Products You May Like

It’s been almost a year since California banned the sale of all flavored tobacco products, and the big question is: did it work?

While legal sales are down, new data reveal that Californians are still smoking menthol cigarettes after the ban.

Prior to the ban in December 2022, menthol cigarettes made up about 24.5 percent of legal sales in the state. In the months after, from December 2022 to September 2023, total taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

-paid cigarette sales dropped about 15 percent from the same period the previous year, exceeding the rate at which sales had been falling in California.

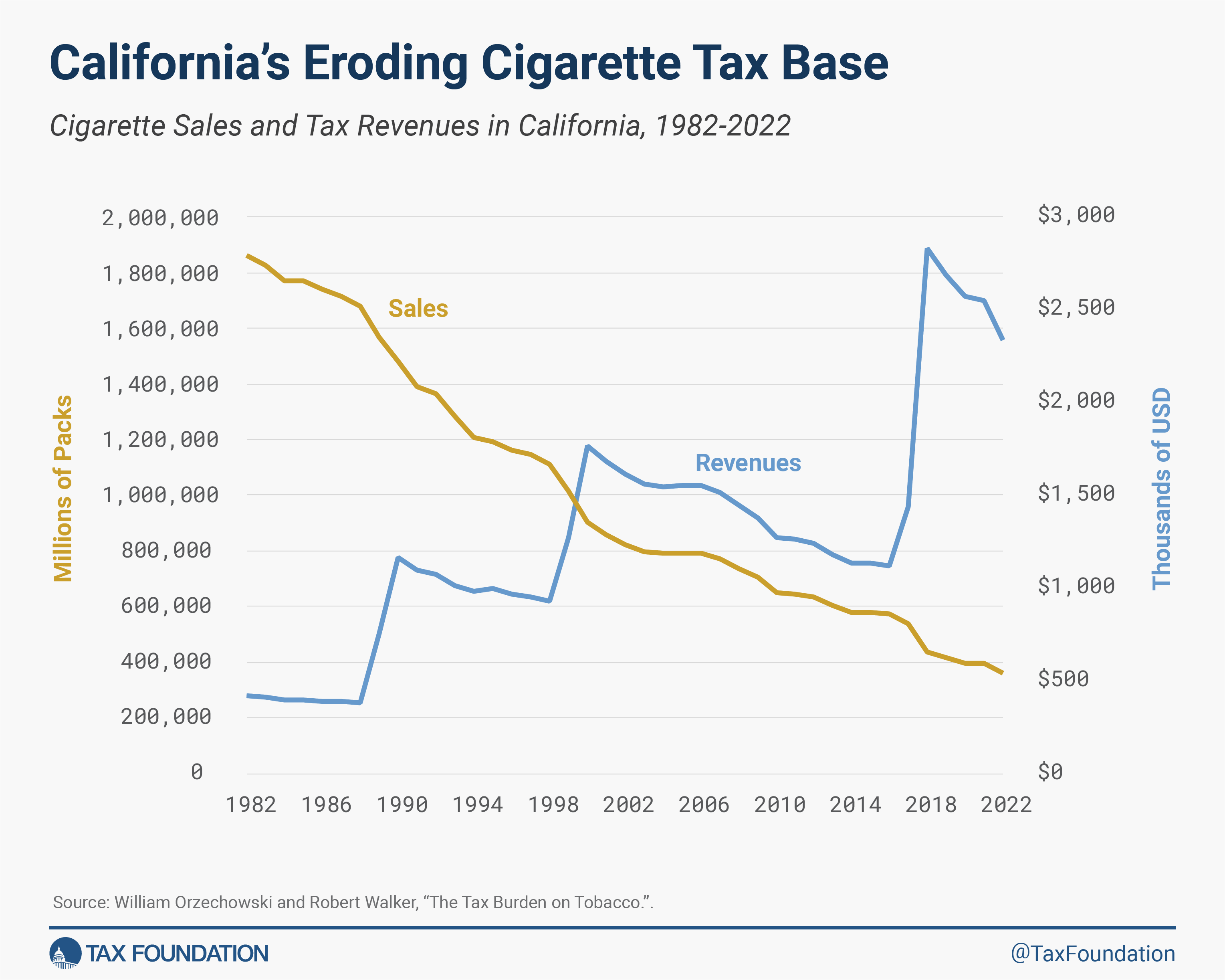

Figure 1 shows that legal sales have been trending downward for more than 40 years. 2022 sales were down more than 80 percent from their 1982 levels, averaging about a two percent decline per year over the period.

Excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

revenues are down 15 percent as well. Over 10 months, sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding.

collections from cigarettes decreased an estimated $52 million, and excise tax revenues fell nearly $192 million, similar to forecasted projections. California dedicates 96 percent of its cigarette tax revenue to specific purposes, including health care, social services, and Medicaid.

Social programs that receive a large portion of their revenue from these earmarked taxes have been hit particularly hard. California’s First 5 program—named for the first five years of life—provides services including preschools, homeless family housing, and pediatric dental and mental health services. The First 5 program expects a 20 percent decline in revenue by June 2024 and is already struggling to maintain current operations.

Some may deem these social costs acceptable if smoking rates declined 15 percent, as suggested by the legal sales data. But the results from a similar ban in Massachusetts should give caution to such a simple analysis. While legal sales fell after Massachusetts’ 2020 flavor ban, 9 out of every 10 packs no longer sold in Massachusetts could be traced to sales in neighboring states. People didn’t stop smoking, they just bought their packs elsewhere.

California is different from Massachusetts in several ways that would make interstate shopping less likely: the bulk of California’s population is several hundred miles from a neighboring U.S. state, California shares a land border with Mexico, and the state has some of the busiest international ports. Not surprisingly, there has been no observed increase in sales in neighboring states following California’s flavor ban. The likelihood of international smuggling is substantially greater and more difficult to track.

We previously estimated that as recently as 2020, California had the second-highest cigarette smuggling rate in the country, behind only New York. Forty-four percent of the cigarettes consumed in California were not purchased in the state, with as much as 17 percent of all consumed packs originating from foreign sources. With robust international smuggling operations in place, illicit operators are well-positioned to provide consumers with newly banned products.

To evaluate the consumption choices of Californians after the menthol ban, market research firm WSPM Group conducted a discarded cigarette pack audit. WSPM collected 15,000 discarded cigarette packs from public trash containers across 10 major California cities in May and June of 2023. Details on each pack were then collected and categorized, including the cigarette brand, whether the pack contained menthol, if the pack originated domestically or from abroad, and details on the tax stamp (if any was present).

The data show that Californians are still smoking menthol cigarettes after the ban. 14.1 percent of the sample (2,144 packs) were menthol. Another 7.0 percent of the packs included a form of menthol work-around. Menthol flavoring is commonly added to manufactured cigarettes by adding a mint-like flavoring to the pack container, not by modifying the cigarette sticks. This process is therefore simple to mimic using secondary additives. At the time of writing this article, menthol balls, flavor card pack inserts, and other devices are readily available for purchase online. Smokers can also incorporate a mint flavor to cigarettes without any purchase simply by adding a mint leaf or two and closing the pack for a day.

In total, 21.1 percent of the discarded packs were menthol-style cigarettes. A mere 3-percentage-point drop in menthol market share should immediately raise questions as to whether the menthol ban is having any significant effects on consumption.

In contrast, foreign and illicit market share spiked. Non-U.S. packs comprised 27.6 percent of the sample. These packs were found in high quantities in all cities studied. Over half of these packs, 14.2 percent of the entire sample, were duty-free cigarettes designated for export, but somehow made their way back into California cities.

Only 41.2 percent of packs had the proper California tax stamp, though a quarter of the sample had no cellophane on the package and no tax stamp whatsoever, making the origins of the pack indeterminate. If the sample is representative of the entire state, the forgone excise tax revenue from the illicit packs would be nearly $2 billion per year.

This data should make policymakers cautious as they consider a federal menthol ban and similar prohibitions in other states. The tax losses from these policies are substantial, and illicit smuggling operators appear capable of filling the demand prohibited by legal market transactions.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share