Products You May Like

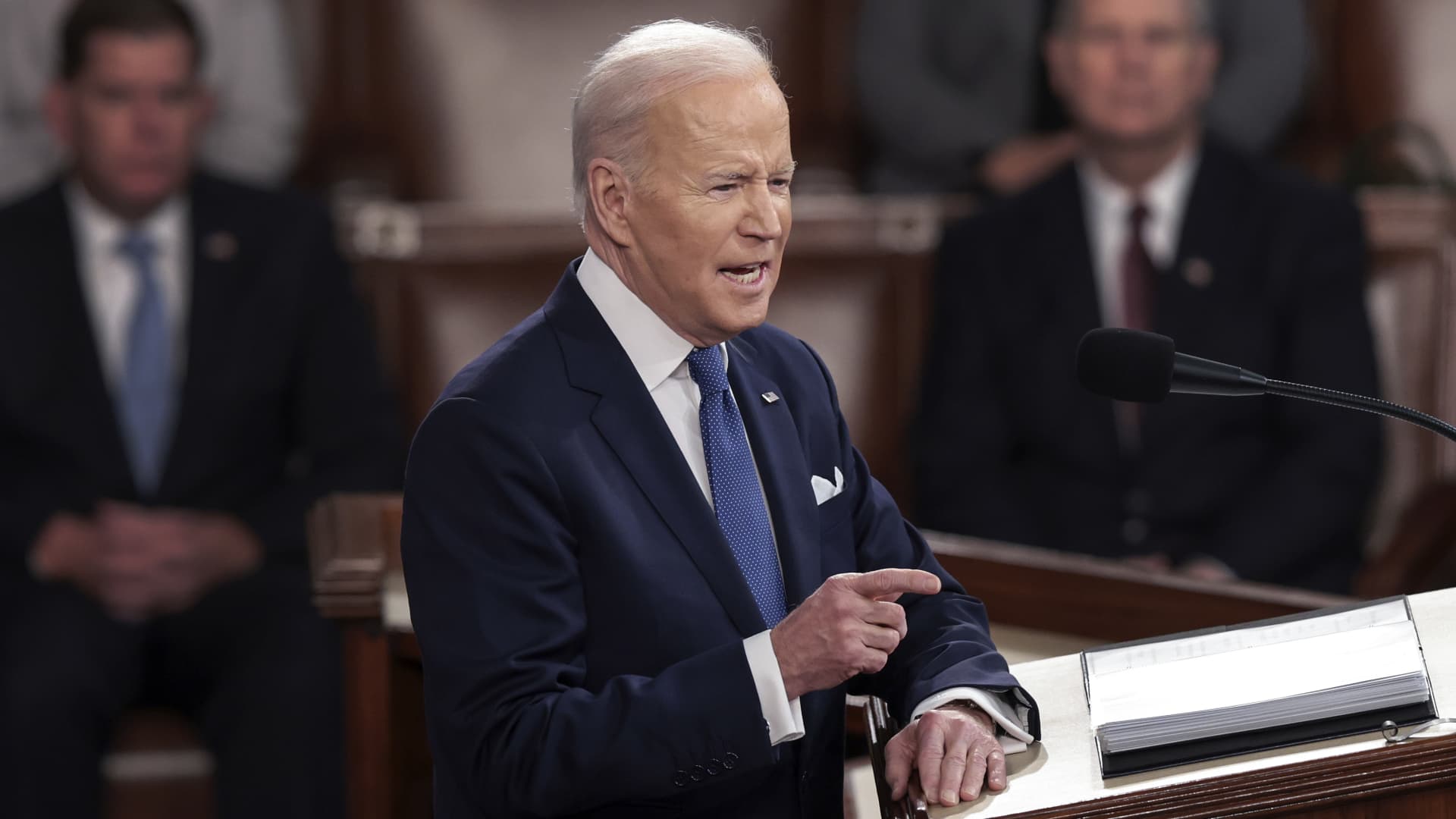

President Joe Biden will again call for a “billionaire minimum tax” during his State of the Union address on Tuesday.

While details haven’t been released, Biden previously proposed a billionaire minimum tax in his 2023 federal budget, calling for a 20% levy on households with a net worth of more than $100 million.

In the original plan, the 20% tax applied to “total income,” including regular earnings and so-called unrealized gains, or investment growth, the U.S. Department of the Treasury outlined.

“This minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters,” the White House said in a press release on Monday, noting the average federal income tax rate for billionaires is typically around 8%.

However, Biden’s original billionaire minimum tax didn’t gain traction in Congress and it’s even less likely to happen with a Republican-controlled House now, experts say.

“I view this billionaire minimum income tax as a messaging bill to highlight some of the problems with our tax code,” said Steve Rosenthal, senior fellow at the Urban-Brookings Tax Policy Center.

I view this billionaire minimum income tax as a messaging bill to highlight some of the problems with our tax code.Steve RosenthalSenior fellow at the Urban-Brookings Tax Policy Center

Senate Democrats pushed for a similar billionaire tax in October 2021 to help fund their domestic spending agenda. But the plan never gained broad support within the party.

“I don’t see a lot of support for Biden’s billionaire minimum tax on the Hill,” Rosenthal said.

Problems with the billionaire minimum tax

Even with more support, Biden’s billionaire minimum tax may face other hurdles, experts say.

“I’m quite skeptical of Biden’s billionaire minimum income tax — both for the administrative and legal issues,” Rosenthal said, describing the original proposal as “very complicated.”

The Tax Foundation has also voiced concerns about Biden’s original proposal, arguing the plan adds “new compliance and administrative challenges for an already overburdened IRS.”

The Senate version of the billionaire minimum tax has also raised legal questions, with experts asking whether unrealized gains count as income, which is taxable under the 16th Amendment.

There are also debates about the definition of “billionaire” and the policy’s net worth calculation. Experts say if it’s “direct tax,” it must be split up by states based on population, which isn’t possible since some places don’t have billionaires.

“I would characterize the landscape here as a lot of uncertainty about whether or not this would pass constitutional muster,” Tax Foundation senior policy analyst Garrett Watson previously told CNBC.

However, Senate Finance Committee Chairman Ron Wyden, D-Ore., insisted their plan is constitutional because it calls for “annually taxing income from capital gains” — a concept that’s already part of the tax code.