Products You May Like

The pandemic led to one of the largest fiscal responses in U.S. history, impacting households across the income distribution. A new report from the Congressional Budget Office (CBO) finds that these temporary policies, along with other fixtures of our taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

and transfer system, reduced income inequality in 2020 by more than any other year since 1979 when the CBO began measuring household income. The analysis also shows that the federal tax system is markedly progressive, even when excluding the most recent pandemic policies, echoing our own research on this topic and other recent academic evidence.

In response to the pandemic, policymakers significantly expanded employment compensation and issued recovery rebate credits (stimulus checks) to households. Together, the two policies increased income by more than $800 billion, or more than $6,000 per household on average. In contrast to other federal means-tested programs targeted toward low-income households, expanded unemployment and stimulus checks benefited households across the distribution. Just over half of the benefits went to the top three quintiles. However, as a percentage of income, the policies had the largest benefit for the bottom quintile, representing more than one-third of their incomes before taxes and transfers. Legislation also expanded Medicaid and the Supplemental Nutrition Assistance Program (SNAP), the two largest means-tested transfer programs, further boosting the incomes of households in the bottom quintile.

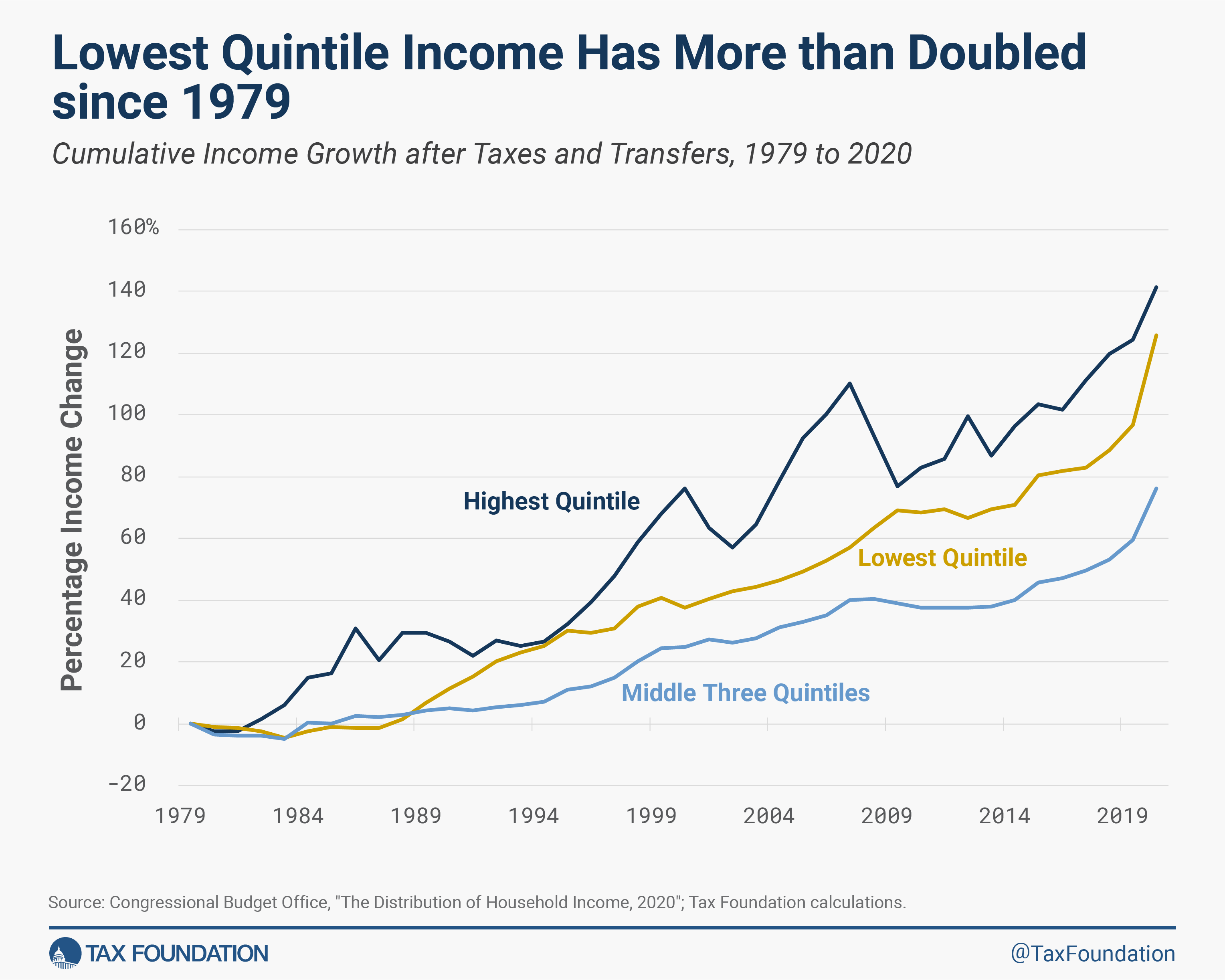

On net, the policies made the federal tax code more redistributive and reduced income inequality to a 14-year low. The bottom quintile saw the largest gains in income after taxes and transfers compared to 2019, rising by about 15 percent. Since 1979, the bottom quintile’s income has increased by 126 percent.

