Products You May Like

Binance and other crypto firms are preparing takeover offers for beleaguered digital currency lender Voyager Digital after FTX, which had initially agreed to acquire the firm, filed for bankruptcy.

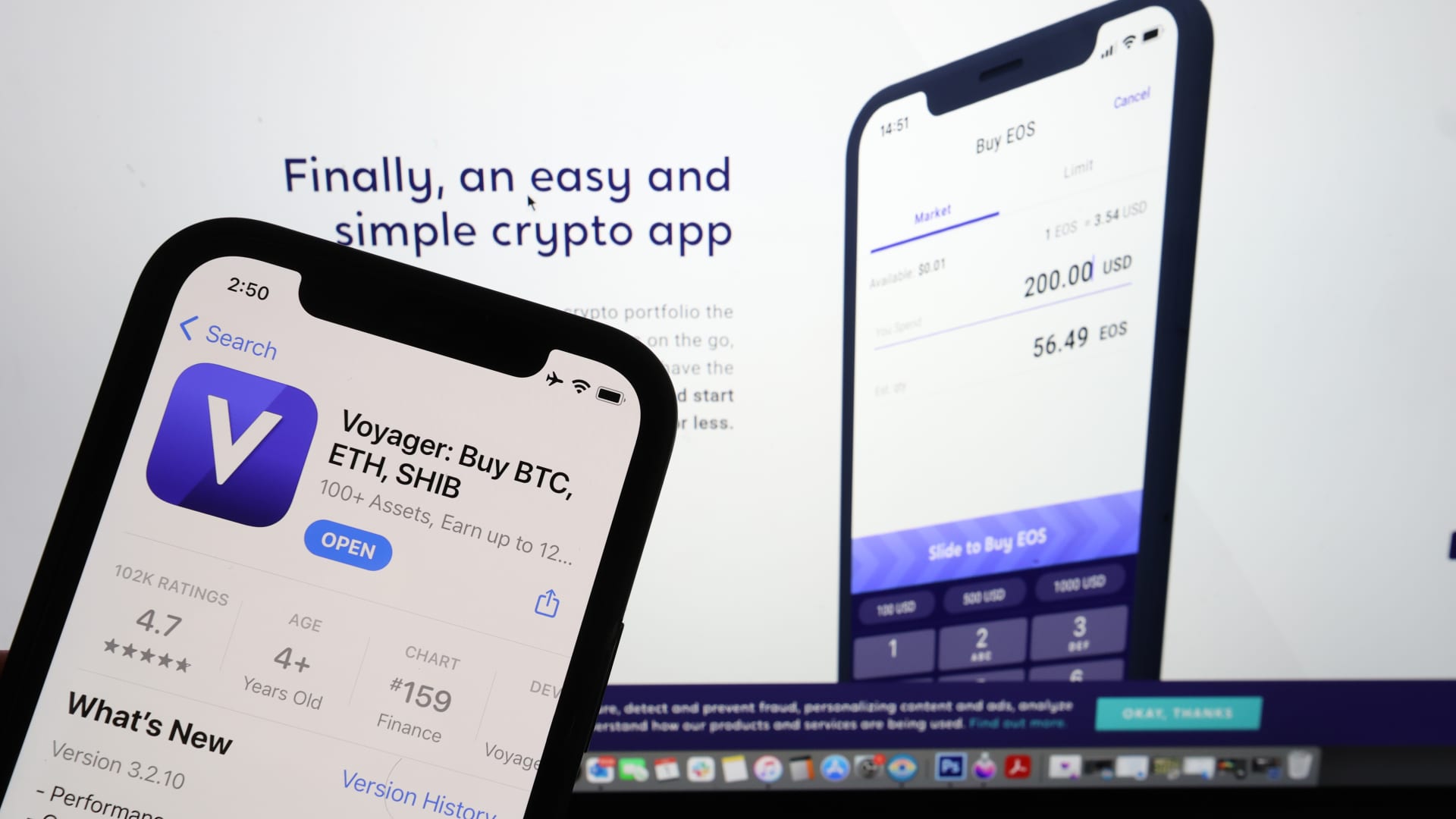

Voyager filed for Chapter 11 bankruptcy protection, which seeks to restructure troubled firms as viable business operations, in July after crypto hedge fund Three Arrows Capital defaulted on a loan from the company worth $670 million.

