Products You May Like

The Internal Revenue Service (IRS) has released data on individual income taxes for tax year 2019, showing the number of taxpayers, adjusted gross income, income tax paid, and income tax shares by income percentiles.[1] The new data outlines the tax system under the second year of the Tax Cuts and Jobs Act (TCJA), the last year before the onset of the COVID-19 pandemic.

The data demonstrates the U.S. individual income tax continues to be progressive, borne primarily by the highest income earners.

Key Findings

- In 2019, taxpayers filed 148.3 million tax returns, reported earning nearly $11.9 trillion in adjusted gross income, and paid $1.6 trillion in individual income taxes.

- The top 1 percent of taxpayers paid a 25.6 percent average individual income tax rate, which is more than seven times higher than taxpayers in the bottom 50 percent (3.5 percent).

- The share of reported income earned by the top 1 percent of taxpayers fell to 20.1 percent from 20.9 percent in 2018. The top 1 percent’s share of federal individual income taxes paid fell to 38.8 percent from 40.1 percent.

- The top 50 percent of all taxpayers paid 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

- The top 1 percent paid a greater share of individual income taxes (38.8 percent) than the bottom 90 percent combined (29.2 percent).

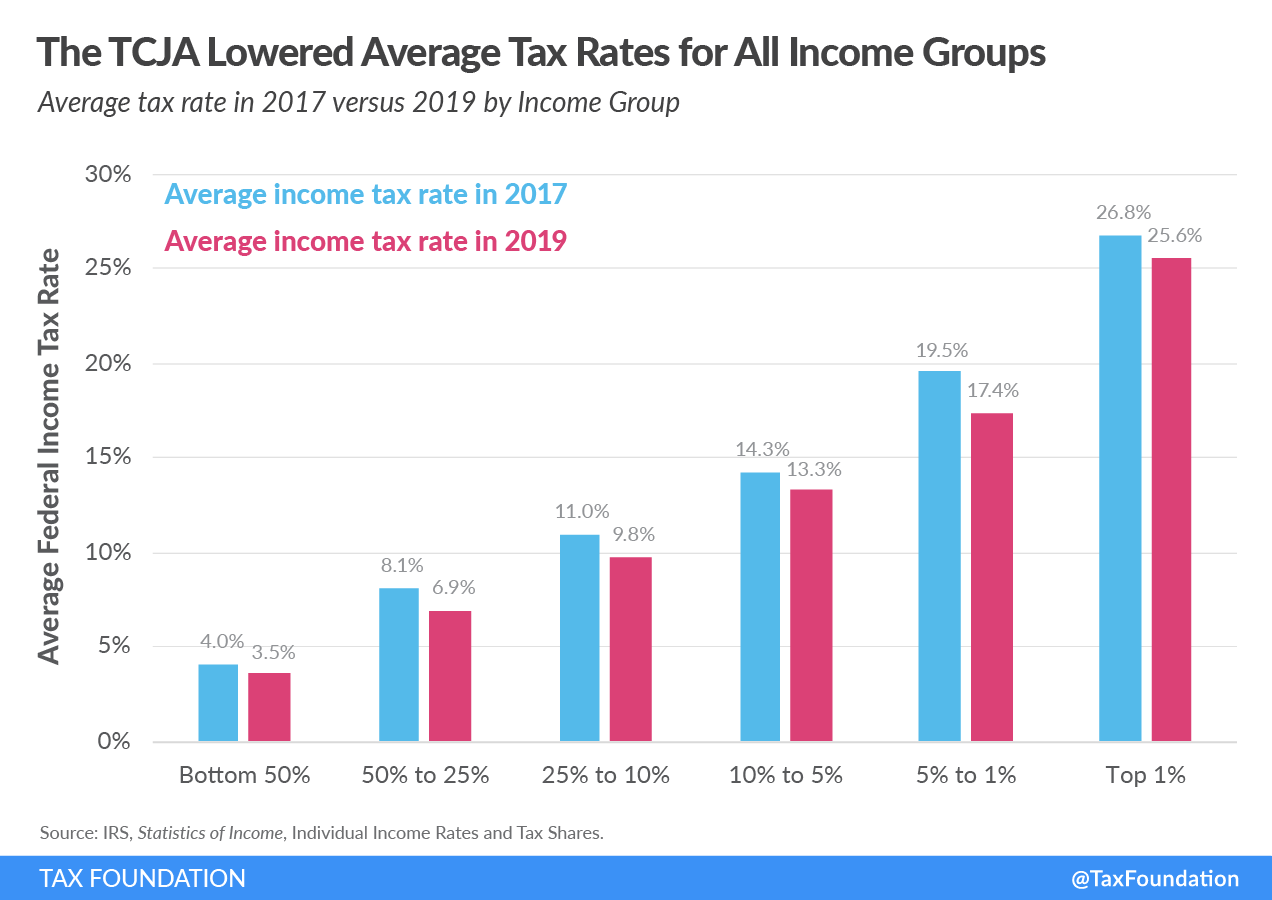

- The Tax Cuts and Jobs Act reduced average tax rates across income groups.

Reported Income and Taxes Paid Increased in Tax Year 2019

Taxpayers reported nearly $11.9 trillion in adjusted gross income (AGI) on 148.3 million tax returns in 2019. The number of returns filed rose by 3.9 million (2.7 percent) and reported AGI rose by $319 million (2.8 percent) above 2018 levels. Total income taxes paid rose by $42 billion to $1.58 trillion, a 2.7 percent increase above 2018. The average individual income tax rate was nearly unchanged: 13.29 percent in 2019, compared to 13.28 percent in 2018.

| Top 1% | Top 5% | Top 10% | Top 25% | Top 50% | Bottom 50% | All Taxpayers | |

|---|---|---|---|---|---|---|---|

| Number of Returns | 1,482,459 | 7,412,296 | 14,824,593 | 37,061,482 | 74,122,965 | 74,122,965 | 148,245,929 |

| Adjusted Gross Income ($ millions) | $2,393,383 | $4,269,727 | $5,621,027 | $8,177,266 | $10,517,131 | $1,365,719 | $11,882,850 |

| Share of Total Adjusted Gross Income | 20.1% | 35.9% | 47.3% | 68.8% | 88.5% | 11.5% | 100.0% |

| Income Taxes Paid ($ millions) | $612,027 | $938,429 | $1,117,856 | $1,367,843 | $1,530,288 | $48,373 | $1,578,661 |

| Share of Total Income Taxes Paid | 38.8% | 59.4% | 70.8% | 86.6% | 96.9% | 3.1% | 100.0% |

| Income Split Point | $546,434 | $221,572 | $154,589 | $87,917 | $44,269 | $44,269 | |

| Average Tax Rate | 25.6% | 22.0% | 19.9% | 16.7% | 14.6% | 3.5% | 13.3% |

| Average Income Taxes Paid | $412,846 | $126,604 | $75,406 | $36,907 | $20,645 | $653 | $10,649 |

|

Note: Table does not include dependent filers. “Income split point” is the minimum AGI for tax returns to fall into each percentile. “Income taxes paid” is the sum of income tax after credits (including the subtraction of excess advance premium tax credit repayment, the earned income credit, American opportunity credit, health coverage tax credit, and the regulated investment credit credit) limited to zero plus net investment income tax from Form 8960 and the tax from Form 4970, Tax on Accumulation Distribution of Trusts. It does not include any refundable portions of these credits. Source: IRS, Statistics of Income, ”Individual Income Rates and Tax Shares.” |

|||||||

High-Income Taxpayers Paid the Highest Average Income Tax Rates

In 2019, taxpayers with higher incomes paid much higher average income tax rates than lower-income taxpayers.[2]

The bottom 50 percent of taxpayers (taxpayers with AGI below $44,269) faced an average income tax rate of 3.5 percent. As household income increases, average income tax rates rise. For example, taxpayers with AGI between the top 10th and 5th percentiles ($154,589 and $221,572) paid an average income tax rate of 13.3 percent—3.8 times the rate paid by taxpayers in the bottom 50 percent.

The top 1 percent of taxpayers (AGI of $546,434 and above) paid the highest effective income tax rate of 25.6 percent—more than seven times the rate faced by the bottom 50 percent of taxpayers.

Readers should note the IRS dataset excludes the refundable portion of tax credits such as the earned income tax credit, which means the IRS data overstates the tax rate paid by taxpayers at the bottom.

High-Income Taxpayers Paid the Majority of Federal Income Taxes

In 2019, the bottom 50 percent of taxpayers (taxpayers with AGI below $44,269) earned 11.5 percent of total AGI and paid 3.1 percent ($48.4 billion) of all federal individual income taxes.

The top 1 percent (taxpayers with AGI of $546,434 and above) earned 20.1 percent of total AGI in 2019 and paid 38.8 percent of all federal income taxes.

In 2019, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. The top 1 percent of taxpayers paid $612 billion in income taxes while the bottom 90 percent paid $461 billion in income taxes.

Readers should note the IRS dataset does not account for the refundable portion of tax credits such as the earned income tax credit. If the refundable portion were included, the tax share of the top income groups would be higher than what is reported here. The refundable portion is classified as a spending program by the Office of Management and Budget (OMB) and therefore is not included by the IRS in tax share figures.

The share of income taxes paid by the top 1 percent increased from 33.2 percent in 2001 to 38.8 percent in 2019, down about 1.3 percentage points from a high of 40.1 percent in 2018. Over the same period, the share paid by the bottom 50 percent of taxpayers fell from 4.9 percent to just over 3 percent in 2019, up about a tenth of a percentage point from 2018.

Similarly, the share of adjusted gross income reported by the top 1 percent increased from 17.4 percent in 2001 to 20.1 percent in 2019. The AGI share of the top 1 percent fluctuates considerably over the business cycle, rising with expansions and falling with contractions to a greater extent than income reported by other groups. The share of AGI reported by the bottom 50 percent of taxpayers fell from 14.4 percent in 2001 to 11.5 percent in 2019.

The Tax Cuts and Jobs Act Reduced Average Tax Rates Across Income Groups

The 2019 filing season was the second filing season under the TCJA. The TCJA made many significant, but temporary, changes to the individual income tax code including lower tax rates, wider brackets, a larger standard deduction, and an expanded child tax credit. The net effect of all the changes was to lower tax burdens, on average, for taxpayers across all income levels.

In 2019, individual taxpayers paid $1.6 trillion in individual income taxes, $23 billion less than in 2017, even as adjusted gross income was $946 billion higher. Average tax rates were lower in 2019 than in 2017 across all income groups. Average rates for the bottom 50 percent fell from 4.05 percent in 2017 to 3.54 percent in 2019 and for the top 1 percent, from 26.76 percent to 25.57 percent.

The share of income taxes paid by the bottom 50 percent of taxpayers changed little from 2017, when it was 3.11 percent, to 3.06 percent in 2019. The share of income taxes paid by the top 1 percent increased slightly from 38.47 percent in 2017 to 38.77 percent in 2019.

Appendix

- For data prior to 2001, all tax returns that have a positive AGI are included, even those that do not have a positive income tax liability. For data from 2001 forward, returns with negative AGI are also included, but dependent returns are excluded.

- Income tax after credits (the measure of “income taxes paid” above) does not account for the refundable portion of tax credits such as the earned income tax credit. If the refundable portion were included, the tax share of the top income groups would be higher and the average tax rate of bottom income groups would be lower. The refundable portion is classified as a spending program by the OMB and therefore is not included by the IRS in these figures.

- The only tax analyzed here is the federal individual income tax, which is responsible for more than 25 percent of the nation’s taxes paid (at all levels of government). Federal income taxes are much more progressive than federal payroll taxes, which are responsible for about 20 percent of all taxes paid (at all levels of government) and are more progressive than most state and local taxes.

- AGI is a fairly narrow income concept and does not include income items like government transfers (except for the portion of Social Security benefits that is taxed), the value of employer-provided health insurance, underreported or unreported income (most notably that of sole proprietors), income derived from municipal bond interest, and net imputed rental income.

- The unit of analysis here is the tax return. In the figures prior to 2001, some dependent returns are included. Under other units of analysis (like the U.S. Treasury Department’s Family Economic Unit), these returns would likely be paired with parents’ returns.