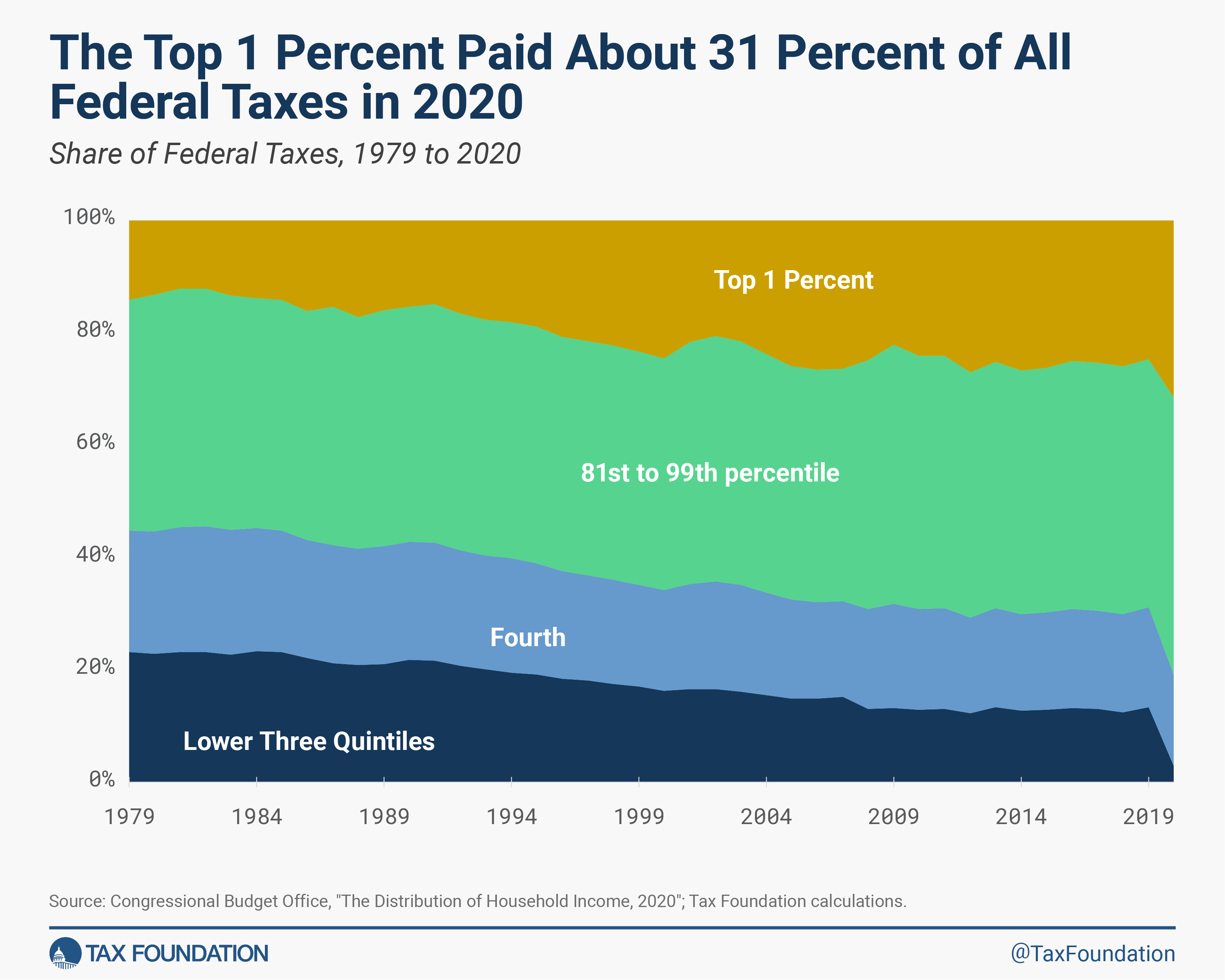

High-income households continue to pay a large share of federal taxes, including individual income taxes, payroll taxes, corporate taxes, and excise taxes. In 2020, the top quintile earned about 56 percent of all income, but paid 81 percent of federal taxes—12 percentage points more than in 2019, despite earning about the same share of income. The top 1 percent of households alone paid 31 percent of all federal taxes.

