Products You May Like

Despite being advertised as a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

on large out-of-state businesses, Oregon’s Measure 118 functions, as we have previously explained, as a very high-rate sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding.

on the goods and services Oregonians buy every day. Perhaps even more surprisingly, though, this tax designed to target large multinational enterprises will have an even worse effect on Oregon’s main street businesses.

This may seem counterintuitive, since small-to-midsized Oregon businesses will be well below the threshold required to remit the tax. But that doesn’t mean that they won’t be paying it, just like we’d be wrong to say that consumers don’t pay sales tax because they aren’t the ones remitting it to the Department of Revenue. Under the tax created by Measure 118, Oregon businesses would be significantly disadvantaged against their larger and out-of-state rivals.

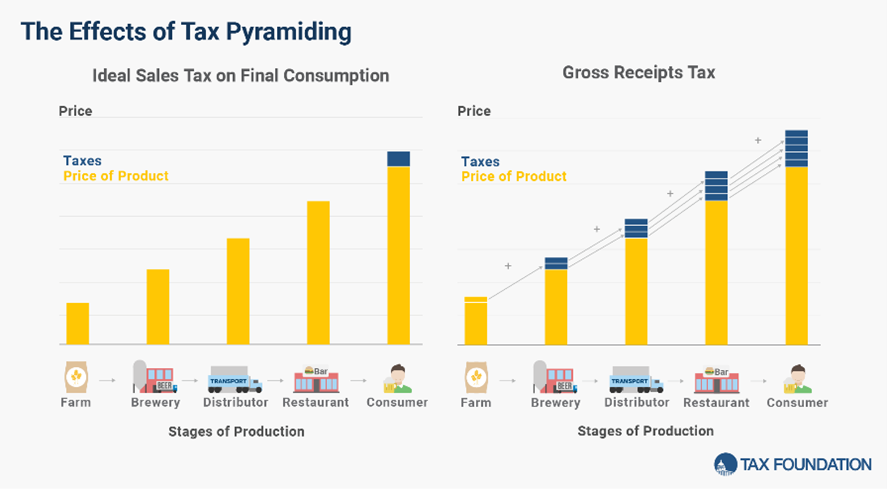

Measure 118 establishes a 3 percent gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding.

on large businesses, defined as those with more than $25 million in revenue. These businesses pay the greater of either their liability under the existing corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

, which is imposed on net income (profits), or this tax on gross revenue. In practice, the gross receipts tax component will almost always be the higher tax—massively higher. It is imposed at each stage of production, every time there is a transaction.

No large business selling into Oregon can avoid the final level of this tax, when it is imposed on retail sales to consumers. Large Oregon businesses and large out-of-state businesses will both face this tax, while smaller businesses—both in and out of Oregon—won’t have to pay. Advantage small businesses, right?

Wrong.

Because that’s just the last layer of tax, and arguably the least important one. When an Oregon business buys raw materials from a large business, the tax is applied. When it purchases machinery and equipment, that’s taxed too. The energy used in production is taxed, as are the company’s computers, servers, and office equipment. If the company pays for advertising, leases vehicles, pays another company to handle distribution, or purchases subscription services, all of that is taxed. If some other company packages the product, that’s taxed. If they sell to an in-state wholesaler, the entire cost of the product up to that point is taxed too. The result: taxes atop taxes stacked on other taxes.

Meanwhile, larger businesses can avoid many of these layers of tax in two ways.

First, large businesses have more capacity for vertical integration, bringing different functions in-house, which avoids taxable transactions. Their smaller competitors are more likely to focus on the one or two things they do well, without also trying to become a software company, run a distribution network, design their own product packaging, or create their own marketing campaigns.

Second, large businesses can more easily shift most of these operations out of Oregon—if they were even in Oregon to begin with. The transaction is only taxable if it takes place in Oregon, so an Oregon business, which can’t easily shift all its processes out of state, experiences a tax that pyramids across its stages of production, while larger multistate businesses can avoid several layers of the tax.

That is not to say that large businesses will be fine with the tax, or that paying on gross revenues rather than profits won’t be a serious problem for them too. It will. A tax that is on gross rather than net revenue is completely indifferent to profit margins or ability to pay, and when you add pyramiding—the way that it’s imposed multiple times across the production chain for a single good or service—the tax becomes especially onerous. But what’s notable, and what has stopped many states from considering gross receipts taxes, is that even when you design them to make large businesses (many of them headquartered out of state) the legal remitters, the greater burdens tend to be in-state, and are particularly acute for the smaller businesses that are supposed to be exempt from the tax.

Make no mistake: Oregon’s small businesses will pay this tax. They will pay it multiple times on everything they produce. And this will leave them at a competitive disadvantage against out-of-state businesses that weren’t taxed quite so many times. They may find that the price point at which they would turn a profit is significantly higher than what their out-of-state competitors can charge, and lose market share to, or even be run out of business by, these out-of-state companies less impacted by the tax.

Ironically, proponents of Measure 118 argue that Oregonians worried about higher prices under the new tax can avoid it by buying local. That’s pretty much backward. Small local firms, which have most (or all) of their stages of production in Oregon, will be hardest hit.

Measure 118 will raise prices, because most sales into the state will have the tax applied, and usually several times over. But prices are determined by the laws of supply and demand, not by the costs of production. All businesses will find it more expensive to sell in Oregon, causing prices to rise. Consumers will respond to this by reducing their quantity of goods demanded and, where possible, finding substitutes, but to a significant degree, they’ll have to pay these higher prices.

But if for many businesses in a particular industry, the tax embeds three or four times over, raising the price by 9 to 12 percent, while for some businesses with additional stages of production, the increased cost is 15 percent or more, what happens then? Will consumers maintain their current preferences and buy just as readily from a firm that had to raise its prices by about 15 percent as one that raised prices by 9 percent? Hardly. Those businesses will find themselves in a tight spot.

Those Oregon businesses. Because they’re the ones most exposed to the tax, and with the least capacity to avoid it. Measure 118, as we’ve documented previously, is costly for consumers. And it’s certainly no picnic for large businesses. But despite its intentions, it’s even worse for small Oregon-based businesses and those they employ.

Note: This is part of a series exploring Oregon Measure 118. See our related analysis:

- Oregon Measure 118 Is an Aggressive Sales Tax—and Worse See more

- Oregon Ballot Measure Would Yield Sky-High Business Tax Rates See more

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share