- These figures represent the legal incidence of the income tax. Most distributional tables (such as those from the Congressional Budget Office, the Tax Policy Center, Citizens for Tax Justice, the Treasury Department, and the Joint Committee on Taxation) assume that the entire economic incidence of personal income taxes falls on the income earner.

| Year | Total | Top 0.1% | Top 1% | Top 5% | Between 5% and 10% | Top 10% | Between 10% and 25% | Top 25% | Between 25% and 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1981 | 94,587 | 946 | 4,729 | 4,729 | 9,459 | 14,188 | 23,647 | 23,647 | 47,293 | 47,293 | |

| 1982 | 94,426 | 944 | 4,721 | 4,721 | 9,443 | 14,164 | 23,607 | 23,607 | 47,213 | 47,213 | |

| 1983 | 95,331 | 953 | 4,767 | 4,767 | 9,533 | 14,300 | 23,833 | 23,833 | 47,665 | 47,665 | |

| 1984 | 98,436 | 984 | 4,922 | 4,922 | 9,844 | 14,765 | 24,609 | 24,609 | 49,218 | 49,219 | |

| 1985 | 100,625 | 1,006 | 5,031 | 5,031 | 10,063 | 15,094 | 25,156 | 25,156 | 50,313 | 50,313 | |

| 1986 | 102,088 | 1,021 | 5,104 | 5,104 | 10,209 | 15,313 | 25,522 | 25,522 | 51,044 | 51,044 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | |||||||||||

| 1987 | 106,155 | 1,062 | 5,308 | 5,308 | 10,615 | 15,923 | 26,539 | 26,539 | 53,077 | 53,077 | |

| 1988 | 108,873 | 1,089 | 5,444 | 5,444 | 10,887 | 16,331 | 27,218 | 27,218 | 54,436 | 54,436 | |

| 1989 | 111,313 | 1,113 | 5,566 | 5,566 | 11,131 | 16,697 | 27,828 | 27,828 | 55,656 | 55,656 | |

| 1990 | 112,812 | 1,128 | 5,641 | 5,641 | 11,281 | 16,922 | 28,203 | 28,203 | 56,406 | 56,406 | |

| 1991 | 113,804 | 1,138 | 5,690 | 5,690 | 11,380 | 17,071 | 28,451 | 28,451 | 56,902 | 56,902 | |

| 1992 | 112,653 | 1,127 | 5,633 | 5,633 | 11,265 | 16,898 | 28,163 | 28,163 | 56,326 | 56,326 | |

| 1993 | 113,681 | 1,137 | 5,684 | 5,684 | 11,368 | 17,052 | 28,420 | 28,420 | 56,841 | 56,841 | |

| 1994 | 114,990 | 1,150 | 5,749 | 5,749 | 11,499 | 17,248 | 28,747 | 28,747 | 57,495 | 57,495 | |

| 1995 | 117,274 | 1,173 | 5,864 | 5,864 | 11,727 | 17,591 | 29,319 | 29,319 | 58,637 | 58,637 | |

| 1996 | 119,442 | 1,194 | 5,972 | 5,972 | 11,944 | 17,916 | 29,860 | 29,860 | 59,721 | 59,721 | |

| 1997 | 121,503 | 1,215 | 6,075 | 6,075 | 12,150 | 18,225 | 30,376 | 30,376 | 60,752 | 60,752 | |

| 1998 | 123,776 | 1,238 | 6,189 | 6,189 | 12,378 | 18,566 | 30,944 | 30,944 | 61,888 | 61,888 | |

| 1999 | 126,009 | 1,260 | 6,300 | 6,300 | 12,601 | 18,901 | 31,502 | 31,502 | 63,004 | 63,004 | |

| 2000 | 128,227 | 1,282 | 6,411 | 6,411 | 12,823 | 19,234 | 32,057 | 32,057 | 64,114 | 64,114 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | |||||||||||

| 2001 | 119,371 | 119 | 1,194 | 5,969 | 5,969 | 11,937 | 17,906 | 29,843 | 29,843 | 59,685 | 59,685 |

| 2002 | 119,851 | 120 | 1,199 | 5,993 | 5,993 | 11,985 | 17,978 | 29,963 | 29,963 | 59,925 | 59,925 |

| 2003 | 120,759 | 121 | 1,208 | 6,038 | 6,038 | 12,076 | 18,114 | 30,190 | 30,190 | 60,379 | 60,379 |

| 2004 | 122,510 | 123 | 1,225 | 6,125 | 6,125 | 12,251 | 18,376 | 30,627 | 30,627 | 61,255 | 61,255 |

| 2005 | 124,673 | 125 | 1,247 | 6,234 | 6,234 | 12,467 | 18,701 | 31,168 | 31,168 | 62,337 | 62,337 |

| 2006 | 128,441 | 128 | 1,284 | 6,422 | 6,422 | 12,844 | 19,266 | 32,110 | 32,110 | 64,221 | 64,221 |

| 2007 | 132,655 | 133 | 1,327 | 6,633 | 6,633 | 13,265 | 19,898 | 33,164 | 33,164 | 66,327 | 66,327 |

| 2008 | 132,892 | 133 | 1,329 | 6,645 | 6,645 | 13,289 | 19,934 | 33,223 | 33,223 | 66,446 | 66,446 |

| 2009 | 132,620 | 133 | 1,326 | 6,631 | 6,631 | 13,262 | 19,893 | 33,155 | 33,155 | 66,310 | 66,310 |

| 2010 | 135,033 | 135 | 1,350 | 6,752 | 6,752 | 13,503 | 20,255 | 33,758 | 33,758 | 67,517 | 67,517 |

| 2011 | 136,586 | 137 | 1,366 | 6,829 | 6,829 | 13,659 | 20,488 | 34,146 | 34,146 | 68,293 | 68,293 |

| 2012 | 136,080 | 136 | 1,361 | 6,804 | 6,804 | 13,608 | 20,412 | 34,020 | 34,020 | 68,040 | 68,040 |

| 2013 | 138,313 | 138 | 1,383 | 6,916 | 6,916 | 13,831 | 20,747 | 34,578 | 34,578 | 69,157 | 69,157 |

| 2014 | 139,562 | 140 | 1,396 | 6,978 | 6,978 | 13,956 | 20,934 | 34,891 | 34,891 | 69,781 | 69,781 |

| 2015 | 141,205 | 141 | 1,412 | 7,060 | 7,060 | 14,120 | 21,181 | 35,301 | 35,301 | 70,602 | 70,602 |

| 2016 | 140,889 | 141 | 1,409 | 7,044 | 7,044 | 14,089 | 21,133 | 35,222 | 35,222 | 70,444 | 70,444 |

| 2017 | 143,295 | 143 | 1,433 | 7,165 | 7,165 | 14,330 | 21,494 | 35,824 | 35,824 | 71,648 | 71,648 |

| 2018 | 144,318 | 144 | 1,443 | 7,216 | 7,216 | 14,432 | 21,648 | 36,079 | 36,079 | 72,159 | 72,159 |

| 2019 | 148,246 | 148 | 1,482 | 7,412 | 7,412 | 14,825 | 22,237 | 37,061 | 37,061 | 74,123 | 74,123 |

|

Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares (2019). |

|||||||||||

| Year | Total | Top 0.1% | Top 1% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | $1,627 | $138 | $342 | $181 | $523 | $400 | $922 | $417 | $1,339 | $288 | |

| 1981 | $1,791 | $149 | $372 | $201 | $573 | $442 | $1,015 | $458 | $1,473 | $318 | |

| 1982 | $1,876 | $167 | $398 | $207 | $605 | $460 | $1,065 | $478 | $1,544 | $332 | |

| 1983 | $1,970 | $183 | $428 | $217 | $646 | $481 | $1,127 | $498 | $1,625 | $344 | |

| 1984 | $2,173 | $210 | $482 | $240 | $723 | $528 | $1,251 | $543 | $1,794 | $379 | |

| 1985 | $2,344 | $235 | $531 | $260 | $791 | $567 | $1,359 | $580 | $1,939 | $405 | |

| 1986 | $2,524 | $285 | $608 | $278 | $887 | $604 | $1,490 | $613 | $2,104 | $421 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | |||||||||||

| 1987 | $2,814 | $347 | $722 | $316 | $1,038 | $671 | $1,709 | $664 | $2,374 | $440 | |

| 1988 | $3,124 | $474 | $891 | $342 | $1,233 | $718 | $1,951 | $707 | $2,658 | $466 | |

| 1989 | $3,299 | $468 | $918 | $368 | $1,287 | $768 | $2,054 | $751 | $2,805 | $494 | |

| 1990 | $3,451 | $483 | $953 | $385 | $1,338 | $806 | $2,144 | $788 | $2,933 | $519 | |

| 1991 | $3,516 | $457 | $943 | $400 | $1,343 | $832 | $2,175 | $809 | $2,984 | $532 | |

| 1992 | $3,681 | $524 | $1,031 | $413 | $1,444 | $856 | $2,299 | $832 | $3,131 | $549 | |

| 1993 | $3,776 | $521 | $1,048 | $426 | $1,474 | $883 | $2,358 | $854 | $3,212 | $563 | |

| 1994 | $3,961 | $547 | $1,103 | $449 | $1,552 | $929 | $2,481 | $890 | $3,371 | $590 | |

| 1995 | $4,245 | $620 | $1,223 | $482 | $1,705 | $985 | $2,690 | $938 | $3,628 | $617 | |

| 1996 | $4,591 | $737 | $1,394 | $515 | $1,909 | $1,043 | $2,953 | $992 | $3,944 | $646 | |

| 1997 | $5,023 | $873 | $1,597 | $554 | $2,151 | $1,116 | $3,268 | $1,060 | $4,328 | $695 | |

| 1998 | $5,469 | $1,010 | $1,797 | $597 | $2,394 | $1,196 | $3,590 | $1,132 | $4,721 | $748 | |

| 1999 | $5,909 | $1,153 | $2,012 | $641 | $2,653 | $1,274 | $3,927 | $1,199 | $5,126 | $783 | |

| 2000 | $6,424 | $1,337 | $2,267 | $688 | $2,955 | $1,358 | $4,314 | $1,276 | $5,590 | $834 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | |||||||||||

| 2001 | $6,116 | $492 | $1,065 | $1,934 | $666 | $2,600 | $1,334 | $3,933 | $1,302 | $5,235 | $881 |

| 2002 | $5,982 | $421 | $960 | $1,812 | $660 | $2,472 | $1,339 | $3,812 | $1,303 | $5,115 | $867 |

| 2003 | $6,157 | $466 | $1,030 | $1,908 | $679 | $2,587 | $1,375 | $3,962 | $1,325 | $5,287 | $870 |

| 2004 | $6,735 | $615 | $1,279 | $2,243 | $725 | $2,968 | $1,455 | $4,423 | $1,403 | $5,826 | $908 |

| 2005 | $7,366 | $784 | $1,561 | $2,623 | $778 | $3,401 | $1,540 | $4,940 | $1,473 | $6,413 | $953 |

| 2006 | $7,970 | $895 | $1,761 | $2,918 | $841 | $3,760 | $1,652 | $5,412 | $1,568 | $6,980 | $990 |

| 2007 | $8,622 | $1,030 | $1,971 | $3,223 | $905 | $4,128 | $1,770 | $5,898 | $1,673 | $7,571 | $1,051 |

| 2008 | $8,206 | $826 | $1,657 | $2,868 | $905 | $3,773 | $1,782 | $5,555 | $1,673 | $7,228 | $978 |

| 2009 | $7,579 | $602 | $1,305 | $2,439 | $878 | $3,317 | $1,740 | $5,058 | $1,620 | $6,678 | $900 |

| 2010 | $8,040 | $743 | $1,517 | $2,716 | $915 | $3,631 | $1,800 | $5,431 | $1,665 | $7,096 | $944 |

| 2011 | $8,317 | $737 | $1,556 | $2,819 | $956 | $3,775 | $1,866 | $5,641 | $1,716 | $7,357 | $961 |

| 2012 | $9,042 | $1,017 | $1,977 | $3,331 | $997 | $4,328 | $1,934 | $6,262 | $1,776 | $8,038 | $1,004 |

| 2013 | $9,034 | $816 | $1,720 | $3,109 | $1,034 | $4,143 | $2,008 | $6,152 | $1,844 | $7,996 | $1,038 |

| 2014 | $9,709 | $986 | $1,998 | $3,491 | $1,093 | $4,583 | $2,107 | $6,690 | $1,924 | $8,615 | $1,094 |

| 2015 | $10,143 | $1,033 | $2,095 | $3,659 | $1,145 | $4,803 | $2,194 | $6,998 | $2,000 | $8,998 | $1,145 |

| 2016 | $10,157 | $966 | $2,003 | $3,575 | $1,155 | $4,729 | $2,221 | $6,950 | $2,030 | $8,980 | $1,177 |

| 2017 | $10,937 | $1,150 | $2,301 | $3,995 | $1,226 | $5,221 | $2,340 | $7,561 | $2,145 | $9,706 | $1,230 |

| 2018 | $11,564 | $1,197 | $2,420 | $4,218 | $1,293 | $5,511 | $2,458 | $7,969 | $2,253 | $10,222 | $1,342 |

| 2019 | $11,883 | $1,141 | $2,393 | $4,270 | $1,351 | $5,621 | $2,556 | $8,177 | $2,340 | $10,517 | $1,366 |

|

Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares (2019). |

|||||||||||

| Year | Total | Top 0.1% | Top 1% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | $249 | $47 | $92 | $31 | $123 | $59 | $182 | $50 | $232 | $18 | |

| 1981 | $282 | $50 | $99 | $36 | $135 | $69 | $204 | $57 | $261 | $21 | |

| 1982 | $276 | $53 | $100 | $34 | $134 | $66 | $200 | $56 | $256 | $20 | |

| 1983 | $272 | $55 | $101 | $34 | $135 | $64 | $199 | $54 | $252 | $19 | |

| 1984 | $297 | $63 | $113 | $37 | $150 | $68 | $219 | $57 | $276 | $22 | |

| 1985 | $322 | $70 | $125 | $41 | $166 | $73 | $238 | $60 | $299 | $23 | |

| 1986 | $367 | $94 | $156 | $44 | $201 | $78 | $279 | $64 | $343 | $24 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | |||||||||||

| 1987 | $369 | $92 | $160 | $46 | $205 | $79 | $284 | $63 | $347 | $22 | |

| 1988 | $413 | $114 | $188 | $48 | $236 | $85 | $321 | $68 | $389 | $24 | |

| 1989 | $433 | $109 | $190 | $51 | $241 | $93 | $334 | $73 | $408 | $25 | |

| 1990 | $447 | $112 | $195 | $52 | $248 | $97 | $344 | $77 | $421 | $26 | |

| 1991 | $448 | $111 | $194 | $56 | $250 | $96 | $347 | $77 | $424 | $25 | |

| 1992 | $476 | $131 | $218 | $58 | $276 | $97 | $374 | $78 | $452 | $24 | |

| 1993 | $503 | $146 | $238 | $60 | $298 | $101 | $399 | $80 | $479 | $24 | |

| 1994 | $535 | $154 | $254 | $64 | $318 | $108 | $425 | $84 | $509 | $25 | |

| 1995 | $588 | $178 | $288 | $70 | $357 | $115 | $473 | $88 | $561 | $27 | |

| 1996 | $658 | $213 | $335 | $76 | $411 | $124 | $535 | $95 | $630 | $28 | |

| 1997 | $727 | $241 | $377 | $82 | $460 | $134 | $594 | $102 | $696 | $31 | |

| 1998 | $788 | $274 | $425 | $88 | $513 | $139 | $652 | $103 | $755 | $33 | |

| 1999 | $877 | $317 | $486 | $97 | $583 | $150 | $733 | $109 | $842 | $35 | |

| 2000 | $981 | $367 | $554 | $106 | $660 | $164 | $824 | $118 | $942 | $38 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | |||||||||||

