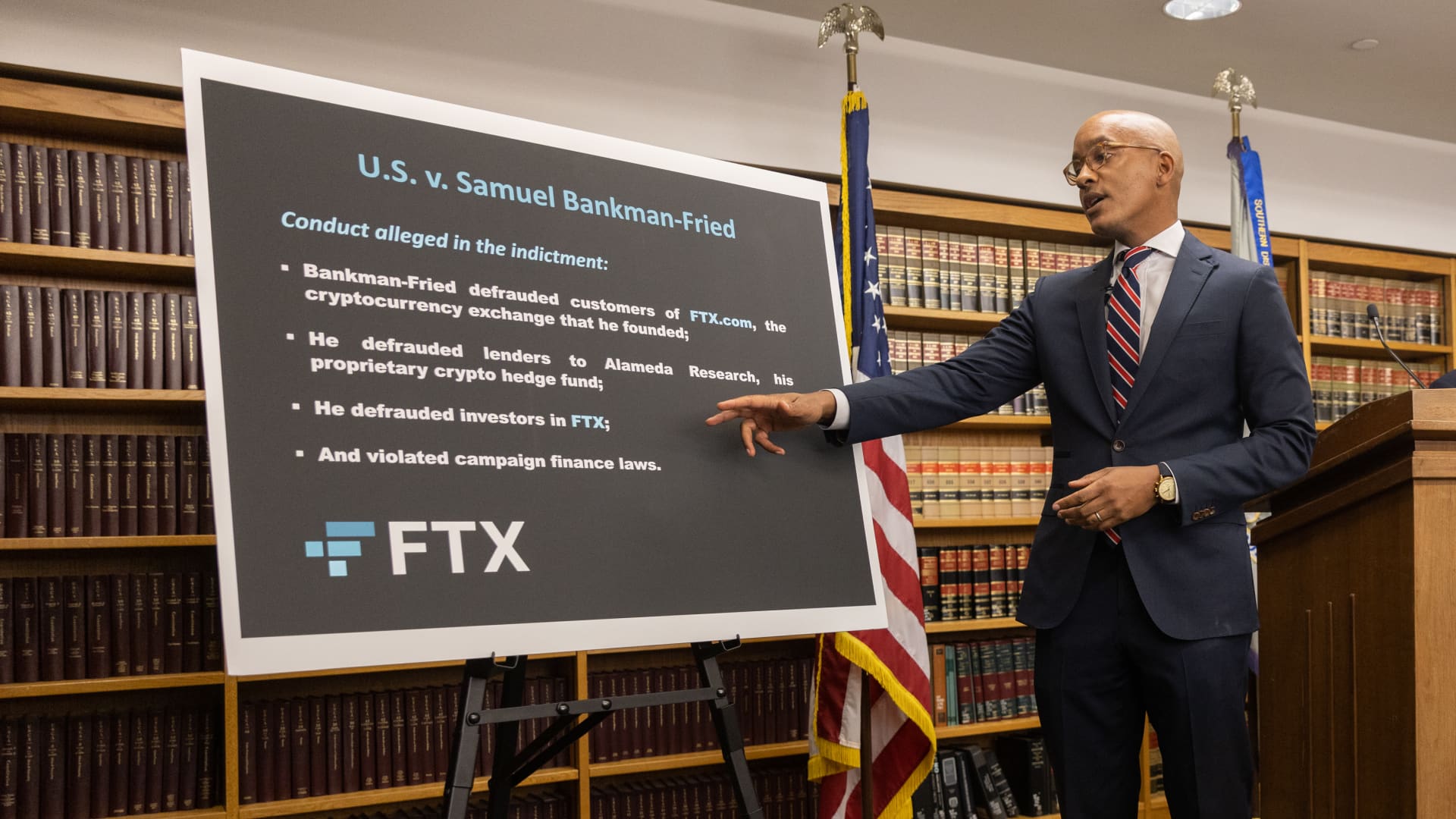

Whether Bankman-Fried, 30, has made a plea deal has not yet been disclosed. In a prerecorded statement Wednesday night, U.S. Attorney Damian Williams said the indicted former FTX CEO had been taken into FBI custody after a chaotic Bahamas extradition process.

Bankman-Fried will appear before a judge Thursday.

FTX’s collapse was precipitated when reporting by CoinDesk revealed a highly concentrated position in self-issued FTT coins, which Bankman-Fried’s hedge fund Alameda Research used as collateral for billions in crypto loans. Binance, a rival exchange, announced it would sell its stake in FTT, spurring a massive withdrawal in funds. The company froze assets and declared bankruptcy days later. Charges from the SEC and CFTC indicated that FTX had commingled customer funds with Alameda Research and that billions in customer deposits had been lost along the way.