Voyager was set to be acquired by FTX’s American unit, FTX U.S., for $1.4 billion after Sam Bankman-Fried’s firm won in a U.S. bankruptcy auction. It was then thrown back to square one after FTX itself filed for bankruptcy after experiencing its own bank run-style surge in withdrawals.

Customers of Voyager have been unable to get their funds out since it paused withdrawals amid an industry-wide liquidity crisis.

This week, Binance confirmed reports that its U.S. subsidiary Binance.US plans to make an offer to rescue Voyager from collapse. Binance.US had previously offered to buy Voyager as part of its insolvency auction.

Speaking on Bloomberg, Binance CEO Changpeng Zhao said Binance.US “will make another bid for Voyager now, given FTX is no longer able to follow through on that commitment.”

Zhao has also set up a $1 billion fund aimed at supporting ailing companies in the industry.

CrossTower, a crypto and NFT trading platform, was among the parties that initially competed to buy Voyager in the court auction. The company says it plans to make a renewed offer for the company — though details are scant for now.

CrossTower is “submitting a revised bid, one it feels will benefit both the customers and the wider crypto community,” a CrossTower spokesperson told CNBC via email.

CrossTower is also planning its own separate industry recovery fund. The firm told CNBC it doesn’t view the fund as “competing” with Binance’s.

“This is about stabilizing an industry, regaining trust and rebuilding what is arguably the future of finance,” the CrossTower spokesman said.

“We will do so, with funds and talent, and we will collaborate with governments and policy makers and promote transparency. One venture fund did not build the technology industry and one recovery fund will not rebuild this one.”

Meanwhile, Wave Financial is also planning to make a fresh offer to acquire Voyager, after having initially lost out to FTX, according to a report from London’s Financial News newspaper.

Matteo Perruccio, president of international for Wave, declined to comment on the report when contacted by CNBC via WhatsApp. Last month, Perruccio told CNBC his company “felt that our bid was better for the investors and the debtors.”

Wave’s bid “saw us reinvigorating VGX,” Voyager’s exchange token, he said in the October interview.

Voyager customers are hopeful that any corporate bailout of the firm will include VGX, a token that was created by Voyager as a kind of loyalty rewards program, offering discounts on trading fees.

“We also had some, I think, pretty clever ideas about how to bring traffic at a much lower cost of acquisition at a higher per customer balance, which were the two big problems at Voyager,” Perruccio told CNBC in October.

In August, Voyager paused trading and transfers of VGX and outlined a plan for customers to swap their tokens for new coins on a separate blockchain. The fate of the token, which has fallen over 85% since the start of the year, remains unclear.

FTX U.S. had offered to buy all the VGX held by Voyager and its affiliates for $10 million. But Voyager said it was working to find a “higher and better solution” for the token that was compatible with FTX U.S.’ offer.

FTX U.S. is now part of bankruptcy proceedings in a Delaware court, along with its parent company and other affiliates including Alameda Research. The company’s offer was initially rejected by Voyager, which called it a “low-ball bid dressed up as a white knight rescue.”

Another player involved in the messy restructuring process is Ethos.io, a startup Voyager had acquired in 2019. Voyager only acquired Ethos.io’s technology, and the firm is planning to revive itself as a separate brand after Voyager’s collapse.

Shingo Lavine, co-founder of Ethos.io, says his firm’s technology was core to helping Voyager build out its crypto capabilities. Voyager saw significant growth after offering support for dogecoin, a meme-inspired digital coin, he added.

Adam Lavine, Shingo’s father and fellow co-founder of Ethos.io, said the company has established its own recovery program for VGX holders and Voyager creditors and has “seen a good response so far across the Voyager community.”

So far, “several thousand users representing 10% of the total VGX market cap” have signed up to the recovery initiative, the elder Lavine said. Voyager was not immediately available for comment when contacted by CNBC.