| 2001 | $885 | $139 | $294 | $462 | $101 | $564 | $158 | $722 | $120 | $842 | $43 |

| 2002 | $794 | $120 | $263 | $420 | $93 | $513 | $143 | $657 | $104 | $761 | $33 |

| 2003 | $746 | $115 | $251 | $399 | $85 | $484 | $133 | $617 | $98 | $715 | $30 |

| 2004 | $829 | $142 | $301 | $467 | $91 | $558 | $137 | $695 | $102 | $797 | $32 |

| 2005 | $932 | $176 | $361 | $549 | $98 | $647 | $145 | $793 | $106 | $898 | $33 |

| 2006 | $1,020 | $196 | $402 | $607 | $108 | $715 | $157 | $872 | $113 | $986 | $35 |

| 2007 | $1,112 | $221 | $443 | $666 | $117 | $783 | $170 | $953 | $122 | $1,075 | $37 |

| 2008 | $1,029 | $187 | $386 | $597 | $115 | $712 | $168 | $880 | $117 | $997 | $32 |

| 2009 | $863 | $146 | $314 | $502 | $101 | $604 | $146 | $749 | $93 | $842 | $21 |

| 2010 | $949 | $170 | $355 | $561 | $110 | $670 | $156 | $827 | $100 | $927 | $22 |

| 2011 | $1,043 | $168 | $366 | $589 | $123 | $712 | $181 | $893 | $120 | $1,012 | $30 |

| 2012 | $1,185 | $220 | $451 | $699 | $133 | $831 | $193 | $1,024 | $128 | $1,152 | $33 |

| 2013 | $1,232 | $228 | $466 | $721 | $139 | $860 | $203 | $1,063 | $135 | $1,198 | $34 |

| 2014 | $1,374 | $273 | $543 | $824 | $150 | $974 | $219 | $1,193 | $144 | $1,337 | $38 |

| 2015 | $1,454 | $284 | $568 | $866 | $160 | $1,027 | $233 | $1,260 | $154 | $1,413 | $41 |

| 2016 | $1,442 | $261 | $538 | $840 | $162 | $1,002 | $238 | $1,240 | $159 | $1,399 | $44 |

| 2017 | $1,601 | $310 | $616 | $947 | $175 | $1,122 | $257 | $1,379 | $173 | $1,552 | $50 |

| 2018 | $1,536 | $311 | $616 | $926 | $170 | $1,096 | $240 | $1,336 | $155 | $1,491 | $45 |

| 2019 | $1,579 | $298 | $612 | $938 | $179 | $1,118 | $250 | $1,368 | $162 | $1,530 | $48 |

|

Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares |

|||||||||||

| Year | Total | Top 0.1% | Top 1% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 100% | 8.46% | 21.01% | 11.12% | 32.13% | 24.57% | 56.70% | 25.62% | 82.32% | 17.68% | |

| 1981 | 100% | 8.30% | 20.78% | 11.20% | 31.98% | 24.69% | 56.67% | 25.59% | 82.25% | 17.75% | |

| 1982 | 100% | 8.91% | 21.23% | 11.03% | 32.26% | 24.53% | 56.79% | 25.50% | 82.29% | 17.71% | |

| 1983 | 100% | 9.29% | 21.74% | 11.04% | 32.78% | 24.44% | 57.22% | 25.30% | 82.52% | 17.48% | |

| 1984 | 100% | 9.66% | 22.19% | 11.06% | 33.25% | 24.31% | 57.56% | 25.00% | 82.56% | 17.44% | |

| 1985 | 100% | 10.03% | 22.67% | 11.10% | 33.77% | 24.21% | 57.97% | 24.77% | 82.74% | 17.26% | |

| 1986 | 100% | 11.30% | 24.11% | 11.02% | 35.12% | 23.92% | 59.04% | 24.30% | 83.34% | 16.66% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | |||||||||||

| 1987 | 100% | 12.32% | 25.67% | 11.23% | 36.90% | 23.85% | 60.75% | 23.62% | 84.37% | 15.63% | |

| 1988 | 100% | 15.16% | 28.51% | 10.94% | 39.45% | 22.99% | 62.44% | 22.63% | 85.07% | 14.93% | |

| 1989 | 100% | 14.19% | 27.84% | 11.16% | 39.00% | 23.28% | 62.28% | 22.76% | 85.04% | 14.96% | |

| 1990 | 100% | 14.00% | 27.62% | 11.15% | 38.77% | 23.36% | 62.13% | 22.84% | 84.97% | 15.03% | |

| 1991 | 100% | 12.99% | 26.83% | 11.37% | 38.20% | 23.65% | 61.85% | 23.01% | 84.87% | 15.13% | |

| 1992 | 100% | 14.23% | 28.01% | 11.21% | 39.23% | 23.25% | 62.47% | 22.61% | 85.08% | 14.92% | |

| 1993 | 100% | 13.79% | 27.76% | 11.29% | 39.05% | 23.40% | 62.45% | 22.63% | 85.08% | 14.92% | |

| 1994 | 100% | 13.80% | 27.85% | 11.34% | 39.19% | 23.45% | 62.64% | 22.48% | 85.11% | 14.89% | |

| 1995 | 100% | 14.60% | 28.81% | 11.35% | 40.16% | 23.21% | 63.37% | 22.09% | 85.46% | 14.54% | |

| 1996 | 100% | 16.04% | 30.36% | 11.23% | 41.59% | 22.73% | 64.32% | 21.60% | 85.92% | 14.08% | |

| 1997 | 100% | 17.38% | 31.79% | 11.03% | 42.83% | 22.22% | 65.05% | 21.11% | 86.16% | 13.84% | |

| 1998 | 100% | 18.47% | 32.85% | 10.92% | 43.77% | 21.87% | 65.63% | 20.69% | 86.33% | 13.67% | |

| 1999 | 100% | 19.51% | 34.04% | 10.85% | 44.89% | 21.57% | 66.46% | 20.29% | 86.75% | 13.25% | |

| 2000 | 100% | 20.81% | 35.30% | 10.71% | 46.01% | 21.15% | 67.15% | 19.86% | 87.01% | 12.99% | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | |||||||||||

| 2001 | 100% | 8.05% | 17.41% | 31.61% | 10.89% | 42.50% | 21.80% | 64.31% | 21.29% | 85.60% | 14.40% |

| 2002 | 100% | 7.04% | 16.05% | 30.29% | 11.04% | 41.33% | 22.39% | 63.71% | 21.79% | 85.50% | 14.50% |

| 2003 | 100% | 7.56% | 16.73% | 30.99% | 11.03% | 42.01% | 22.33% | 64.34% | 21.52% | 85.87% | 14.13% |

| 2004 | 100% | 9.14% | 18.99% | 33.31% | 10.77% | 44.07% | 21.60% | 65.68% | 20.83% | 86.51% | 13.49% |

| 2005 | 100% | 10.64% | 21.19% | 35.61% | 10.56% | 46.17% | 20.90% | 67.07% | 19.99% | 87.06% | 12.94% |

| 2006 | 100% | 11.23% | 22.10% | 36.62% | 10.56% | 47.17% | 20.73% | 67.91% | 19.68% | 87.58% | 12.42% |

| 2007 | 100% | 11.95% | 22.86% | 37.39% | 10.49% | 47.88% | 20.53% | 68.41% | 19.40% | 87.81% | 12.19% |

| 2008 | 100% | 10.06% | 20.19% | 34.95% | 11.03% | 45.98% | 21.71% | 67.69% | 20.39% | 88.08% | 11.92% |

| 2009 | 100% | 7.94% | 17.21% | 32.18% | 11.59% | 43.77% | 22.96% | 66.74% | 21.38% | 88.12% | 11.88% |

| 2010 | 100% | 9.24% | 18.87% | 33.78% | 11.38% | 45.17% | 22.38% | 67.55% | 20.71% | 88.26% | 11.74% |

| 2011 | 100% | 8.86% | 18.70% | 33.89% | 11.50% | 45.39% | 22.43% | 67.82% | 20.63% | 88.45% | 11.55% |

| 2012 | 100% | 11.25% | 21.86% | 36.84% | 11.03% | 47.87% | 21.39% | 69.25% | 19.64% | 88.90% | 11.10% |

| 2013 | 100% | 9.03% | 19.04% | 34.42% | 11.45% | 45.87% | 22.23% | 68.10% | 20.41% | 88.51% | 11.49% |

| 2014 | 100% | 10.16% | 20.58% | 35.96% | 11.25% | 47.21% | 21.70% | 68.91% | 19.82% | 88.73% | 11.27% |

| 2015 | 100% | 10.19% | 20.65% | 36.07% | 11.29% | 47.36% | 21.64% | 68.99% | 19.72% | 88.72% | 11.28% |

| 2016 | 100% | 9.52% | 19.72% | 35.20% | 11.37% | 46.56% | 21.86% | 68.43% | 19.98% | 88.41% | 11.59% |

| 2017 | 100% | 10.52% | 21.04% | 36.53% | 11.21% | 47.74% | 21.40% | 69.14% | 19.61% | 88.75% | 11.25% |

| 2018 | 100% | 10.35% | 20.93% | 36.48% | 11.18% | 47.66% | 21.26% | 68.91% | 19.48% | 88.39% | 11.61% |

| 2019 | 100% | 9.60% | 20.14% | 35.93% | 11.37% | 47.30% | 21.51% | 68.82% | 19.69% | 88.51% | 11.49% |

|

Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares |

|||||||||||

| Year | Total | Top 0.1% | Top 1% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 100% | 19.05% | 36.84% | 12.44% | 49.28% | 23.74% | 73.02% | 19.93% | 92.95% | 7.05% | |

| 1981 | 100% | 17.58% | 35.06% | 12.90% | 47.96% | 24.33% | 72.29% | 20.26% | 92.55% | 7.45% | |

| 1982 | 100% | 19.03% | 36.13% | 12.45% | 48.59% | 23.91% | 72.50% | 20.15% | 92.65% | 7.35% | |

| 1983 | 100% | 20.32% | 37.26% | 12.44% | 49.71% | 23.39% | 73.10% | 19.73% | 92.83% | 7.17% | |

| 1984 | 100% | 21.12% | 37.98% | 12.58% | 50.56% | 22.92% | 73.49% | 19.16% | 92.65% | 7.35% | |

| 1985 | 100% | 21.81% | 38.78% | 12.67% | 51.46% | 22.60% | 74.06% | 18.77% | 92.83% | 7.17% | |

| 1986 | 100% | 25.75% | 42.57% | 12.12% | 54.69% | 21.33% | 76.02% | 17.52% | 93.54% | 6.46% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | |||||||||||

| 1987 | 100% | 24.81% | 43.26% | 12.35% | 55.61% | 21.31% | 76.92% | 17.02% | 93.93% | 6.07% | |

| 1988 | 100% | 27.58% | 45.62% | 11.66% | 57.28% | 20.57% | 77.84% | 16.44% | 94.28% | 5.72% | |

| 1989 | 100% | 25.24% | 43.94% | 11.85% | 55.78% | 21.44% | 77.22% | 16.94% | 94.17% | 5.83% | |

| 1990 | 100% | 25.13% | 43.64% | 11.73% | 55.36% | 21.66% | 77.02% | 17.16% | 94.19% | 5.81% | |

| 1991 | 100% | 24.82% | 43.38% | 12.45% | 55.82% | 21.46% | 77.29% | 17.23% | 94.52% | 5.48% | |

| 1992 | 100% | 27.54% | 45.88% | 12.12% | 58.01% | 20.47% | 78.48% | 16.46% | 94.94% | 5.06% | |

| 1993 | 100% | 29.01% | 47.36% | 11.88% | 59.24% | 20.03% | 79.27% | 15.92% | 95.19% | 4.81% | |

| 1994 | 100% | 28.86% | 47.52% | 11.93% | 59.45% | 20.10% | 79.55% | 15.68% | 95.23% | 4.77% | |

| 1995 | 100% | 30.26% | 48.91% | 11.84% | 60.75% | 19.62% | 80.36% | 15.03% | 95.39% | 4.61% | |

| 1996 | 100% | 32.31% | 50.97% | 11.54% | 62.51% | 18.80% | 81.32% | 14.36% | 95.68% | 4.32% | |

| 1997 | 100% | 33.17% | 51.87% | 11.33% | 63.20% | 18.47% | 81.67% | 14.05% | 95.72% | 4.28% | |

| 1998 | 100% | 34.75% | 53.84% | 11.20% | 65.04% | 17.65% | 82.69% | 13.10% | 95.79% | 4.21% | |

| 1999 | 100% | 36.18% | 55.45% | 11.00% | 66.45% | 17.09% | 83.54% | 12.46% | 96.00% | 4.00% | |

| 2000 | 100% | 37.42% | 56.47% | 10.86% | 67.33% | 16.68% | 84.01% | 12.08% | 96.09% | 3.91% | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | |||||||||||

| 2001 | 100% | 15.68% | 33.22% | 52.24% | 11.44% | 63.68% | 17.88% | 81.56% | 13.54% | 95.10% | 4.90% |

| 2002 | 100% | 15.09% | 33.09% | 52.86% | 11.77% | 64.63% | 18.04% | 82.67% | 13.12% | 95.79% | 4.21% |

| 2003 | 100% | 15.37% | 33.69% | 53.54% | 11.35% | 64.89% | 17.87% | 82.76% | 13.17% | 95.93% | 4.07% |

| 2004 | 100% | 17.12% | 36.28% | 56.35% | 10.96% | 67.30% | 16.52% | 83.82% | 12.31% | 96.13% | 3.87% |

