Products You May Like

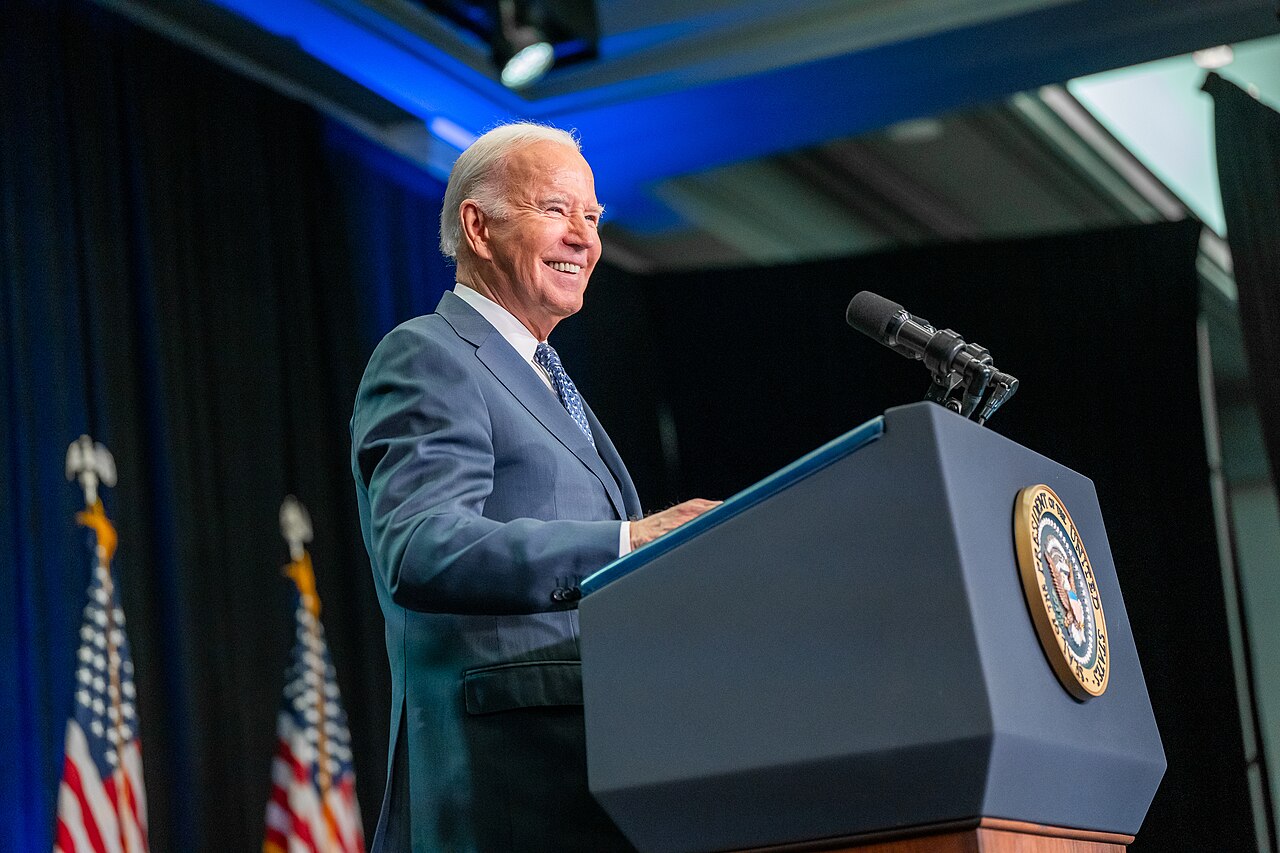

Today, the Biden administration released the findings of its investigation into the Trump-imposed Section 301 tariffs on China. The report acknowledged the economic harms the tariffs have caused, and the lack of significant improvement in Chinese IP practices even with the tariffs, but recommended keeping Trump’s tariffs on roughly $360 billion worth of goods in place and imposing significant hikes on an additional $18 billion worth of goods. The claim is that this recommended approach is more strategic than the initial Section 301 tariffs, but a closer look reveals the latest tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for U.S. businesses and consumers.

hikes on China suffer from the same procedural, political, and policy problems.

The Section 301 case that originally led to the tariffs concerned China’s intellectual property practices, and upon finding that the IP practices were discriminatory and burdening U.S. commerce, the Trump administration imposed tariffs on Chinese goods. Originally, the tariffs applied to about $50 billion worth of goods affected by the IP practices. The tariffs were then expanded to cover another $200 billion after China retaliated against the first tranche.