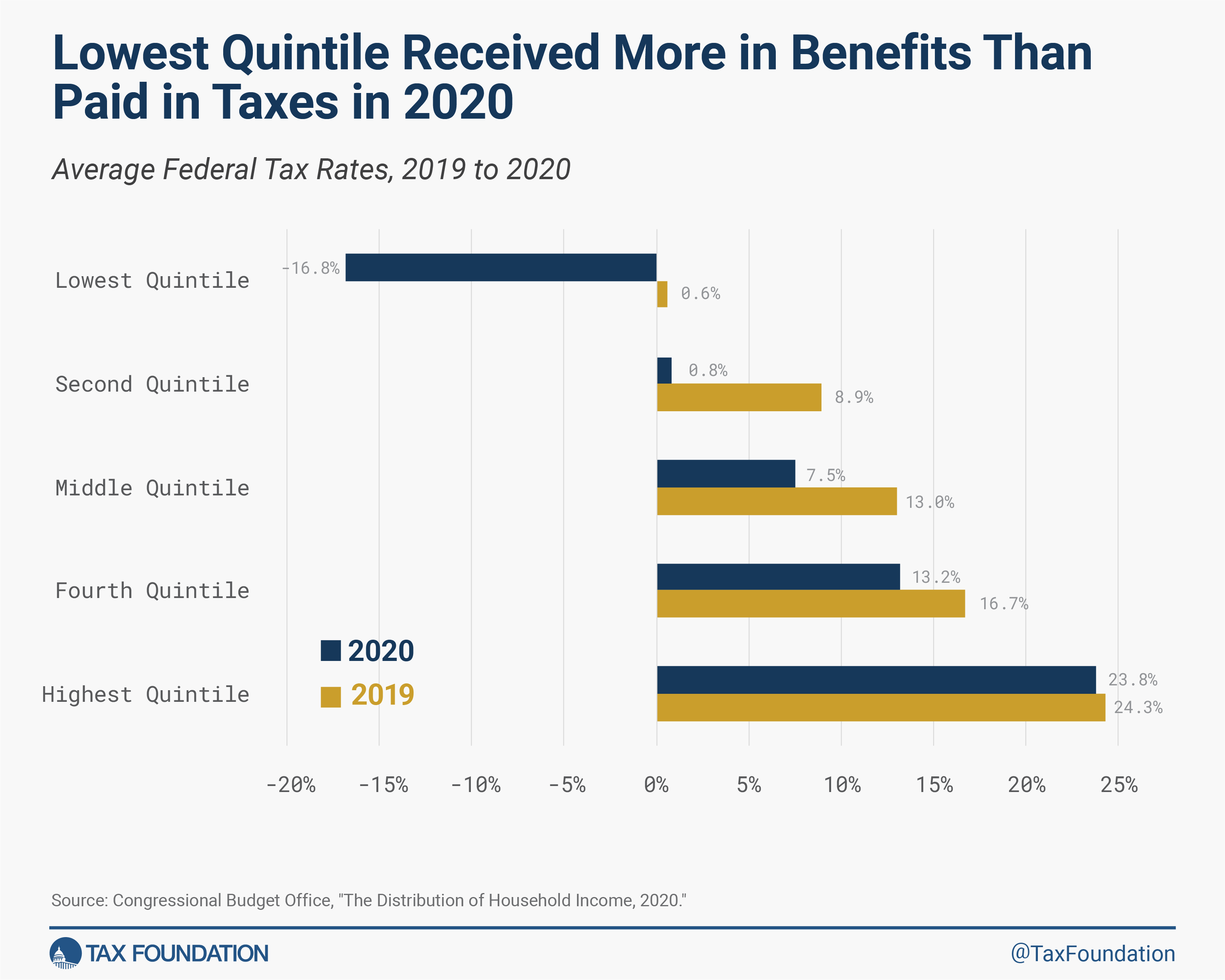

Average federal tax rates (inclusive of all individual income, corporate, payroll, and excises taxes) barely changed for the top quintile but declined notably for everyone else, mostly due to the recovery credit rebates, which reduce tax liabilities. The bottom quintile saw its average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes.

fall by 17 percentage points and become negative, meaning households received more in tax credits than they paid in taxes. Even without the rebate recovery credits, the bottom quintile would have faced close to zero in federal tax liabilities due to other credits and lower pre-tax incomes more generally.

The overall distribution of average tax rates, where the top quintile faces the largest burden and the burden declines for each subsequent quintile, indicates the U.S. federal tax and transfer system is progressive. A recent academic paper affirmed this finding by looking not only at the CBO data but also two other measures of income constructed by Treasury economists and other academics. Though all three sources use different measures of income, they all show that the “tax system has become more progressive and more redistributive over the last several decades, with much of that change occurring in recent years.” The increase in progressivity is primarily due to an increase in transfers to households in the bottom half of the income distribution.

Altogether, the data presented in the latest CBO report lends itself to three main takeaways:

- COVID fiscal stimulus policies significantly increased incomes for people in the bottom quintile.

- The COVID policies made an already progressive federal tax and transfer system even more progressive.

- The federal tax system continues to rely heavily on high-income taxpayers to raise revenue.

Policymakers should keep these facts in mind as they continue to debate how progressive our tax system should be and weigh the benefits and costs of expanding federal transfer programs going forward.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share