| 2005 | 100% | 18.91% | 38.78% | 58.93% | 10.52% | 69.46% | 15.61% | 85.07% | 11.35% | 96.41% | 3.59% |

| 2006 | 100% | 19.24% | 39.36% | 59.49% | 10.59% | 70.08% | 15.41% | 85.49% | 11.10% | 96.59% | 3.41% |

| 2007 | 100% | 19.84% | 39.81% | 59.90% | 10.51% | 70.41% | 15.30% | 85.71% | 10.93% | 96.64% | 3.36% |

| 2008 | 100% | 18.20% | 37.51% | 58.06% | 11.14% | 69.20% | 16.37% | 85.57% | 11.33% | 96.90% | 3.10% |

| 2009 | 100% | 16.91% | 36.34% | 58.17% | 11.72% | 69.89% | 16.85% | 86.74% | 10.80% | 97.54% | 2.46% |

| 2010 | 100% | 17.88% | 37.38% | 59.07% | 11.55% | 70.62% | 16.49% | 87.11% | 10.53% | 97.64% | 2.36% |

| 2011 | 100% | 16.14% | 35.06% | 56.49% | 11.77% | 68.26% | 17.36% | 85.62% | 11.50% | 97.11% | 2.89% |

| 2012 | 100% | 18.60% | 38.09% | 58.95% | 11.22% | 70.17% | 16.25% | 86.42% | 10.80% | 97.22% | 2.78% |

| 2013 | 100% | 18.48% | 37.80% | 58.55% | 11.25% | 69.80% | 16.47% | 86.27% | 10.94% | 97.22% | 2.78% |

| 2014 | 100% | 19.85% | 39.48% | 59.97% | 10.91% | 70.88% | 15.90% | 86.78% | 10.47% | 97.25% | 2.75% |

| 2015 | 100% | 19.50% | 39.04% | 59.58% | 11.01% | 70.59% | 16.03% | 86.62% | 10.55% | 97.17% | 2.83% |

| 2016 | 100.00% | 18.12% | 37.32% | 58.23% | 11.24% | 69.47% | 16.50% | 85.97% | 10.99% | 96.96% | 3.04% |

| 2017 | 100.00% | 19.34% | 38.47% | 59.14% | 10.94% | 70.08% | 16.02% | 86.10% | 10.79% | 96.89% | 3.11% |

| 2018 | 100.00% | 20.22% | 40.08% | 60.30% | 11.06% | 71.37% | 15.60% | 86.97% | 10.09% | 97.06% | 2.94% |

| 2019 | 100.00% | 18.87% | 38.77% | 59.44% | 11.37% | 70.81% | 15.84% | 86.65% | 10.29% | 96.94% | 3.06% |

|

Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares |

|||||||||||

| Year | Top 0.1% | Top 1% | Top 5% | Top 10% | Top 25% | Top 50% |

|---|---|---|---|---|---|---|

| 1980 | $80,580 | $43,792 | $35,070 | $23,606 | $12,936 | |

| 1981 | $85,428 | $47,845 | $38,283 | $25,655 | $14,000 | |

| 1982 | $89,388 | $49,284 | $39,676 | $27,027 | $14,539 | |

| 1983 | $93,512 | $51,553 | $41,222 | $27,827 | $15,044 | |

| 1984 | $100,889 | $55,423 | $43,956 | $29,360 | $15,998 | |

| 1985 | $108,134 | $58,883 | $46,322 | $30,928 | $16,688 | |

| 1986 | $118,818 | $62,377 | $48,656 | $32,242 | $17,302 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||

| 1987 | $139,289 | $68,414 | $52,921 | $33,983 | $17,768 | |

| 1988 | $157,136 | $72,735 | $55,437 | $35,398 | $18,367 | |

| 1989 | $163,869 | $76,933 | $58,263 | $36,839 | $18,993 | |

| 1990 | $167,421 | $79,064 | $60,287 | $38,080 | $19,767 | |

| 1991 | $170,139 | $81,720 | $61,944 | $38,929 | $20,097 | |

| 1992 | $181,904 | $85,103 | $64,457 | $40,378 | $20,803 | |

| 1993 | $185,715 | $87,386 | $66,077 | $41,210 | $21,179 | |

| 1994 | $195,726 | $91,226 | $68,753 | $42,742 | $21,802 | |

| 1995 | $209,406 | $96,221 | $72,094 | $44,207 | $22,344 | |

| 1996 | $227,546 | $101,141 | $74,986 | $45,757 | $23,174 | |

| 1997 | $250,736 | $108,048 | $79,212 | $48,173 | $24,393 | |

| 1998 | $269,496 | $114,729 | $83,220 | $50,607 | $25,491 | |

| 1999 | $293,415 | $120,846 | $87,682 | $52,965 | $26,415 | |

| 2000 | $313,469 | $128,336 | $92,144 | $55,225 | $27,682 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||

| 2001 | $1,393,718 | $306,635 | $132,082 | $96,151 | $59,026 | $31,418 |

| 2002 | $1,245,352 | $296,194 | $130,750 | $95,699 | $59,066 | $31,299 |

| 2003 | $1,317,088 | $305,939 | $133,741 | $97,470 | $59,896 | $31,447 |

| 2004 | $1,617,918 | $339,993 | $140,758 | $101,838 | $62,794 | $32,622 |

| 2005 | $1,938,175 | $379,261 | $149,216 | $106,864 | $64,821 | $33,484 |

| 2006 | $2,124,625 | $402,603 | $157,390 | $112,016 | $67,291 | $34,417 |

| 2007 | $2,251,017 | $426,439 | $164,883 | $116,396 | $69,559 | $35,541 |

| 2008 | $1,867,652 | $392,513 | $163,512 | $116,813 | $69,813 | $35,340 |

| 2009 | $1,469,393 | $351,968 | $157,342 | $114,181 | $68,216 | $34,156 |

| 2010 | $1,634,386 | $369,691 | $161,579 | $116,623 | $69,126 | $34,338 |

| 2011 | $1,717,675 | $388,905 | $167,728 | $120,136 | $70,492 | $34,823 |

| 2012 | $2,161,175 | $434,682 | $175,817 | $125,195 | $73,354 | $36,055 |

| 2013 | $1,860,848 | $428,713 | $179,760 | $127,695 | $74,955 | $36,841 |

| 2014 | $2,136,762 | $465,626 | $188,996 | $133,445 | $77,714 | $38,173 |

| 2015 | $2,220,264 | $480,930 | $195,778 | $138,031 | $79,655 | $39,275 |

| 2016 | $2,124,117 | $480,804 | $197,651 | $139,713 | $80,921 | $40,078 |

| 2017 | $2,374,937 | $515,371 | $208,053 | $145,135 | $83,682 | $41,740 |

| 2018 | $2,514,209 | $540,009 | $217,913 | $151,935 | $87,044 | $43,614 |

| 2019 | $2,458,432 | $546,434 | $221,572 | $154,589 | $87,917 | $44,269 |

|

Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares |

||||||

| Year | Total | Top 0.1% | Top 1% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 15.31% | 34.47% | 26.85% | 17.13% | 23.49% | 14.80% | 19.72% | 11.91% | 17.29% | 6.10% | |

| 1981 | 15.76% | 33.37% | 26.59% | 18.16% | 23.64% | 15.53% | 20.11% | 12.48% | 17.73% | 6.62% | |

| 1982 | 14.72% | 31.43% | 25.05% | 16.61% | 22.17% | 14.35% | 18.79% | 11.63% | 16.57% | 6.10% | |

| 1983 | 13.79% | 30.18% | 23.64% | 15.54% | 20.91% | 13.20% | 17.62% | 10.76% | 15.52% | 5.66% | |

| 1984 | 13.68% | 29.92% | 23.42% | 15.57% | 20.81% | 12.90% | 17.47% | 10.48% | 15.35% | 5.77% | |

| 1985 | 13.73% | 29.86% | 23.50% | 15.69% | 20.93% | 12.83% | 17.55% | 10.41% | 15.41% | 5.70% | |

| 1986 | 14.54% | 33.13% | 25.68% | 15.99% | 22.64% | 12.97% | 18.72% | 10.48% | 16.32% | 5.63% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | |||||||||||

| 1987 | 13.12% | 26.41% | 22.10% | 14.43% | 19.77% | 11.71% | 16.61% | 9.45% | 14.60% | 5.09% | |

| 1988 | 13.21% | 24.04% | 21.14% | 14.07% | 19.18% | 11.82% | 16.47% | 9.60% | 14.64% | 5.06% | |

| 1989 | 13.12% | 23.34% | 20.71% | 13.93% | 18.77% | 12.08% | 16.27% | 9.77% | 14.53% | 5.11% | |

| 1990 | 12.95% | 23.25% | 20.46% | 13.63% | 18.50% | 12.01% | 16.06% | 9.73% | 14.36% | 5.01% | |

| 1991 | 12.75% | 24.37% | 20.62% | 13.96% | 18.63% | 11.57% | 15.93% | 9.55% | 14.20% | 4.62% | |

| 1992 | 12.94% | 25.05% | 21.19% | 13.99% | 19.13% | 11.39% | 16.25% | 9.42% | 14.44% | 4.39% | |

| 1993 | 13.32% | 28.01% | 22.71% | 14.01% | 20.20% | 11.40% | 16.90% | 9.37% | 14.90% | 4.29% | |

| 1994 | 13.50% | 28.23% | 23.04% | 14.20% | 20.48% | 11.57% | 17.15% | 9.42% | 15.11% | 4.32% | |

| 1995 | 13.86% | 28.73% | 23.53% | 14.46% | 20.97% | 11.71% | 17.58% | 9.43% | 15.47% | 4.39% | |

| 1996 | 14.34% | 28.87% | 24.07% | 14.74% | 21.55% | 11.86% | 18.12% | 9.53% | 15.96% | 4.40% | |

| 1997 | 14.48% | 27.64% | 23.62% | 14.87% | 21.36% | 12.04% | 18.18% | 9.63% | 16.09% | 4.48% | |

| 1998 | 14.42% | 27.12% | 23.63% | 14.79% | 21.42% | 11.63% | 18.16% | 9.12% | 16.00% | 4.44% | |

| 1999 | 14.85% | 27.53% | 24.18% | 15.06% | 21.98% | 11.76% | 18.66% | 9.12% | 16.43% | 4.48% | |

| 2000 | 15.26% | 27.45% | 24.42% | 15.48% | 22.34% | 12.04% | 19.09% | 9.28% | 16.86% | 4.60% | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | |||||||||||

| 2001 | 14.47% | 28.17% | 27.60% | 23.91% | 15.20% | 21.68% | 11.87% | 18.35% | 9.20% | 16.08% | 4.92% |

| 2002 | 13.28% | 28.48% | 27.37% | 23.17% | 14.15% | 20.76% | 10.70% | 17.23% | 8.00% | 14.87% | 3.86% |

| 2003 | 12.11% | 24.60% | 24.38% | 20.92% | 12.46% | 18.70% | 9.69% | 15.57% | 7.41% | 13.53% | 3.49% |

| 2004 | 12.31% | 23.06% | 23.52% | 20.83% | 12.53% | 18.80% | 9.41% | 15.71% | 7.27% | 13.68% | 3.53% |

| 2005 | 12.65% | 22.48% | 23.15% | 20.93% | 12.61% | 19.03% | 9.45% | 16.04% | 7.18% | 14.01% | 3.51% |

| 2006 | 12.80% | 21.94% | 22.80% | 20.80% | 12.84% | 19.02% | 9.52% | 16.12% | 7.22% | 14.12% | 3.51% |

| 2007 | 12.90% | 21.42% | 22.46% | 20.66% | 12.92% | 18.96% | 9.61% | 16.16% | 7.27% | 14.19% | 3.56% |

| 2008 | 12.54% | 22.67% | 23.29% | 20.83% | 12.66% | 18.87% | 9.45% | 15.85% | 6.97% | 13.79% | 3.26% |

| 2009 | 11.39% | 24.28% | 24.05% | 20.59% | 11.53% | 18.19% | 8.36% | 14.81% | 5.76% | 12.61% | 2.35% |

| 2010 | 11.81% | 22.84% | 23.39% | 20.64% | 11.98% | 18.46% | 8.70% | 15.22% | 6.01% | 13.06% | 2.37% |

| 2011 | 12.54% | 22.82% | 23.50% | 20.89% | 12.83% | 18.85% | 9.70% | 15.82% | 6.98% | 13.76% | 3.13% |

| 2012 | 13.11% | 21.67% | 22.83% | 20.97% | 13.33% | 19.21% | 9.96% | 16.35% | 7.21% | 14.33% | 3.28% |

| 2013 | 13.64% | 27.91% | 27.08% | 23.20% | 13.40% | 20.75% | 10.11% | 17.28% | 7.31% | 14.98% | 3.30% |

| 2014 | 14.16% | 27.67% | 27.16% | 23.61% | 13.73% | 21.25% | 10.37% | 17.83% | 7.48% | 15.52% | 3.45% |

| 2015 | 14.34% | 27.44% | 27.10% | 23.68% | 13.99% | 21.37% | 10.62% | 18.00% | 7.67% | 15.71% | 3.59% |

| 2016 | 14.20% | 27.05% | 26.87% | 23.49% | 14.05% | 21.19% | 10.71% | 17.84% | 7.81% | 15.57% | 3.73% |

| 2017 | 14.64% | 26.93% | 26.76% | 23.70% | 14.29% | 21.49% | 10.96% | 18.23% | 8.06% | 15.99% | 4.05% |

| 2018 | 13.28% | 25.96% | 25.44% | 21.96% | 13.14% | 19.89% | 9.75% | 16.77% | 6.88% | 14.59% | 3.36% |

| 2019 | 13.29% | 26.12% | 25.57% | 21.98% | 13.28% | 19.89% | 9.78% | 16.73% | 6.94% | 14.55% | 3.54% |

|

Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares |

|||||||||||

| [All figures are estimates based on samples] | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total | Descending cumulative percentiles | ||||||||||||||