As many trade experts have noted, including National Taxpayers Union’s Bryan Riley and the Cato Institute’s Clark Packard, Section 301 states that actions should “affect goods or services of the foreign country in an amount equivalent in value to the burden or restriction being imposed by that country.” In other words, Section 301 does not give the executive the authority to arbitrarily hike tariffs; the tariffs imposed are supposed to be a measured response to the harms uncovered in the investigation. Abusing executive authority to impose arbitrary tariff hikes on “strategic goods” only paves the way for more abuses of executive tariff authority in the future—such as Trump’s proposals of 10 percent or more across-the-board tariffs, 60 percent tariffs on everything from China, and 200 percent tariffs on autos from Mexico.

Alas, it is an election year, and while quadrupling tariffs on China is not good policy, it can be good politics. Former President Trump scored political points with the initial tariffs on China, even as they failed to provide economic help to protected areas and the retaliation they brought on delivered job losses. In keeping all of Trump’s levies, and upping the ante with tariffs on another $18 billion, Biden is making a similar political calculation, even though it likely violates his pledge to not increase taxes on people making under $400,000.

Specifically, Biden is increasing the following tariffs:

- Steel and aluminum from 0-7.5 percent to 25 percent

- Semiconductor from 25 percent to 50 percent

- EVs from 25 percent to 100 percent

- Battery and components from 0-7.5 percent to 25 percent

- Natural graphite and permanent magnets tariffs from 0 percent to 25 percent

- Solar cells from 25 percent to 50 percent

- Ship-to-shore cranes from 0 percent to 25 percent

- Medical syringes and needles from 0 percent to 50 percent

- Respirators, face masks, and rubber medical and surgical gloves from 0-7.5 percent to 25 percent

When it comes to policy, it’s worth examining the goal of higher tariffs on these strategic goods, which include EVs, solar panels, and their component parts. Will shutting out more affordably priced Chinese EVs and solar panels help the U.S. reach its green transition goals faster? Will quadrupling the price of the competition make U.S. products better? Will increasing the costs for key inputs help U.S. manufacturers get off the ground? Will U.S.-made EVs become more internationally competitive with further insulation from international competition?

The policy argument for higher EV tariffs claims the U.S. needs more tariffs to be on a level playing field with China so that we can develop our own capacity. And looking at China, the argument continues, tariffs and industrial policy have been a success. First, we have many reasons to question the narrative that Chinese economic policy is a success. Take the research from economist Lee Branstetter and others:

We find little evidence that the Chinese government consistently “picks winners”. Firms’ ex-ante productivity is negatively correlated with subsidies received by firms, and subsidies appear to have a negative impact on firms’ ex-post productivity growth throughout our data window, 2007 to 2018. Neither subsidies given out under the name of R&D and innovation promotion nor industrial and equipment upgrading positively affect firms’ productivity growth.

Setting aside whether central planners in China should receive credit for the country’s competitive EVs, the United States already maintains a 27.5 percent tariff on Chinese EVs, effectively shutting them out of the U.S. market, and the U.S. government is pouring billions into EV and other green energy subsidies of its own.

Unfortunately, in sector after sector, we have seen how import protection, Buy American requirements, and government-directed investment play out—they are wasteful, raise costs and prices for U.S. businesses and consumers elsewhere, and the rents they deliver are too often plowed into the pockets of the well-connected instead of reinvested in R&D or capital expenditures.

The USITC report on the Section 301 tariffs President Biden is maintaining finds:

Studies estimate that the 2018-2019 U.S. tariff actions, in aggregate, have had small negative effects on U.S. aggregate economic welfare and real incomes in the short run, due largely to reduction in imports from and exports to China. In studies that estimate long-run impacts, those effects are estimated to continue in the long run. . . . Both the USITC, with respect to the section 301 duties, and other studies that analyze U.S. tariff actions more broadly, find the pass through of the duties to U.S. importers was generally complete . . . The 2018-2019 tariff actions did not increase overall manufacturing employment or wages in the short run. Adverse overall employment impacts tend to be more strongly associated with retaliatory tariffs applied by China and others than with U.S. duties.

Calling the latest round of tariffs “strategic” does not change the underlying reality: these policies are just another form of protectionism, and therefore, subject to all the same economic problems. The economic evidence so far is that the Trump-Biden tariffs have failed in their aims to boost U.S. manufacturing or to prevent China from becoming even more aggressive in its IP practices—quadrupling down on a failed policy is a political decision, not an economic one.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe

Share