Products You May Like

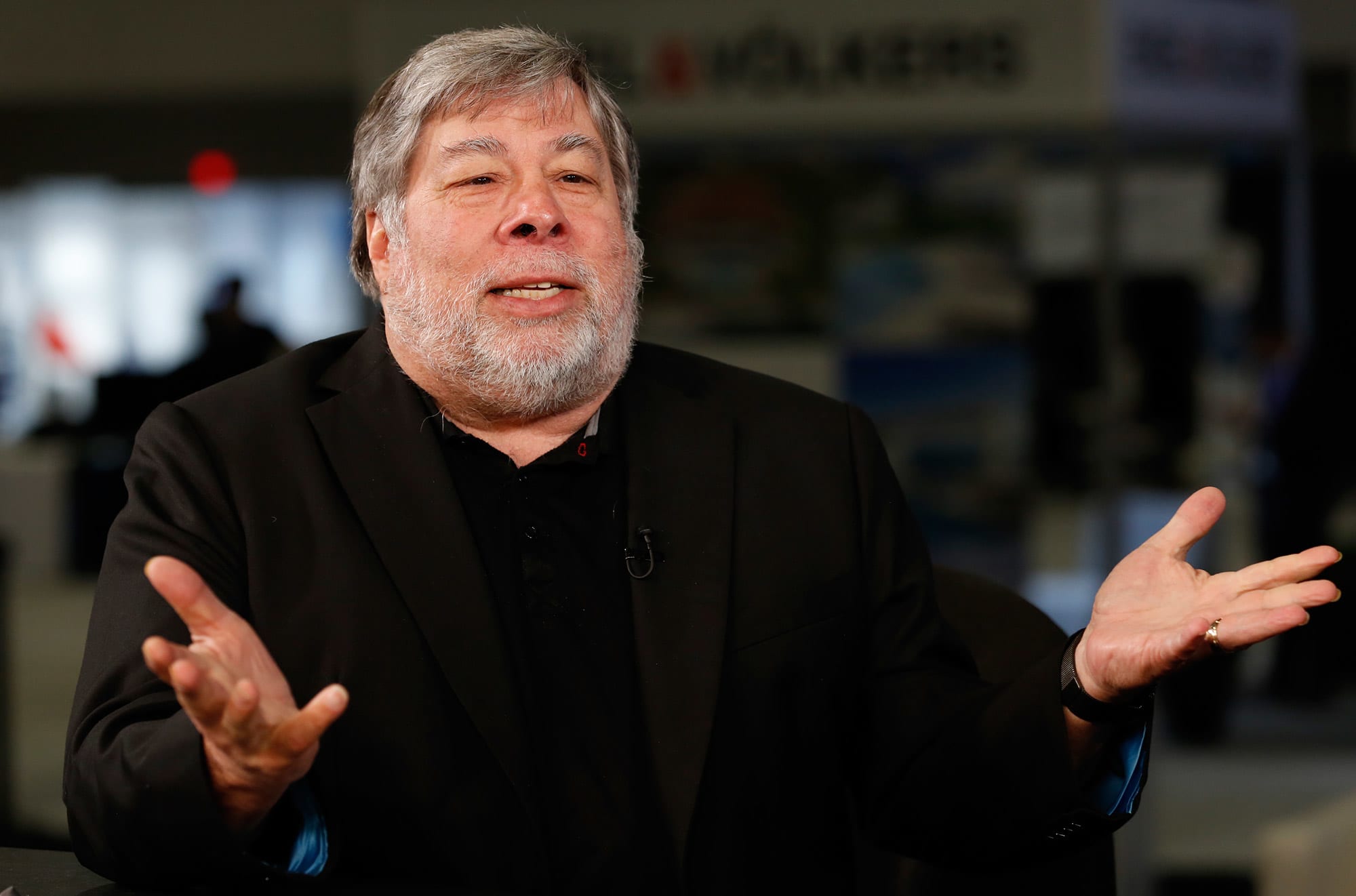

For Apple co-founder Steve Wozniak, investing can be a real headache.

“As a rule, I don’t invest [often], because then you’ve got to be watching it every day, and I like my head to be really peaceful and low stress,” Wozniak tells CNBC Make It. That’s why he says he tries to avoid buying stocks or other volatile assets – because, as he told Fortune in 2018, a daily obsession with their worth “could corrupt your values.”