| Top 0.001 percent | Top 0.01 percent | Top 0.1 percent | Top 1 percent | Top 2 percent | Top 3 percent | Top 4 percent | Top 5 percent | Top 10 percent | Top 20 percent | Top 25 percent | Top 30 percent | Top 40 percent | Top 50 percent | ||

| Number of returns: | |||||||||||||||

| 2001 | 119,370,886 | 1,194 | 11,937 | 119,371 | 1,193,709 | 2,387,418 | 3,581,127 | 4,774,835 | 5,968,544 | 11,937,089 | 23,874,177 | 29,842,722 | 35,811,266 | 47,748,354 | 59,685,443 |

| 2002 | 119,850,561 | 1,199 | 11,985 | 119,851 | 1,198,506 | 2,397,011 | 3,595,517 | 4,794,022 | 5,992,528 | 11,985,056 | 23,970,112 | 29,962,640 | 35,955,168 | 47,940,224 | 59,925,281 |

| 2003 | 120,758,947 | 1,208 | 12,076 | 120,759 | 1,207,589 | 2,415,179 | 3,622,768 | 4,830,358 | 6,037,947 | 12,075,895 | 24,151,789 | 30,189,737 | 36,227,684 | 48,303,579 | 60,379,474 |

| 2004 | 122,509,974 | 1,225 | 12,251 | 122,510 | 1,225,100 | 2,450,199 | 3,675,299 | 4,900,399 | 6,125,499 | 12,250,997 | 24,501,995 | 30,627,494 | 36,752,992 | 49,003,990 | 61,254,987 |

| 2005 | 124,673,055 | 1,247 | 12,467 | 124,673 | 1,246,731 | 2,493,461 | 3,740,192 | 4,986,922 | 6,233,653 | 12,467,306 | 24,934,611 | 31,168,264 | 37,401,917 | 49,869,222 | 62,336,528 |

| 2006 | 128,441,165 | 1,284 | 12,844 | 128,441 | 1,284,412 | 2,568,823 | 3,853,235 | 5,137,647 | 6,422,058 | 12,844,117 | 25,688,233 | 32,110,291 | 38,532,350 | 51,376,466 | 64,220,583 |

| 2007 | [4] 132,654,911 | [4] 1,327 | [4] 13,265 | 132,654 | 1,326,549 | 2,653,098 | 3,979,647 | 5,306,196 | 6,632,746 | 13,265,491 | 26,530,982 | 33,163,728 | 39,796,473 | 53,061,964 | 66,327,456 |

| 2008 | 132,891,770 | 1,329 | 13,289 | 132,892 | 1,328,918 | 2,657,835 | 3,986,753 | 5,315,671 | 6,644,589 | 13,289,177 | 26,578,354 | 33,222,943 | 39,867,531 | 53,156,708 | 66,445,885 |

| 2009 | 132,619,936 | 1,326 | 13,262 | 132,620 | 1,326,199 | 2,652,399 | 3,978,598 | 5,304,797 | 6,630,997 | 13,261,994 | 26,523,987 | 33,154,984 | 39,785,981 | 53,047,974 | 66,309,968 |

| 2010 | 135,033,492 | 1,350 | 13,503 | 135,033 | 1,350,335 | 2,700,670 | 4,051,005 | 5,401,340 | 6,751,675 | 13,503,349 | 27,006,698 | 33,758,373 | 40,510,048 | 54,013,397 | 67,516,746 |

| 2011 | 136,585,712 | 1,366 | 13,659 | 136,586 | 1,365,857 | 2,731,714 | 4,097,571 | 5,463,428 | 6,829,286 | 13,658,571 | 27,317,142 | 34,146,428 | 40,975,714 | 54,634,285 | 68,292,856 |

| 2012 | 136,080,353 | 1,361 | 13,608 | 136,080 | 1,360,804 | 2,721,607 | 4,082,411 | 5,443,214 | 6,804,018 | 13,608,035 | 27,216,071 | 34,020,088 | 40,824,106 | 54,432,141 | 68,040,177 |

| 2013 | 138,313,155 | 1,383 | 13,831 | 138,313 | 1,383,132 | 2,766,263 | 4,149,395 | 5,532,526 | 6,915,658 | 13,831,316 | 27,662,631 | 34,578,289 | 41,493,947 | 55,325,262 | 69,156,578 |

| 2014 | 139,562,034 | 1,396 | 13,956 | 139,562 | 1,395,620 | 2,791,241 | 4,186,861 | 5,582,481 | 6,978,102 | 13,956,203 | 27,912,407 | 34,890,509 | 41,868,610 | 55,824,814 | 69,781,017 |

| 2015 | 141,204,625 | 1,412 | 14,120 | 141,205 | 1,412,046 | 2,824,093 | 4,236,139 | 5,648,185 | 7,060,231 | 14,120,463 | 28,240,925 | 35,301,156 | 42,361,388 | 56,481,850 | 70,602,313 |

| 2016 | 140,888,785 | 1,409 | 14,089 | 140,889 | 1,408,888 | 2,817,776 | 4,226,664 | 5,635,551 | 7,044,439 | 14,088,879 | 28,177,757 | 35,222,196 | 42,266,636 | 56,355,514 | 70,444,393 |

| 2017 | 143,295,160 | 1,433 | 14,330 | 143,295 | 1,432,952 | 2,865,903 | 4,298,855 | 5,731,806 | 7,164,758 | 14,329,516 | 28,659,032 | 35,823,790 | 42,988,548 | 57,318,064 | 71,647,580 |

| 2018 | 144,317,866 | 1,443 | 14,432 | 144,318 | 1,443,179 | 2,886,357 | 4,329,536 | 5,772,715 | 7,215,893 | 14,431,787 | 28,863,573 | 36,079,467 | 43,295,360 | 57,727,146 | 72,158,933 |

| 2019 | 148,245,929 | 1,482 | 14,825 | 148,246 | 1,482,459 | 2,964,919 | 4,447,378 | 5,929,837 | 7,412,296 | 14,824,593 | 29,649,186 | 37,061,482 | 44,473,779 | 59,298,372 | 74,122,965 |

| Adjusted gross income floor on percentiles (current dollars): | |||||||||||||||

| 2001 | N/A | 31,331,335 | 6,869,952 | 1,393,718 | 306,635 | 207,592 | 167,788 | 145,667 | 132,082 | 96,151 | 67,818 | 59,026 | 51,863 | 40,293 | 31,418 |

| 2002 | N/A | 25,921,482 | 5,891,214 | 1,245,352 | 296,194 | 200,654 | 164,409 | 144,575 | 130,750 | 95,699 | 67,928 | 59,066 | 51,721 | 40,073 | 31,299 |

| 2003 | N/A | 28,489,160 | 6,386,149 | 1,317,088 | 305,939 | 205,565 | 168,248 | 147,132 | 133,741 | 97,470 | 69,304 | 59,896 | 52,353 | 40,383 | 31,447 |

| 2004 | N/A | 38,780,500 | 8,455,107 | 1,617,918 | 339,993 | 224,320 | 181,127 | 156,665 | 140,758 | 101,838 | 72,069 | 62,794 | 54,765 | 42,081 | 32,622 |

| 2005 | N/A | 50,796,495 | 10,738,867 | 1,938,175 | 379,261 | 245,392 | 194,726 | 167,281 | 149,216 | 106,864 | 74,790 | 64,821 | 56,583 | 43,361 | 33,484 |

| 2006 | N/A | 54,665,360 | 11,649,460 | 2,124,625 | 402,603 | 258,800 | 205,835 | 176,455 | 157,390 | 112,016 | 77,776 | 67,291 | 58,505 | 44,748 | 34,417 |

| 2007 | N/A | 62,955,875 | 12,747,384 | 2,251,017 | 426,439 | 270,440 | 214,832 | 184,473 | 164,883 | 116,396 | 80,723 | 69,559 | 60,617 | 46,200 | 35,541 |

| 2008 | N/A | 49,546,782 | 10,097,827 | 1,867,652 | 392,513 | 260,381 | 209,750 | 181,624 | 163,512 | 116,813 | 80,886 | 69,813 | 60,535 | 46,120 | 35,340 |

| 2009 | N/A | 34,381,494 | 7,206,540 | 1,469,393 | 351,968 | 243,096 | 198,731 | 174,432 | 157,342 | 114,181 | 79,237 | 68,216 | 58,876 | 44,529 | 34,156 |

| 2010 | N/A | 45,039,369 | 8,762,618 | 1,634,386 | 369,691 | 252,785 | 205,942 | 179,023 | 161,579 | 116,623 | 80,462 | 69,126 | 59,512 | 44,895 | 34,338 |

| 2011 | N/A | 41,965,258 | 8,830,028 | 1,717,675 | 388,905 | 262,933 | 213,441 | 185,812 | 167,728 | 120,136 | 82,241 | 70,492 | 60,789 | 45,722 | 34,823 |

| 2012 | N/A | 62,068,187 | 12,104,014 | 2,161,175 | 434,682 | 285,908 | 227,923 | 196,416 | 175,817 | 125,195 | 85,440 | 73,354 | 63,222 | 47,475 | 36,055 |

| 2013 | N/A | 45,097,112 | 9,460,540 | 1,860,848 | 428,713 | 287,018 | 231,507 | 200,472 | 179,760 | 127,695 | 87,434 | 74,955 | 64,650 | 48,463 | 36,841 |

| 2014 | N/A | 56,981,718 | 11,407,987 | 2,136,762 | 465,626 | 306,650 | 245,902 | 211,261 | 188,996 | 133,445 | 90,606 | 77,714 | 66,868 | 50,083 | 38,173 |

| 2015 | N/A | 59,380,503 | 11,930,649 | 2,220,264 | 480,930 | 316,913 | 253,979 | 218,911 | 195,778 | 138,031 | 93,212 | 79,655 | 68,632 | 51,571 | 39,275 |

| 2016 | N/A | 53,052,900 | 10,963,921 | 2,124,117 | 480,804 | 319,796 | 256,673 | 221,381 | 197,651 | 139,713 | 94,620 | 80,921 | 69,581 | 52,529 | 40,078 |

| 2017 | N/A | 63,430,119 | 12,899,070 | 2,374,937 | 515,371 | 339,478 | 271,182 | 232,955 | 208,053 | 145,135 | 97,870 | 83,682 | 72,268 | 54,672 | 41,740 |

| 2018 | N/A | 68,934,261 | 13,576,286 | 2,514,209 | 540,009 | 359,368 | 286,106 | 245,050 | 217,913 | 151,935 | 101,765 | 87,044 | 75,083 | 57,092 | 43,614 |

| 2019 | N/A | 60,658,598 | 12,623,539 | 2,458,432 | 546,434 | 364,693 | 291,384 | 249,320 | 221,572 | 154,589 | 103,012 | 87,917 | 75,991 | 57,685 | 44,269 |

| Adjusted gross income floor on percentiles (constant dollars): [1] | |||||||||||||||

| 2001 | N/A | 23,122,756 | 5,070,075 | 1,028,574 | 226,299 | 153,204 | 123,829 | 107,503 | 97,477 | 70,960 | 50,050 | 43,562 | 38,275 | 29,737 | 23,187 |

| 2002 | N/A | 18,838,286 | 4,281,406 | 905,052 | 215,257 | 145,824 | 119,483 | 105,069 | 95,022 | 69,549 | 49,366 | 42,926 | 37,588 | 29,123 | 22,746 |

| 2003 | N/A | 20,233,778 | 4,535,617 | 935,432 | 217,286 | 145,998 | 119,494 | 104,497 | 94,987 | 69,226 | 49,222 | 42,540 | 37,183 | 28,681 | 22,335 |

| 2004 | N/A | 26,837,716 | 5,851,285 | 1,119,666 | 235,289 | 155,239 | 125,347 | 108,419 | 97,410 | 70,476 | 49,875 | 43,456 | 37,900 | 29,122 | 22,576 |

| 2005 | N/A | 34,000,331 | 7,187,997 | 1,297,306 | 253,856 | 164,252 | 130,339 | 111,969 | 99,877 | 71,529 | 50,060 | 43,388 | 37,873 | 29,023 | 22,412 |

| 2006 | N/A | 35,450,947 | 7,554,773 | 1,377,837 | 261,091 | 167,834 | 133,486 | 114,433 | 102,069 | 72,643 | 50,438 | 43,639 | 37,941 | 29,019 | 22,320 |

| 2007 | N/A | 39,694,751 | 8,037,443 | 1,419,305 | 268,877 | 170,517 | 135,455 | 116,313 | 103,962 | 73,390 | 50,897 | 43,858 | 38,220 | 29,130 | 22,409 |

| 2008 | N/A | 30,083,049 | 6,131,043 | 1,133,972 | 238,320 | 158,094 | 127,353 | 110,276 | 99,279 | 70,925 | 49,111 | 42,388 | 36,755 | 28,002 | 21,457 |

| 2009 | N/A | 20,951,550 | 4,391,554 | 895,425 | 214,484 | 148,139 | 121,104 | 106,296 | 95,882 | 69,580 | 48,286 | 41,570 | 35,878 | 27,135 | 20,814 |

| 2010 | N/A | 27,002,020 | 5,253,368 | 979,848 | 221,637 | 151,550 | 123,466 | 107,328 | 96,870 | 69,918 | 48,239 | 41,442 | 35,679 | 26,915 | 20,586 |

| 2011 | N/A | 24,384,229 | 5,130,754 | 998,068 | 225,976 | 152,779 | 124,021 | 107,967 | 97,460 | 69,806 | 47,787 | 40,960 | 35,322 | 26,567 | 20,234 |

| 2012 | N/A | 35,346,348 | 6,892,946 | 1,230,737 | 247,541 | 162,818 | 129,797 | 111,854 | 100,124 | 71,296 | 48,656 | 41,773 | 36,003 | 27,036 | 20,532 |

| 2013 | N/A | 25,301,633 | 5,307,815 | 1,044,025 | 240,528 | 161,031 | 129,886 | 112,474 | 100,854 | 71,643 | 49,055 | 42,053 | 36,272 | 27,190 | 20,670 |

| 2014 | N/A | 31,464,229 | 6,299,275 | 1,179,880 | 257,110 | 169,326 | 135,782 | 116,654 | 104,360 | 73,686 | 50,031 | 42,912 | 36,923 | 27,655 | 21,078 |

| 2015 | N/A | 32,752,622 | 6,580,612 | 1,224,635 | 265,268 | 174,800 | 140,088 | 120,745 | 107,986 | 76,134 | 51,413 | 43,935 | 37,855 | 28,445 | 21,663 |

| 2016 | N/A | 28,895,915 | 5,971,635 | 1,156,926 | 261,876 | 174,181 | 139,800 | 120,578 | 107,653 | 76,096 | 51,536 | 44,075 | 37,898 | 28,611 | 21,829 |

| 2017 | N/A | 33,829,397 | 6,879,504 | 1,266,633 | 274,865 | 181,055 | 144,630 | 124,243 | 110,962 | 77,405 | 52,197 | 44,630 | 38,543 | 29,158 | 22,261 |

| 2018 | N/A | 35,884,571 | 7,067,301 | 1,308,802 | 281,108 | 187,073 | 148,936 | 127,564 | 113,437 | 79,092 | 52,975 | 45,312 | 39,085 | 29,720 | 22,704 |

| 2019 | N/A | 31,011,553 | 6,453,752 | 1,256,867 | 279,363 | 186,448 | 148,969 | 127,464 | 113,278 | 79,033 | 52,665 | 44,947 | 38,850 | 29,491 | 22,632 |

| Adjusted gross income (millions of dollars): | |||||||||||||||

| 2001 | 6,116,274 | 84,705 | 216,684 | 492,437 | 1,064,928 | 1,360,872 | 1,582,562 | 1,768,355 | 1,933,563 | 2,599,650 | 3,555,692 | 3,933,186 | 4,263,535 | 4,810,102 | 5,235,273 |

| 2002 | 5,982,260 | 68,565 | 179,420 | 420,987 | 960,352 | 1,247,308 | 1,463,587 | 1,647,849 | 1,812,094 | 2,472,326 | 3,431,568 | 3,811,534 | 4,143,048 | 4,689,683 | 5,114,828 |

| 2003 | 6,156,994 | 83,238 | 206,010 | 465,594 | 1,030,178 | 1,327,075 | 1,549,825 | 1,738,945 | 1,907,837 | 2,586,777 | 3,572,674 | 3,961,657 | 4,300,174 | 4,855,774 | 5,286,949 |

| 2004 | 6,734,554 | 111,932 | 280,449 | 615,494 | 1,278,879 | 1,610,803 | 1,855,778 | 2,061,398 | 2,243,098 | 2,968,169 | 4,010,897 | 4,423,150 | 4,782,507 | 5,371,578 | 5,826,206 |

| 2005 | 7,365,689 | 143,370 | 362,581 | 783,762 | 1,560,659 | 1,932,055 | 2,202,354 | 2,426,492 | 2,623,077 | 3,400,596 | 4,506,197 | 4,940,249 | 5,317,903 | 5,936,944 | 6,412,897 |

| 2006 | 7,969,813 | 170,567 | 418,573 | 895,044 | 1,761,119 | 2,166,188 | 2,460,559 | 2,704,549 | 2,918,422 | 3,759,733 | 4,947,104 | 5,412,038 | 5,815,385 | 6,474,937 | 6,980,130 |

| 2007 | 8,621,963 | 219,494 | 503,678 | 1,030,091 | 1,971,021 | 2,411,916 | 2,729,468 | 2,992,467 | 3,223,396 | 4,128,240 | 5,401,825 | 5,898,437 | 6,329,354 | 7,032,507 | 7,571,084 |

| 2008 | 8,206,158 | 173,257 | 397,957 | 825,898 | 1,656,771 | 2,072,196 | 2,380,698 | 2,639,100 | 2,867,730 | 3,772,889 | 5,055,298 | 5,554,583 | 5,986,923 | 6,690,342 | 7,228,036 |

| 2009 | 7,578,641 | 126,242 | 281,687 | 601,504 | 1,304,627 | 1,684,139 | 1,973,637 | 2,219,853 | 2,439,146 | 3,317,402 | 4,570,256 | 5,057,761 | 5,478,063 | 6,159,780 | 6,678,194 |

| 2010 | 8,039,779 | 166,727 | 366,563 | 742,989 | 1,517,146 | 1,922,058 | 2,228,360 | 2,486,918 | 2,716,199 | 3,631,364 | 4,927,262 | 5,430,952 | 5,864,278 | 6,564,169 | 7,095,680 |

| 2011 | 8,317,188 | 144,984 | 342,338 | 737,251 | 1,555,701 | 1,984,960 | 2,306,674 | 2,578,137 | 2,818,879 | 3,774,978 | 5,120,188 | 5,640,585 | 6,088,552 | 6,810,489 | 7,356,627 |

| 2012 | 9,041,744 | 219,067 | 501,374 | 1,017,057 | 1,976,738 | 2,446,464 | 2,791,205 | 3,078,337 | 3,330,944 | 4,327,899 | 5,722,980 | 6,261,677 | 6,725,553 | 7,473,507 | 8,037,800 |

| 2013 | 9,033,840 | 168,992 | 384,881 | 815,662 | 1,719,794 | 2,195,723 | 2,550,046 | 2,847,179 | 3,109,388 | 4,143,498 | 5,591,750 | 6,151,678 | 6,633,611 | 7,409,491 | 7,995,603 |

| 2014 | 9,708,663 | 207,145 | 475,714 | 986,078 | 1,997,819 | 2,514,973 | 2,895,712 | 3,212,471 | 3,490,867 | 4,583,416 | 6,104,146 | 6,690,287 | 7,193,799 | 8,002,581 | 8,614,544 |

| 2015 | 10,142,620 | 214,647 | 495,201 | 1,033,473 | 2,094,906 | 2,636,987 | 3,034,889 | 3,366,920 | 3,658,556 | 4,803,327 | 6,389,094 | 6,997,737 | 7,519,683 | 8,360,826 | 8,998,075 |

| 2016 | 10,156,612 | 204,934 | 460,894 | 966,465 | 2,003,066 | 2,544,904 | 2,946,100 | 3,280,595 | 3,574,828 | 4,729,405 | 6,333,469 | 6,950,051 | 7,479,129 | 8,331,664 | 8,979,705 |

| 2017 | 10,936,500 | 256,250 | 565,453 | 1,150,471 | 2,301,449 | 2,889,391 | 3,321,003 | 3,680,328 | 3,995,037 | 5,220,949 | 6,913,130 | 7,561,368 | 8,118,508 | 9,019,611 | 9,706,054 |

| 2018 | 11,563,883 | 241,954 | 570,189 | 1,196,670 | 2,420,025 | 3,044,552 | 3,503,876 | 3,884,856 | 4,217,996 | 5,511,117 | 7,289,834 | 7,969,121 | 8,552,653 | 9,499,838 | 10,221,814 |

| 2019 | 11,882,850 | 214,487 | 522,449 | 1,140,517 | 2,393,383 | 3,042,810 | 3,523,664 | 3,921,774 | 4,269,727 | 5,621,027 | 7,472,188 | 8,177,266 | 8,783,586 | 9,766,007 | 10,517,131 |

| Total income tax (millions of dollars): [2] | |||||||||||||||

| 2001 | 884,931 | 20,363 | 57,329 | 138,735 | 293,968 | 358,761 | 401,189 | 434,411 | 462,288 | 563,525 | 681,732 | 721,756 | 755,307 | 807,098 | 841,587 |

| 2002 | 794,282 | 16,728 | 48,388 | 119,894 | 262,820 | 323,052 | 362,355 | 393,407 | 419,871 | 513,320 | 620,746 | 656,602 | 687,111 | 731,873 | 760,808 |

| 2003 | 745,514 | 17,169 | 47,192 | 114,559 | 251,146 | 308,878 | 345,930 | 374,786 | 399,176 | 483,792 | 582,130 | 617,015 | 645,885 | 688,113 | 715,163 |

| 2004 | 829,096 | 21,437 | 59,739 | 141,937 | 300,802 | 367,392 | 409,259 | 440,979 | 467,165 | 558,007 | 659,803 | 694,983 | 724,830 | 769,074 | 797,040 |

| 2005 | 931,693 | 27,171 | 75,151 | 176,152 | 361,264 | 437,452 | 485,042 | 520,483 | 549,068 | 647,115 | 755,252 | 792,545 | 823,488 | 869,272 | 898,262 |

| 2006 | 1,020,438 | 30,860 | 83,499 | 196,358 | 401,610 | 485,109 | 536,823 | 575,603 | 607,088 | 715,108 | 832,153 | 872,385 | 905,569 | 954,823 | 985,657 |

| 2007 | 1,111,872 | 38,587 | 97,979 | 220,636 | 442,633 | 534,150 | 590,292 | 631,830 | 666,021 | 782,903 | 909,392 | 952,964 | 988,633 | 1,041,166 | 1,074,502 |

| 2008 | 1,028,669 | 33,136 | 83,085 | 187,200 | 385,857 | 470,285 | 523,500 | 563,684 | 597,246 | 711,873 | 837,561 | 880,244 | 915,035 | 965,691 | 996,815 |

| 2009 | 863,486 | 26,328 | 64,253 | 146,030 | 313,826 | 387,828 | 435,662 | 472,299 | 502,274 | 603,504 | 712,700 | 749,022 | 777,801 | 818,789 | 842,286 |

| 2010 | 949,144 | 31,453 | 76,390 | 169,734 | 354,810 | 436,043 | 488,303 | 528,045 | 560,649 | 670,319 | 787,407 | 826,796 | 858,000 | 901,560 | 926,782 |

| 2011 | 1,042,571 | 26,488 | 70,545 | 168,222 | 365,518 | 453,679 | 510,000 | 553,220 | 588,967 | 711,663 | 846,579 | 892,616 | 929,529 | 981,800 | 1,012,460 |

| 2012 | 1,184,978 | 38,563 | 97,902 | 220,414 | 451,328 | 550,934 | 613,192 | 660,121 | 698,543 | 831,445 | 975,377 | 1,024,046 | 1,063,388 | 1,119,368 | 1,152,063 |

| 2013 | 1,231,911 | 40,764 | 100,868 | 227,623 | 465,705 | 567,786 | 631,900 | 680,817 | 721,242 | 859,863 | 1,011,220 | 1,062,798 | 1,104,510 | 1,163,238 | 1,197,603 |

| 2014 | 1,374,379 | 49,740 | 123,288 | 272,826 | 542,640 | 656,229 | 727,556 | 780,687 | 824,153 | 974,124 | 1,137,716 | 1,192,679 | 1,236,678 | 1,299,383 | 1,336,637 |

| 2015 | 1,454,325 | 51,375 | 127,236 | 283,577 | 567,697 | 688,137 | 763,764 | 820,335 | 866,447 | 1,026,601 | 1,201,501 | 1,259,698 | 1,306,271 | 1,373,073 | 1,413,200 |

| 2016 | 1,442,385 | 46,845 | 115,384 | 261,423 | 538,257 | 658,950 | 735,763 | 793,331 | 839,898 | 1,002,072 | 1,180,713 | 1,240,010 | 1,288,231 | 1,356,952 | 1,398,523 |

| 2017 | 1,601,309 | 61,750 | 143,024 | 309,765 | 615,979 | 748,944 | 833,142 | 895,962 | 946,954 | 1,122,158 | 1,314,957 | 1,378,757 | 1,430,369 | 1,505,513 | 1,551,537 |

| 2018 | 1,536,178 | 55,455 | 139,455 | 310,631 | 615,716 | 737,900 | 815,821 | 876,470 | 926,367 | 1,096,343 | 1,279,036 | 1,336,041 | 1,382,868 | 1,450,202 | 1,491,041 |

| 2019 | 1,578,661 | 49,185 | 128,817 | 297,920 | 612,027 | 739,896 | 822,470 | 886,070 | 938,429 | 1,117,856 | 1,308,416 | 1,367,843 | 1,416,809 | 1,487,163 | 1,530,288 |

| Average tax rate (percentage): [3] | |||||||||||||||

| 2001 | 14.47 | 24.04 | 26.46 | 28.17 | 27.60 | 26.36 | 25.35 | 24.57 | 23.91 | 21.68 | 19.17 | 18.35 | 17.72 | 16.78 | 16.08 |

| 2002 | 13.28 | 24.40 | 26.97 | 28.48 | 27.37 | 25.90 | 24.76 | 23.87 | 23.17 | 20.76 | 18.09 | 17.23 | 16.58 | 15.61 | 14.87 |

| 2003 | 12.11 | 20.63 | 22.91 | 24.60 | 24.38 | 23.28 | 22.32 | 21.55 | 20.92 | 18.70 | 16.29 | 15.57 | 15.02 | 14.17 | 13.53 |

| 2004 | 12.31 | 19.15 | 21.30 | 23.06 | 23.52 | 22.81 | 22.05 | 21.39 | 20.83 | 18.80 | 16.45 | 15.71 | 15.16 | 14.32 | 13.68 |

| 2005 | 12.65 | 18.95 | 20.73 | 22.48 | 23.15 | 22.64 | 22.02 | 21.45 | 20.93 | 19.03 | 16.76 | 16.04 | 15.49 | 14.64 | 14.01 |

| 2006 | 12.80 | 18.09 | 19.95 | 21.94 | 22.80 | 22.39 | 21.82 | 21.28 | 20.80 | 19.02 | 16.82 | 16.12 | 15.57 | 14.75 | 14.12 |

| 2007 | 12.90 | 17.58 | 19.45 | 21.42 | 22.46 | 22.15 | 21.63 | 21.11 | 20.66 | 18.96 | 16.83 | 16.16 | 15.62 | 14.81 | 14.19 |