Still, he’ll put money behind a venture he believes in: Wozniak is currently an investor on the online reality show “Unicorn Hunters.” The show sees Wozniak and other stars – including former U.S. Treasurer Rosie Rios and singer Lance Bass, among others – field investment pitches from tech start-up founders.

Wozniak’s goal isn’t to “make a ton of money,” he says. Rather, it’s to support companies and ideas that personally interest him. The mindset isn’t new: It’s one reason why Wozniak is now, reportedly, a millionaire – as opposed to a billionaire, like the late Steve Jobs was before his death in 2011.

But Wozniak wouldn’t have it any other way. Here’s how he weighs a company or asset before he decides to do one of his least favorite things: invest.

It has to apply to his life

Wozniak’s aversion to investing doesn’t stop tech companies from pitching him constantly, he says.

“For ages and ages, I get pitched a dozen times a day to join other companies and startups [that say], ‘We’re going to be the next Apple, we’re gonna be the next Steve Jobs, whatever,'” he says. “I just get so tired of telling them all, I am backlogged and I don’t really have the time.”

A start-up has to tickle one of his personal interests or play into his computer engineering experience – at a minimum – if its founders want to reel him in as a backer. Wozniak says his decades of experience take over when he judges whether a company has a chance to succeed.

“I’m just looking at: Does this technology mathematically, scientifically, [and] engineering-wise have a chance of actually being developed at a reasonable cost?” he says.

Skepticism is valuable

It always helps to be skeptical as an investor, Wozniak says. Most sales pitches only highlight the best possible outcomes for a product or company.

“I try to be a little skeptical and get into the mathematics of it a bit,” he says. “I also try to think about: Does this technology already exist? Does it have worthwhile alternatives? Is it really saving people as much as it claims to be? Every story you ever hear, every pitch, is always extremely good for the world, [so] I try to give it some analysis.”

That tech skepticism also extends to any company’s business side. Wozniak says he considers himself to be fairly financially conservative, and the last thing he wants to do is invest in a company that’s overextending itself.

“I always believe you should do everything that you can afford, and don’t do everything on credit,” he says. “So I look for that in a company: Are they going to be successful? Their money that’s coming in, is it real? Is it going to be scalable, and continue through time?”

Crypto is risky, unless it’s not

Wozniak says he’s “very skeptical” of most cryptocurrencies, and that investing in crypto is often “too risky” for the average person – especially if they’re biting off more than they can chew.

The Apple co-founder says he sees “an awful lot of opportunity for [scammers]” using crypto hype, and the digital currency’s complicated and volatile nature, to take advantage of uninformed investors. “I only look for cryptocurrencies that are based upon – kind of like stock in a company – something you could visualize and see, and they’ve been successful already,” he says.

In that vein, Wozniak is currently involved with two cryptocurrency projects. One is from Efforce, a blockchain project that funds energy-efficient companies, which Wozniak helped launch in 2020. Efforce offers a crypto token called WOZX that Wozniak says allows investors to earn a portion of the profits that come from those companies’ energy savings.

On the plus side, Wozniak says, “it’s based upon real results and real return on investment.” On the minus side, he notes, Efforce is “having problems getting [WOZX] implemented.” The cryptocurrency’s price has dropped more than 90% over the past year, according to Coinbase.

Wozniak also touts a cryptocurrency called Unicoin, recently created for “Unicorn Hunters.” The token helps fund start-ups who pitch investors on the show, and pays dividends based on those companies’ success. In other words, it’s a chance to invest in start-ups alongside Wozniak.

Wozniak says he’s “played with” many other cryptocurrencies. He’s the least skeptical about bitcoin and Ethereum’s ether, he says: “Bitcoin is just gold. I mean, nobody owns it. It’s mathematics.”

Still, he says, he quickly sold most of those crypto holdings. “I just kept one bitcoin, because I’m scared,” he says. “I don’t want to be tracking it up and down, up and down, like stocks every day. That’s just not my life… I have a lot of desire for things that are stable and predictable.”

Sign up now: Get smarter about your money and career with our weekly newsletter

Don’t miss:

Steve Wozniak: Steve Jobs wasn’t a natural-born leader, he worked to ‘develop his communication’ skills

Steve Wozniak is starting another company, 45 years after co-founding Apple with Steve Jobs