| 2008 | 12.54 | 19.13 | 20.88 | 22.67 | 23.29 | 22.70 | 21.99 | 21.36 | 20.83 | 18.87 | 16.57 | 15.85 | 15.28 | 14.43 | 13.79 |

| 2009 | 11.39 | 20.86 | 22.81 | 24.28 | 24.05 | 23.03 | 22.07 | 21.28 | 20.59 | 18.19 | 15.59 | 14.81 | 14.20 | 13.29 | 12.61 |

| 2010 | 11.81 | 18.87 | 20.84 | 22.84 | 23.39 | 22.69 | 21.91 | 21.23 | 20.64 | 18.46 | 15.98 | 15.22 | 14.63 | 13.73 | 13.06 |

| 2011 | 12.54 | 18.27 | 20.61 | 22.82 | 23.50 | 22.86 | 22.11 | 21.46 | 20.89 | 18.85 | 16.53 | 15.82 | 15.27 | 14.42 | 13.76 |

| 2012 | 13.11 | 17.60 | 19.53 | 21.67 | 22.83 | 22.52 | 21.97 | 21.44 | 20.97 | 19.21 | 17.04 | 16.35 | 15.81 | 14.98 | 14.33 |

| 2013 | 13.64 | 24.12 | 26.21 | 27.91 | 27.08 | 25.86 | 24.78 | 23.91 | 23.20 | 20.75 | 18.08 | 17.28 | 16.65 | 15.70 | 14.98 |

| 2014 | 14.16 | 24.01 | 25.92 | 27.67 | 27.16 | 26.09 | 25.13 | 24.30 | 23.61 | 21.25 | 18.64 | 17.83 | 17.19 | 16.24 | 15.52 |

| 2015 | 14.34 | 23.93 | 25.69 | 27.44 | 27.10 | 26.10 | 25.17 | 24.36 | 23.68 | 21.37 | 18.81 | 18.00 | 17.37 | 16.42 | 15.71 |

| 2016 | 14.20 | 22.86 | 25.03 | 27.05 | 26.87 | 25.89 | 24.97 | 24.18 | 23.49 | 21.19 | 18.64 | 17.84 | 17.22 | 16.29 | 15.57 |

| 2017 | 14.64 | 24.10 | 25.29 | 26.93 | 26.76 | 25.92 | 25.09 | 24.34 | 23.70 | 21.49 | 19.02 | 18.23 | 17.62 | 16.69 | 15.99 |

| 2018 | 13.28 | 22.92 | 24.46 | 25.96 | 25.44 | 24.24 | 23.28 | 22.56 | 21.96 | 19.89 | 17.55 | 16.77 | 16.17 | 15.27 | 14.59 |

| 2019 | 13.29 | 22.93 | 24.66 | 26.12 | 25.57 | 24.32 | 23.34 | 22.59 | 21.98 | 19.89 | 17.51 | 16.73 | 16.13 | 15.23 | 14.55 |

| Adjusted gross income share (percentage): | |||||||||||||||

| 2001 | 100.00 | 1.38 | 3.54 | 8.05 | 17.41 | 22.25 | 25.87 | 28.91 | 31.61 | 42.50 | 58.13 | 64.31 | 69.71 | 78.64 | 85.60 |

| 2002 | 100.00 | 1.15 | 3.00 | 7.04 | 16.05 | 20.85 | 24.47 | 27.55 | 30.29 | 41.33 | 57.36 | 63.71 | 69.26 | 78.39 | 85.50 |

| 2003 | 100.00 | 1.35 | 3.35 | 7.56 | 16.73 | 21.55 | 25.17 | 28.24 | 30.99 | 42.01 | 58.03 | 64.34 | 69.84 | 78.87 | 85.87 |

| 2004 | 100.00 | 1.66 | 4.16 | 9.14 | 18.99 | 23.92 | 27.56 | 30.61 | 33.31 | 44.07 | 59.56 | 65.68 | 71.01 | 79.76 | 86.51 |

| 2005 | 100.00 | 1.95 | 4.92 | 10.64 | 21.19 | 26.23 | 29.90 | 32.94 | 35.61 | 46.17 | 61.18 | 67.07 | 72.20 | 80.60 | 87.06 |

| 2006 | 100.00 | 2.14 | 5.25 | 11.23 | 22.10 | 27.18 | 30.87 | 33.93 | 36.62 | 47.17 | 62.07 | 67.91 | 72.97 | 81.24 | 87.58 |

| 2007 | 100.00 | 2.55 | 5.84 | 11.95 | 22.86 | 27.97 | 31.66 | 34.71 | 37.39 | 47.88 | 62.65 | 68.41 | 73.41 | 81.57 | 87.81 |

| 2008 | 100.00 | 2.11 | 4.85 | 10.06 | 20.19 | 25.25 | 29.01 | 32.16 | 34.95 | 45.98 | 61.60 | 67.69 | 72.96 | 81.53 | 88.08 |

| 2009 | 100.00 | 1.67 | 3.72 | 7.94 | 17.21 | 22.22 | 26.04 | 29.29 | 32.18 | 43.77 | 60.30 | 66.74 | 72.28 | 81.28 | 88.12 |

| 2010 | 100.00 | 2.07 | 4.56 | 9.24 | 18.87 | 23.91 | 27.72 | 30.93 | 33.78 | 45.17 | 61.29 | 67.55 | 72.94 | 81.65 | 88.26 |

| 2011 | 100.00 | 1.74 | 4.12 | 8.86 | 18.70 | 23.87 | 27.73 | 31.00 | 33.89 | 45.39 | 61.56 | 67.82 | 73.20 | 81.88 | 88.45 |

| 2012 | 100.00 | 2.42 | 5.55 | 11.25 | 21.86 | 27.06 | 30.87 | 34.05 | 36.84 | 47.87 | 63.30 | 69.25 | 74.38 | 82.66 | 88.90 |

| 2013 | 100.00 | 1.87 | 4.26 | 9.03 | 19.04 | 24.31 | 28.23 | 31.52 | 34.42 | 45.87 | 61.90 | 68.10 | 73.43 | 82.02 | 88.51 |

| 2014 | 100.00 | 2.13 | 4.90 | 10.16 | 20.58 | 25.90 | 29.83 | 33.09 | 35.96 | 47.21 | 62.87 | 68.91 | 74.10 | 82.43 | 88.73 |

| 2015 | 100.00 | 2.12 | 4.88 | 10.19 | 20.65 | 26.00 | 29.92 | 33.20 | 36.07 | 47.36 | 62.99 | 68.99 | 74.14 | 82.43 | 88.72 |

| 2016 | 100.00 | 2.02 | 4.54 | 9.52 | 19.72 | 25.06 | 29.01 | 32.30 | 35.20 | 46.56 | 62.36 | 68.43 | 73.64 | 82.03 | 88.41 |

| 2017 | 100.00 | 2.34 | 5.17 | 10.52 | 21.04 | 26.42 | 30.37 | 33.65 | 36.53 | 47.74 | 63.21 | 69.14 | 74.23 | 82.47 | 88.75 |

| 2018 | 100.00 | 2.09 | 4.93 | 10.35 | 20.93 | 26.33 | 30.30 | 33.59 | 36.48 | 47.66 | 63.04 | 68.91 | 73.96 | 82.15 | 88.39 |

| 2019 | 100.00 | 1.81 | 4.40 | 9.60 | 20.14 | 25.61 | 29.65 | 33.00 | 35.93 | 47.30 | 62.88 | 68.82 | 73.92 | 82.19 | 88.51 |

| Total income tax share (percentage): | |||||||||||||||

| 2001 | 100.00 | 2.30 | 6.48 | 15.68 | 33.22 | 40.54 | 45.34 | 49.09 | 52.24 | 63.68 | 77.04 | 81.56 | 85.35 | 91.20 | 95.10 |

| 2002 | 100.00 | 2.11 | 6.09 | 15.09 | 33.09 | 40.67 | 45.62 | 49.53 | 52.86 | 64.63 | 78.15 | 82.67 | 86.51 | 92.14 | 95.79 |

| 2003 | 100.00 | 2.30 | 6.33 | 15.37 | 33.69 | 41.43 | 46.40 | 50.27 | 53.54 | 64.89 | 78.08 | 82.76 | 86.64 | 92.30 | 95.93 |

| 2004 | 100.00 | 2.59 | 7.21 | 17.12 | 36.28 | 44.31 | 49.36 | 53.19 | 56.35 | 67.30 | 79.58 | 83.82 | 87.42 | 92.76 | 96.13 |

| 2005 | 100.00 | 2.92 | 8.07 | 18.91 | 38.78 | 46.95 | 52.06 | 55.86 | 58.93 | 69.46 | 81.06 | 85.07 | 88.39 | 93.30 | 96.41 |

| 2006 | 100.00 | 3.02 | 8.18 | 19.24 | 39.36 | 47.54 | 52.61 | 56.41 | 59.49 | 70.08 | 81.55 | 85.49 | 88.74 | 93.57 | 96.59 |

| 2007 | 100.00 | 3.47 | 8.81 | 19.84 | 39.81 | 48.04 | 53.09 | 56.83 | 59.90 | 70.41 | 81.79 | 85.71 | 88.92 | 93.64 | 96.64 |

| 2008 | 100.00 | 3.22 | 8.08 | 18.20 | 37.51 | 45.72 | 50.89 | 54.80 | 58.06 | 69.20 | 81.42 | 85.57 | 88.95 | 93.88 | 96.90 |

| 2009 | 100.00 | 3.05 | 7.44 | 16.91 | 36.34 | 44.91 | 50.45 | 54.70 | 58.17 | 69.89 | 82.54 | 86.74 | 90.08 | 94.82 | 97.54 |

| 2010 | 100.00 | 3.31 | 8.05 | 17.88 | 37.38 | 45.94 | 51.45 | 55.63 | 59.07 | 70.62 | 82.96 | 87.11 | 90.40 | 94.99 | 97.64 |

| 2011 | 100.00 | 2.54 | 6.77 | 16.14 | 35.06 | 43.52 | 48.92 | 53.06 | 56.49 | 68.26 | 81.20 | 85.62 | 89.16 | 94.17 | 97.11 |

| 2012 | 100.00 | 3.25 | 8.26 | 18.60 | 38.09 | 46.49 | 51.75 | 55.71 | 58.95 | 70.17 | 82.31 | 86.42 | 89.74 | 94.46 | 97.22 |

| 2013 | 100.00 | 3.31 | 8.19 | 18.48 | 37.80 | 46.09 | 51.29 | 55.27 | 58.55 | 69.80 | 82.09 | 86.27 | 89.66 | 94.43 | 97.22 |

| 2014 | 100.00 | 3.62 | 8.97 | 19.85 | 39.48 | 47.75 | 52.94 | 56.80 | 59.97 | 70.88 | 82.78 | 86.78 | 89.98 | 94.54 | 97.25 |

| 2015 | 100.00 | 3.53 | 8.75 | 19.50 | 39.04 | 47.32 | 52.52 | 56.41 | 59.58 | 70.59 | 82.62 | 86.62 | 89.82 | 94.41 | 97.17 |

| 2016 | 100.00 | 3.25 | 8.00 | 18.12 | 37.32 | 45.68 | 51.01 | 55.00 | 58.23 | 69.47 | 81.86 | 85.97 | 89.31 | 94.08 | 96.96 |

| 2017 | 100.00 | 3.86 | 8.93 | 19.34 | 38.47 | 46.77 | 52.03 | 55.95 | 59.14 | 70.08 | 82.12 | 86.10 | 89.33 | 94.02 | 96.89 |

| 2018 | 100.00 | 3.61 | 9.08 | 20.22 | 40.08 | 48.03 | 53.11 | 57.06 | 60.30 | 71.37 | 83.26 | 86.97 | 90.02 | 94.40 | 97.06 |

| 2019 | 100.00 | 3.12 | 8.16 | 18.87 | 38.77 | 46.87 | 52.10 | 56.13 | 59.44 | 70.81 | 82.88 | 86.65 | 89.75 | 94.20 | 96.94 |

|

Notes: N/A– Not applicable. [1] For Table 4.1, constant dollars were calculated using the U.S. Bureau of Labor Statistics’ consumer price index for urban consumers (CPI-U, 1990=100). For 2019 the CPI-U = 255.657. [2] Total income tax was the sum of income tax after credits (including the subtraction of excess advance premium tax credit repayment, the earned income credit, American opportunity credit, health coverage tax credit, and the regulated investment credit credit) limited to zero plus net investment income tax from Form 8960 and the tax fromForm 4970, Tax on Accumulation Distribution of Trusts. It does not include any refundable portions of these credits. [3] The average tax rate was computed by dividing total income tax (see footnote 2) by adjusted gross income. [4] The total number of returns does not include the returns filed by individuals to only receive the economic stimulus payment and who had no other reason to file. Source: IRS, Statistics of Income Division, Publication 1304, November 2021 |

|||||||||||||||

| [All figures are estimates based on samples] | ||||||

|---|---|---|---|---|---|---|

| Item, tax year | Total | Ascending cumulative percentiles | ||||

| Bottom 50 percent | Bottom 75 percent | Bottom 90 percent | Bottom 95 percent | Bottom 99 Percent | ||

| Number of returns: | ||||||

| 2001 | 119,370,886 | 59,685,443 | 89,528,165 | 107,433,797 | 113,402,342 | 118,177,177 |

| 2002 | 119,850,561 | 59,925,281 | 89,887,921 | 107,865,505 | 113,858,033 | 118,652,055 |

| 2003 | 120,758,947 | 60,379,474 | 90,569,210 | 108,683,052 | 114,721,000 | 119,551,358 |

| 2004 | 122,509,974 | 61,254,987 | 91,882,481 | 110,258,977 | 116,384,475 | 121,284,874 |

| 2005 | 124,673,055 | 62,336,528 | 93,504,791 | 112,205,750 | 118,439,402 | 123,426,324 |

| 2006 | 128,441,165 | 64,220,583 | 96,330,874 | 115,597,049 | 122,019,107 | 127,156,753 |

| 2007 | [3] 132,654,911 | 66,327,456 | 99,491,183 | 119,389,420 | 126,022,165 | 131,328,362 |

| 2008 | 132,891,770 | 66,445,885 | 99,668,828 | 119,602,593 | 126,247,182 | 131,562,852 |

| 2009 | 132,619,936 | 66,309,968 | 99,464,952 | 119,357,942 | 125,988,939 | 131,293,737 |

| 2010 | 135,033,492 | 67,516,746 | 101,275,119 | 121,530,143 | 128,281,817 | 133,683,157 |

| 2011 | 136,585,712 | 68,292,856 | 102,439,284 | 122,927,141 | 129,756,426 | 135,219,855 |

| 2012 | 136,080,353 | 68,040,177 | 102,060,265 | 122,472,318 | 129,276,335 | 134,719,549 |

| 2013 | 138,313,155 | 69,156,578 | 103,734,866 | 124,481,840 | 131,397,497 | 136,930,023 |

| 2014 | 139,562,034 | 69,781,017 | 104,671,526 | 125,605,831 | 132,583,932 | 138,166,414 |

| 2015 | 141,204,625 | 70,602,313 | 105,903,469 | 127,084,163 | 134,144,394 | 139,792,579 |

| 2016 | 140,888,785 | 70,444,393 | 105,666,589 | 126,799,907 | 133,844,346 | 139,479,897 |

| 2017 | 143,295,160 | 71,647,580 | 107,471,370 | 128,965,644 | 136,130,402 | 141,862,208 |

| 2018 | 144,317,866 | 72,158,933 | 108,238,400 | 129,886,079 | 137,101,973 | 142,874,687 |

| 2019 | 148,245,929 | 74,122,965 | 111,184,447 | 133,421,336 | 140,833,633 | 146,763,470 |

| Adjusted gross income (millions of dollars): | 3,928,063 | 2.7% | ||||

| 2001 | 6,116,274 | 881,001 | 2,183,088 | 3,516,624 | 4,182,711 | 5,051,346 |

| 2002 | 5,982,260 | 867,431 | 2,170,726 | 3,509,933 | 4,170,166 | 5,021,907 |

| 2003 | 6,156,994 | 870,045 | 2,195,336 | 3,570,217 | 4,249,157 | 5,126,816 |

| 2004 | 6,734,554 | 908,348 | 2,311,404 | 3,766,385 | 4,491,456 | 5,455,674 |

| 2005 | 7,365,689 | 952,792 | 2,425,440 | 3,965,094 | 4,742,612 | 5,805,030 |

| 2006 | 7,969,813 | 989,682 | 2,557,775 | 4,210,079 | 5,051,390 | 6,208,693 |

| 2007 | 8,621,963 | 1,050,879 | 2,723,525 | 4,493,722 | 5,398,566 | 6,650,942 |

| 2008 | 8,206,158 | 978,122 | 2,651,575 | 4,433,269 | 5,338,428 | 6,549,387 |

| 2009 | 7,578,641 | 900,447 | 2,520,880 | 4,261,239 | 5,139,495 | 6,274,014 |

| 2010 | 8,039,779 | 944,099 | 2,608,826 | 4,408,415 | 5,323,580 | 6,522,633 |

| 2011 | 8,317,188 | 960,561 | 2,676,602 | 4,542,210 | 5,498,309 | 6,761,487 |

| 2012 | 9,041,744 | 1,003,944 | 2,780,067 | 4,713,845 | 5,710,800 | 7,065,006 |

| 2013 | 9,033,840 | 1,038,237 | 2,882,162 | 4,890,343 | 5,924,452 | 7,314,046 |

| 2014 | 9,708,663 | 1,094,119 | 3,018,376 | 5,125,247 | 6,217,796 | 7,710,844 |

| 2015 | 10,142,620 | 1,144,545 | 3,144,883 | 5,339,293 | 6,484,064 | 8,047,714 |

| 2016 | 10,156,612 | 1,176,907 | 3,206,562 | 5,427,208 | 6,581,784 | 8,153,546 |

| 2017 | 10,936,500 | 1,230,446 | 3,375,132 | 5,715,551 | 6,941,463 | 8,635,051 |

| 2018 | 11,563,883 | 1,342,069 | 3,594,762 | 6,052,766 | 7,345,887 | 9,143,858 |

| 2019 | 11,882,850 | 1,365,719 | 3,705,584 | 6,261,823 | 7,613,122 | 9,489,467 |

| Total income tax (millions of dollars): [1] | 318,967 | 2.8% | ||||

| 2001 | 884,931 | 43,344 | 163,175 | 321,406 | 422,643 | 590,963 |

| 2002 | 794,282 | 33,474 | 137,679 | 280,962 | 374,411 | 531,462 |

| 2003 | 745,514 | 30,351 | 128,499 | 261,722 | 346,338 | 494,368 |

| 2004 | 829,096 | 32,054 | 134,114 | 271,089 | 361,932 | 528,294 |

| 2005 | 931,693 | 33,431 | 139,143 | 284,578 | 382,625 | 570,430 |

| 2006 | 1,020,438 | 34,781 | 148,053 | 305,330 | 413,350 | 618,828 |

| 2007 | 1,111,872 | 37,371 | 158,909 | 328,969 | 445,851 | 669,239 |

| 2008 | 1,028,669 | 31,857 | 148,425 | 316,797 | 431,423 | 642,812 |

| 2009 | 863,486 | 21,200 | 114,465 | 259,982 | 361,213 | 549,660 |

| 2010 | 949,144 | 22,363 | 122,347 | 278,824 | 388,495 | 594,333 |

| 2011 | 1,042,571 | 30,109 | 149,953 | 330,907 | 453,605 | 677,052 |

| 2012 | 1,184,978 | 32,915 | 160,934 | 353,533 | 486,435 | 733,650 |

| 2013 | 1,231,911 | 34,307 | 169,113 | 372,048 | 510,669 | 766,206 |

| 2014 | 1,374,379 | 37,740 | 181,700 | 400,255 | 550,226 | 831,738 |

| 2015 | 1,454,325 | 41,125 | 194,628 | 427,723 | 587,879 | 886,628 |

| 2016 | 1,442,385 | 43,863 | 202,378 | 440,313 | 602,487 | 904,128 |

| 2017 | 1,601,309 | 49,772 | 222,552 | 479,151 | 654,355 | 985,330 |

| 2018 | 1,536,178 | 45,137 | 200,137 | 439,835 | 609,811 | 920,462 |

| 2019 | 1,578,661 | 48,373 | 210,818 | 460,789 | 640,232 | 966,634 |

| Average tax rate (percentage): [2] | ||||||

| 2001 | 14.47 | 4.92 | 7.47 | 9.14 | 10.10 | 11.70 |

| 2002 | 13.28 | 3.86 | 6.34 | 8.00 | 8.98 | 10.58 |

| 2003 | 12.11 | 3.49 | 5.85 | 7.33 | 8.15 | 9.64 |

| 2004 | 12.31 | 3.53 | 5.80 | 7.20 | 8.06 | 9.68 |

| 2005 | 12.65 | 3.51 | 5.74 | 7.18 | 8.07 | 9.83 |

| 2006 | 12.80 | 3.51 | 5.79 | 7.25 | 8.18 | 9.97 |

| 2007 | 12.90 | 3.56 | 5.83 | 7.32 | 8.26 | 10.06 |

| 2008 | 12.54 | 3.26 | 5.60 | 7.15 | 8.08 | 9.81 |

| 2009 | 11.39 | 2.35 | 4.54 | 6.10 | 7.03 | 8.76 |

| 2010 | 11.81 | 2.37 | 4.69 | 6.32 | 7.30 | 9.11 |

| 2011 | 12.54 | 3.13 | 5.60 | 7.29 | 8.25 | 10.01 |

| 2012 | 13.11 | 3.28 | 5.79 | 7.50 | 8.52 | 10.38 |

| 2013 | 13.64 | 3.30 | 5.87 | 7.61 | 8.62 | 10.48 |

| 2014 | 14.16 | 3.45 | 6.02 | 7.81 | 8.85 | 10.79 |

| 2015 | 14.34 | 3.59 | 6.19 | 8.01 | 9.07 | 11.02 |

| 2016 | 14.20 | 3.73 | 6.31 | 8.11 | 9.15 | 11.09 |

| 2017 | 14.64 | 4.05 | 6.59 | 8.38 | 9.43 | 11.41 |

| 2018 | 13.28 | 3.36 | 5.57 | 7.27 | 8.30 | 10.07 |

| 2019 | 13.29 | 3.54 | 5.69 | 7.36 | 8.41 | 10.19 |

| Adjusted gross income share (percentage): | ||||||

| 2001 | 100.00 | 14.40 | 35.69 | 57.50 | 68.39 | 82.59 |

| 2002 | 100.00 | 14.50 | 36.29 | 58.67 | 69.71 | 83.95 |

| 2003 | 100.00 | 14.13 | 35.66 | 57.99 | 69.01 | 83.27 |

| 2004 | 100.00 | 13.49 | 34.32 | 55.93 | 66.69 | 81.01 |

| 2005 | 100.00 | 12.94 | 32.93 | 53.83 | 64.39 | 78.81 |

| 2006 | 100.00 | 12.42 | 32.09 | 52.83 | 63.38 | 77.90 |

| 2007 | 100.00 | 12.19 | 31.59 | 52.12 | 62.61 | 77.14 |

| 2008 | 100.00 | 11.92 | 32.31 | 54.02 | 65.05 | 79.81 |

| 2009 | 100.00 | 11.88 | 33.26 | 56.23 | 67.82 | 82.79 |

| 2010 | 100.00 | 11.74 | 32.45 | 54.83 | 66.22 | 81.13 |

| 2011 | 100.00 | 11.55 | 32.18 | 54.61 | 66.11 | 81.30 |

| 2012 | 100.00 | 11.10 | 30.75 | 52.13 | 63.16 | 78.14 |

| 2013 | 100.00 | 11.49 | 31.90 | 54.13 | 65.58 | 80.96 |

| 2014 | 100.00 | 11.27 | 31.09 | 52.79 | 64.04 | 79.42 |

| 2015 | 100.00 | 11.28 | 31.01 | 52.64 | 63.93 | 79.35 |

| 2016 | 100.00 | 11.59 | 31.57 | 53.44 | 64.80 | 80.28 |

| 2017 | 100.00 | 11.25 | 30.86 | 52.26 | 63.47 | 78.96 |

| 2018 | 100.00 | 11.61 | 31.09 | 52.34 | 63.52 | 79.07 |

| 2019 | 100.00 | 11.49 | 31.18 | 52.70 | 64.07 | 79.86 |

| Total income tax share (percentage): | ||||||

| 2001 | 100.00 | 4.90 | 18.44 | 36.32 | 47.76 | 66.78 |

| 2002 | 100.00 | 4.21 | 17.33 | 35.37 | 47.14 | 66.91 |

| 2003 | 100.00 | 4.07 | 17.24 | 35.11 | 46.46 | 66.31 |

| 2004 | 100.00 | 3.87 | 16.18 | 32.70 | 43.65 | 63.72 |

| 2005 | 100.00 | 3.59 | 14.93 | 30.54 | 41.07 | 61.23 |

| 2006 | 100.00 | 3.41 | 14.51 | 29.92 | 40.51 | 60.64 |

| 2007 | 100.00 | 3.36 | 14.29 | 29.59 | 40.10 | 60.19 |

| 2008 | 100.00 | 3.10 | 14.43 | 30.80 | 41.94 | 62.49 |

| 2009 | 100.00 | 2.46 | 13.26 | 30.11 | 41.83 | 63.66 |

| 2010 | 100.00 | 2.36 | 12.89 | 29.38 | 40.93 | 62.62 |

| 2011 | 100.00 | 2.89 | 14.38 | 31.74 | 43.51 | 64.94 |

| 2012 | 100.00 | 2.78 | 13.58 | 29.83 | 41.05 | 61.91 |

| 2013 | 100.00 | 2.78 | 13.73 | 30.20 | 41.45 | 62.20 |

| 2014 | 100.00 | 2.75 | 13.22 | 29.12 | 40.03 | 60.52 |

| 2015 | 100.00 | 2.83 | 13.38 | 29.41 | 40.42 | 60.96 |

| 2016 | 100.00 | 3.04 | 14.03 | 30.53 | 41.77 | 62.68 |

| 2017 | 100.00 | 3.11 | 13.90 | 29.92 | 40.86 | 61.53 |

| 2018 | 100.00 | 2.94 | 13.03 | 28.63 | 39.70 | 59.92 |

| 2019 | 100.00 | 3.06 | 13.35 | 29.19 | 40.56 | 61.23 |

|

N/A– Not applicable. [1] Total income tax was the sum of income tax after credits (including the subtraction of excess advance premium tax credit repayment, the earned income credit, American opportunity credit, health coverage tax credit and the regulated investment credit credit) limited to zero plus net investment income tax from Form 8960 and the tax from Form 4970, Tax on Accumulation Distribution of Trusts. [2] The average tax rate was computed by dividing total income tax (see footnote 1) by adjusted gross income. [3] The total number of returns does not include the returns filed by individuals to only receive the economic stimulus payment and who had no other reason to file. Source: IRS, Statistics of Income Division, Publication 1304, November 2021 |

||||||

[1] Internal Revenue Service, Statistics of Income, “Number of Returns, Shares of AGI and Total Income Tax, AGI Floor on Percentiles in Current and Constant Dollars, and Average Tax Rates,” Table 1, and “Number of Returns, Shares of AGI and Total Income Tax, and Average Tax Rates,” Table 2, https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-rates-and-tax-shares.

[2] “Average income tax rate” is defined as income taxes paid divided by adjusted gross income.